Gold: Has It Topped Already?

We may have a daily top on our hands.

However silver's sentiment is still really mute - dead neutral.

We will continue with some long deltas in this market especially if the dollar continues to break down.

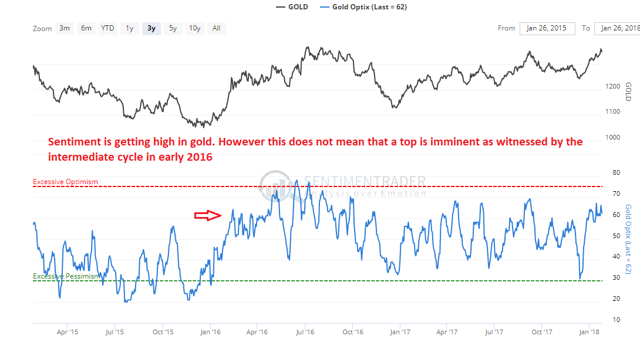

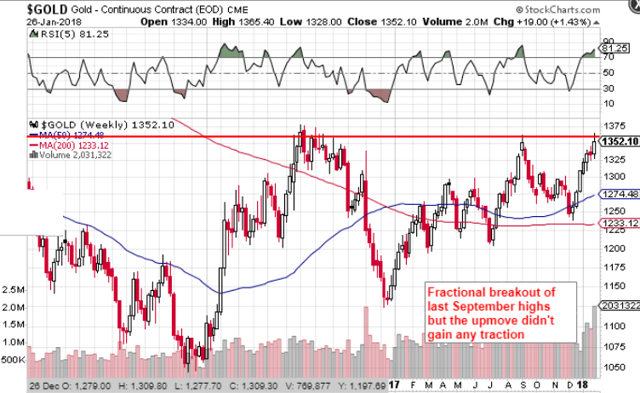

Gold (NYSE:GLD) has tacked on well over $100 an ounce since its hard bottom at the FOMC meeting last month. Long-term sentiment has reached pretty optimistic levels which may mean we have the possibility of a hard top being on the horizon any day now. Besides sentiment, the technical indicators also are illustrating robust overbought conditions. For example, both the weekly stochastics and RSI momentum indicators also are illustrating that a down-move may be in the cards in the not too distant future.

When sentiment in gold (see below) gets to these levels, there are invariably two schools of thought with regard to future direction. In fact, the last intermediate cycle (which bottomed in July 2017) topped early as the highs of that intermediate cycle topped out in less than two months. However, if we go back to the intermediate cycle which bottomed at the tail end of 2015, that particular cycle did not top out for well over five months.

Price just kept on going higher despite clear evidence of bullish technicals and high sentiment readings. So the question now is - whether we continue to play offense or do we decrease our long exposure by either lightening up on our leveraged positions or moving to a more un-leveraged stance? Basically do we decrease our long deltas or do we stand pat? Let's discuss.

Source: Sentimentrader.com

The first reason why I believe it is important to keep long deltas in this market is silver's (NYSE:SLV) rather mute sentiment readings. Usually both silver and the mining complex are leveraged plays on gold and although sentiment of both the mainstay and junior mining companies have reached optimistic extremes, silver's is still rather mute. In fact Silver's long-term sentiment readings are closer to being pessimistic than optimistic which is why I find it difficult to believe that the precious metals complex has printed a hard top here.

Source : Sentimentrader.com

The second reason is the pattern of higher lows since the bear market bottom in late 2015. Now as the chart illustrates, this pattern has not translated into clear higher highs yet but again this may be only a matter of time. In fact, gold actually managed to take out its September 2017 highs only last week so this must be a promising sign, although the up-move wasn't able to stay above that level.

The crux of the issue is this. Many technical traders actually add to positions when a resistance level has been taken out. This means that there remains the distinct possibility that fresh capital will be added to this sector in the not too distant future. This reason alongside mute sentiment in silver is why I wouldn't recommend eliminating long exposure just yet in this sector.

Therefore, the portfolio will most likely deleverage until at least the momentum indicators come back down to oversold levels. We will still want long deltas in this market but not obviously as leveraged as before. Steady as she goes.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.