Gold: The Slight Correction Is Over

Precious metals seem to have bottomed. We should see rising prices over the next month or so.

Long term sentiment is neutral. No need to take profits.

Miners and silver should now begin again to outperform gold.

Gold (NYSEARCA:GLD) is bouncing this morning which could possibly mean that the complex has just printed a half-cycle low. The yellow metal has actually remained quite strong since the start of the year despite some significant weakness in the junior miners (NYSE:GDXJ) for example since the 4th of this month (see below).

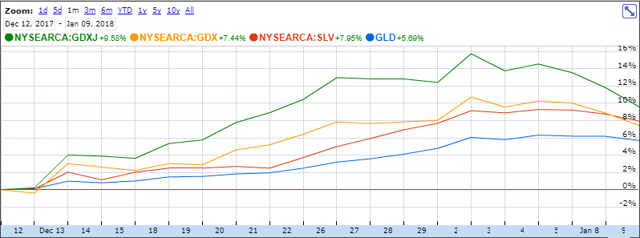

However as the chart illustrates below, the junior miners have outperformed the established miners (NYSE:GDX) as well as gold and silver (NYSE:SLV) since the last daily bottom on the 12th of last December. Ultimately both silver and the mining complex follow gold. Gold usually leads the complex. Therefore investors who are long mining ETFs or individual companies should be pleased with the strength of gold over this last week or so.

Once this half cycle low bottoms (it already may have this morning), then miners should continue to outperform the yellow metal. Remember the mining complex (especially the juniors) are a leveraged play on gold. They severely under-perform on a down-move but outperform on an up-move. Therefore position size is crucial. Here is how I see things shaping up in the precious metals complex over the next few months.

I find it useful to look back at previous intermediate cycles to get an idea on how a present cycle may trade going forward. As we can see from the chart below, gold's last intermediate bottom took place in early July. The first daily cycle low in this intermediate cycle took place on the 5th of October. Here we are looking at a duration of just under 3 months or approximately 60 trading days from bottom to bottom. Now a half cycle low took place around the 7th of August last year.

This bottom printed about a month into gold's daily cycle. We seem to have the same setup at present. Why? Well gold is just short of a month into its intermediate cycle and its momentum indicators have become heavily overbought. It is natural for some profit taking to occur here so sentiment can subside a tad. However (as gold's last intermediate cycle illustrated), if history were to repeat itself, it would mean we would have at least another month of rising prices ahead of us which is why taking profits here may be the wrong decision at this time.

Secondly many mining companies such as Newmont Mining Corp (NYSE:NEM) or streamers such as Royal Gold (NASDAQ:RGLD) continue to languish from a sentiment standpoint which makes me doubt a firm top is near. Furthermore silver's long term sentiment is also only in mid-range which means investors are not overly bullish as of yet (we use sentiment readings as a contrarian signal).

Therefore similar to what we have seen over the past month, I expect the mining complex and silver to outperform gold for the duration of this daily cycle. Therefore being a swing trader and with long tern sentiment still being pretty neutral for the most part, it doesn't make sense to take profits right here. Profits should be taken when optimism becomes too high. We just are not here yet as silver's sentiment chart illustrates below.

Source : Sentimentrader.com

There are two trains of thought I try to live by when adopting swing trades. The first one I believe came from Warren Buffett. He believes that we should be greedy when others are fearful and fearful when others are greedy. Well as the sentiment chart in silver illustrates above, precious metals definitely formed a hard bottom at the FOMC meeting back in December last year. Furthermore and as sentiment still is pretty neutral at present, swing traders at this juncture should remain greedy and wait until sentiment reaches ultra optimistic levels before considering liquidating long exposure.The second train of thought I try to abide by is to never let a profitable trade turn into an unprofitable trade. To achieve this, swing traders can raise their stop loss to the point at which they entered the trade. Furthermore, one could aggressively raise one's stop loss much higher to lock in profits. However the problem with doing this is that if one raises ones stop loss too much, the risk of getting stopped out greatly increases. This is not advisable for a multi-month swing trade for example as you're not giving the trade room to move. In the mining complex for example, one would need to give long positions plenty of room to move due to them being far more volatile than he metals themselves. Start with the end in mind and stay the course. We should see more upside here.

Disclosure: I am/we are long JNUG.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.