Gold: Why This Golden Bull Market Is Just Getting Started

Gold has rallied strongly off the December bottom.

However, gold appears to have stalled, and is now at risk of reversing.

There are plenty of favorable fundamental factors surrounding gold right now, but are they enough to overcome the headwinds?

The bottom line: the gold bull market that started 2 years ago has only just begun.

The Gold Bull Market Is Just Getting Started

SPDR Gold Shares (GLD)/Gold has had a stellar few weeks. In fact, the yellow metal has surged by roughly 10% since hitting a significant short term bottom a few weeks ago. However, since hitting a new 52-week high gold seems to have stalled, and now appears intent on reversing. So, what is likely to transpire next? Is this just a healthy correction, or is gold headed back below $1,300? Are the favorable fundamental developments strong enough to overcome gold's headwinds? Ultimately, will the precious metal breakout to new multiyear highs and head higher throughout the year?

About GLD

GLD is the largest, reportedly physically-backed gold exchange traded fund in the world, with roughly $35 billion worth of net assets. GLD offers market participants an efficient way to access the gold market. The ETF is an attractive alternative to trading gold futures, as it can be traded much like a stock on the NYSE Arca exchange instead of dealing with alternative exchanges and trading requirements pertaining to futures contracts.

Furthermore, GLD is an appealing alternative to buying physical gold, as investors get similar exposure they would to the physical metal, but can buy and sell gold with great fluidity using GLD. This way investors bypass the inconvenience of having to take physical delivery of the asset when buying and delivering it when selling. GLD is a great transactional instrument for trading gold. Yet, I would encourage individuals to diversify or to invest in actual physical gold for the long term.

Since GLD mimics the price of gold almost identically I will refer to GLD and gold interchangeably throughout this article. Now let's look at some key elements that are likely to drive gold's price higher going forward.

Inflation Picture: Prices are Going Higher, and so is Gold

The number one element I look at when assessing the future trajectory of gold prices is inflation. If inflation is likely to decrease going forward so is gold's price. Conversely, if inflation is going to increase going forward, gold should follow. Inflation is everywhere you look, the latest CPI came in at above 2%, the PPI is trending above 2.5%, with final demand goods coming in at 3.5% and trending well above 3% throughout the last year. Even wage growth is on the rise with the most recent figure coming in at 2.9%. Crude oil is on its way to $70 fast, likely $80 before mid-year, and possibly $100 before year's end. Gold is no exception when it comes to price appreciation due to inflationary pressures. Gold's price is approaching multiyear highs, and will very likely break out in the very near future.

The Week Dollar: Bullish for Gold

The Week Dollar: Bullish for Gold

Since gold is priced in dollars, a weakening dollar is beneficial to gold prices. Market participants using international currencies to buy gold get more bang for their buck. Also, banks, institutions, countries and other organizations hold reserves in dollars as well as in gold. The dollar is down by nearly 15% since the highs last March. In addition, the dollar is likely to decline further going forward. Thus, gold is not only cheaper to buy, it is also much more attractive to hold as a reserve, due to the dollar's perpetual depreciation. Why is the dollar likely to continue its decline over the intermediate and long term?

USD 1-Year Chart

USD 5-Year Chart

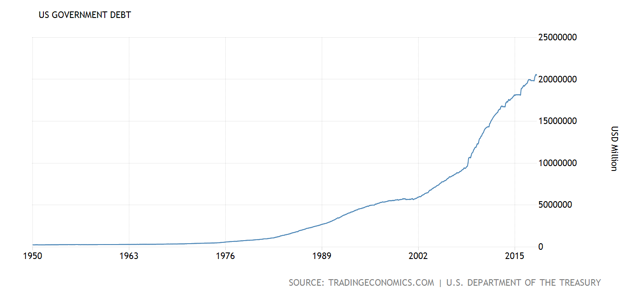

Ballooning National Debt The U.S. has a spending problem. The government loves to spend on entitlement programs, defense, social projects, immigration, foreign aid, tax cuts, etc. The only problem is that the U.S. can't pay for all of it, not even close to be frank. So, the government simply puts the debts on what it sees as the limitless national credit card, also known as the national debt. The only thing is that it's not limitless, there will be repercussions, and we're beginning to see that unwind begin now. Just for reference, the national debt is now over $20.6 trillion, roughly 105% of GDP. Why is this a problem? Primarily because the debt needs to be serviced continuously, currently at around $500 billion for this year. Yes, this is $500 billion American tax payers are paying in interest this year alone to service the national debt.

Ballooning National Debt The U.S. has a spending problem. The government loves to spend on entitlement programs, defense, social projects, immigration, foreign aid, tax cuts, etc. The only problem is that the U.S. can't pay for all of it, not even close to be frank. So, the government simply puts the debts on what it sees as the limitless national credit card, also known as the national debt. The only thing is that it's not limitless, there will be repercussions, and we're beginning to see that unwind begin now. Just for reference, the national debt is now over $20.6 trillion, roughly 105% of GDP. Why is this a problem? Primarily because the debt needs to be serviced continuously, currently at around $500 billion for this year. Yes, this is $500 billion American tax payers are paying in interest this year alone to service the national debt.

How does this pertain to the dollar? Because the higher the national debt, the less likely the U.S. is ever to pay it back. In fact, it is essentially impossible to ever pay this debt back now. Therefore, the country is going to have to inflate its way out of the debt, or default, either scenario is extremely negative for the dollar, and very bullish for gold.

How does this pertain to the dollar? Because the higher the national debt, the less likely the U.S. is ever to pay it back. In fact, it is essentially impossible to ever pay this debt back now. Therefore, the country is going to have to inflate its way out of the debt, or default, either scenario is extremely negative for the dollar, and very bullish for gold.

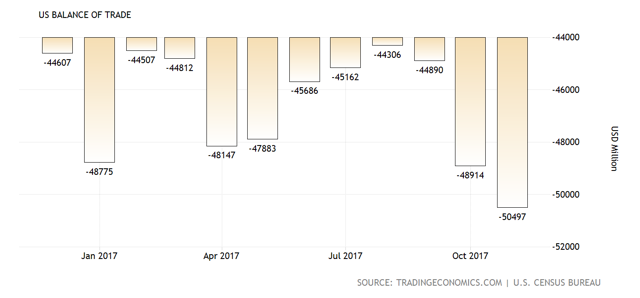

Ballooning Trade Deficit Another factor behind the cascading dollar is the U.S.'s continuous and widening trade deficit. The latest trade deficit figures show that the U.S. imported over $50 billion worth of goods more than it exported, that's just in the last month. This is an ongoing phenomenon. In fact, over the last year the monthly trade deficit has been over $40 billion. This shows that the U.S. consumes a lot more than it actually produces, and the dollar is going to experience further weakness as this trend continues. In conjunction to the dollar weakness, bonds are also now beginning to sell off.

Bond Selloff: Is It Bullish for Gold?

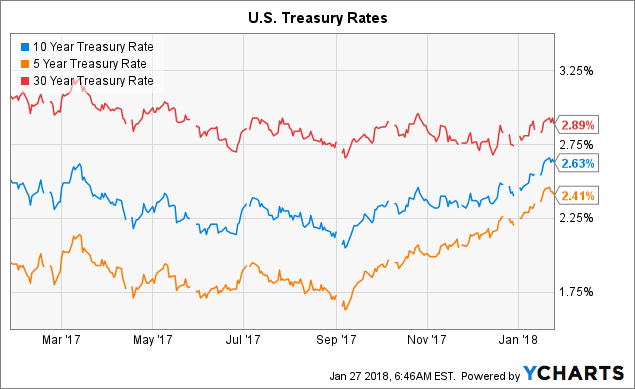

In short, yes, of course it is, allow me to elaborate. Bonds are considered a safe haven asset, much like gold is. However, U.S. bonds have been selling off for various reasons lately. With a cascading dollar, and such low interest rates, many market participants see very little incentive to hold bonds for 5, 10, or 30 years. Also, numerous market participants have expressed concern about the recent bond market selloff. And, it is likely to get worse since the FED has begun to unwind its massive balance sheet. To compound the problem China essentially stated that it is no longer interested in buying U.S. debt. The most troubling fact is that China is the U.S.'s biggest creditor, and if they are not buying U.S. debt, they may be selling it, and they are likely to sell more going forward. All this bond selling is illustrating that major market participants are sick and tired of holding U.S. debt which pays very little interest and is likely to be worth much less going forward due to the dollar's decline. Essentially, market participants are losing money holding U.S. debt because inflation is eating it up. Furthermore, the yield curve is flattening, noticeably. The difference in the yield between the 10 year and the 30 year is now less than 0.25%, or less than one quarter of one percent. Why would anyone choose to hold U.S. treasury bonds for 20 extra years just to receive an additional quarter of one percent per year? Right, it makes very little sense when you could just own gold and know that your investment is safe from inflation eating it up.

Source: YCharts.com

Technical View

The GLD chart shows a constructive image. The uptrend is clear and indicates a series of higher highs and higher lows. The CCI and RSI suggest that GLD was recently overbought but is now approaching a more neutral level. It seems likely that GLD will correct and/or consolidate further in the near term, but significant declines from current levels don't appear likely.

GLD 1-Year Chart

The gold chart essentially illustrates the same image. The uptrend is well intact and the $1,300 level is now very firm support. Given all the positive fundamental developments surrounding gold and the favorable technical image, it does not appear likely that gold's price will fall below $1,300 any time soon. It seems likelier that the price will correct slightly more, then consolidate, and proceed higher throughout 2018.

Gold 1-Year Chart

The 5-year chart illustrates that gold hit the bottom in late 2015 and has established a powerful uptrend since then. Gold's bull market began roughly 2 years ago and it seems likely that it is only getting started. This bull could run for many years, and gains should accelerate going forward.

The 5-year chart illustrates that gold hit the bottom in late 2015 and has established a powerful uptrend since then. Gold's bull market began roughly 2 years ago and it seems likely that it is only getting started. This bull could run for many years, and gains should accelerate going forward.

The Bottom Line: Gold Bull Market Has Only Just Started

There are an overwhelming number of favorable fundamental factors surrounding gold right now. Inflation, a weak dollar, worsening demand for U.S. bonds, as well as other dynamics are indicative of a bullish environment for gold. Moreover, these bullish factors are not likely to go away or weaken any time soon. To the contrary, they will likely strengthen and intensify over time, providing even a more bullish setting for gold down the line. Also, in conjunction with these underlying elements the technical background is extremely favorable. Therefore, the overall atmosphere surrounding gold is particularly constructive right now, and should enable the price of the yellow metal to proceed higher throughout the year. It is very likely that we see prices hit $1,500 - $1,550 in gold by the end of this year, roughly $145 - $150 in GLD respectively.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a recommendation to buy or sell any securities. Investing comes with risk to loss of principal. Please always conduct your own research and consider your investment decisions very carefully.

To receive real time updates, and get more information about this idea as well as other topics we discuss visit our Albright Investment Group trading community. Join us and receive access to exclusive content, trade triggers, trading strategies, price action alerts, and price targets. The value adding features are available to members of our community and are not discussed in public articles.

Disclosure: I am/we are long GLD.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long gold futures.