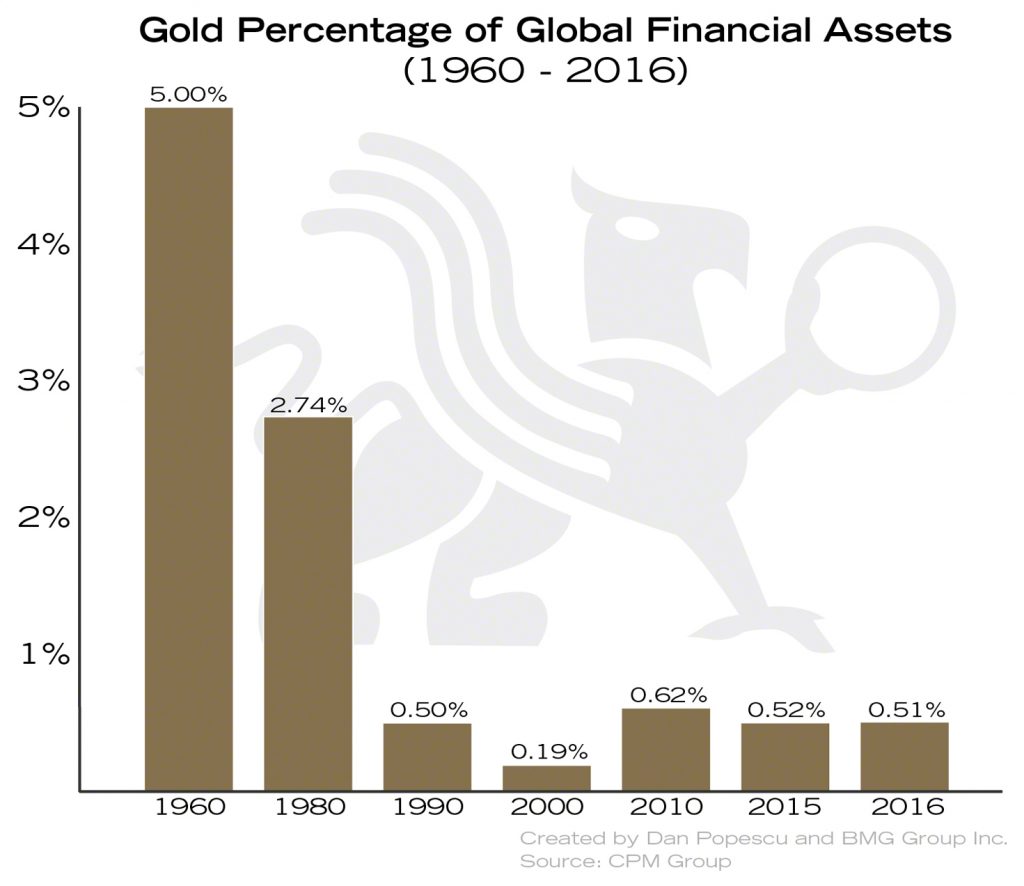

Gold As a Percentage of Global Financial Assets

By Source: Dan Popescu and BMG Group Inc.; / January 17, 2018 / bmg-group.com / Article Link

In the 1960s, most investors and financial institutions held about 5% of their portfolios in gold.

Today, individual investors and institutions hold less than 0.5%. If global investors reallocated just 5% of their financial assets to gold that would be $14.7 trillion of increased demand trying to purchase less than $1.8 trillion of privately held gold bullion. The current price would have to rise by at least 8-fold to $10,560 per ounce.

Source: Dan Popescu and BMG Group Inc.; CPM Group

Recent News

Monetary-driven precious metals outperform major base metals

September 09, 2024 / www.canadianminingreport.com

Gold stocks hit by plunging equities markets

September 09, 2024 / www.canadianminingreport.com

Gold stocks down as metal and equities momentum fades

September 02, 2024 / www.canadianminingreport.com

Another Kazatomprom guidance announcement shakes uranium price

September 02, 2024 / www.canadianminingreport.com

Major monetary drivers still supporting gold

August 26, 2024 / www.canadianminingreport.com