Gold Bulls Fight For Control Of Immediate-Term Trend

Gold price closes barely above immediate-term trend line.

U.S. dollar index is trying to bottom, however, which is pressuring gold.

The outcome of this fight will likely be determined this week.

Gold fell to a one-week low on Tuesday as the U.S. dollar showed signs of firming up. Some profit taking after gold's impressive 6-week rally was also in evidence. In this commentary we'll discuss gold's near-term prospects in light of two potentially conflicting developments: a weaker equity market and a stronger dollar.

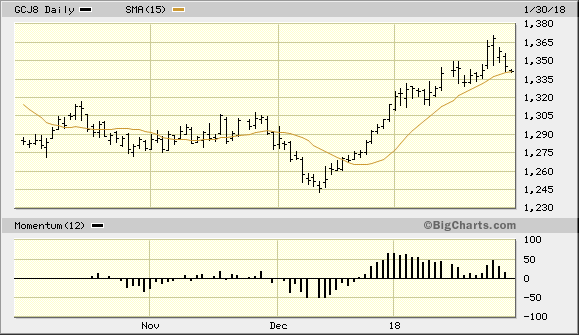

Although the mainstream financial media have taken to blaming the upcoming FOMC meeting for introducing volatility to the gold market, the most likely culprit is technical in nature. That is, the gold price became over-extended from its dominant immediate-term trend line, the 15-day moving average, and thus a pullback was needed.

Source: www.BigCharts.com

While the gold futures price (basis April) has since fallen closer in line to its 15-day MA, the gold price is less than a dollar away from closing under this moving average as of Tuesday, Jan. 30. The rules of the technical trading discipline I use states that a close under the 15-day MA should be respected as a signal that the immediate-term (1-4 week) trend is in danger of reversing. The fact that the gold price had already gained roughly 7% after the Dec. 21 buy signal (when the gold price closed two days above its 15-day MA) only increases this danger.

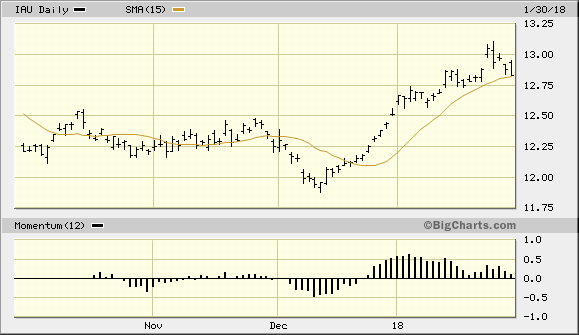

On a related note, my favorite trading vehicle for gold - the iShares Gold Trust ETF (IAU) - closed just slightly above its 15-day moving average on Tuesday. This barely kept the immediate-term uptrend intact for IAU. That said, traders should closely monitor the 12.75 level from here since this is the "line in the sand" for the trading positions in IAU which was recommended in December. A close under the 12.75 level in IAU would violate my stop-loss and thus confirm an exit signal on the remainder of our trading position in this ETF. (I recommended on Jan. 5 taking some profit after IAU's 5% rally from the December entry point).

Source: www.BigCharts.com

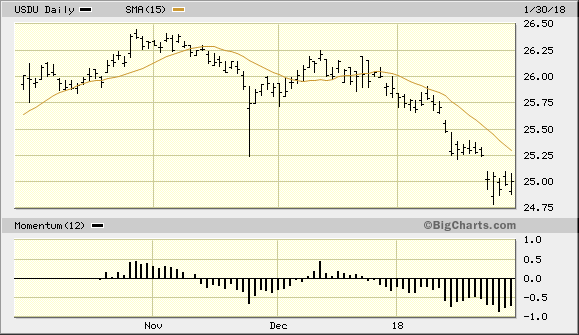

We also discussed the implication that a dollar rally could have on the gold price in the very near term. In my Jan. 26 commentary I noted that the dollar's recent decline had become overdone in the immediate term. There were signs everywhere in the financial media that the dollar was being maligned; from a contrarian's perspective this usually means a technical bounce is imminent.

While no such bounce has yet occurred, traders should nonetheless be on alert for a possible rally in the dollar index in the coming days given how technically oversold the greenback has become after sliding for nearly three months. My favorite trading proxy for the dollar index is the WisdomTree Bloomberg US Dollar Bullish Fund (USDU). A close above the 15-day moving average in USDU, below, would signal that a technical relief rally in the dollar is underway. This in turn would be expected to further pressure the gold price.

Source: www.BigCharts.com

The pullback in the gold price since last week has been an orderly affair up until now. This is undoubtedly due to the latest weakness which has manifested in the U.S. equity market. Indeed, stocks have shown signs of internal selling pressure lately, with more stocks making new 52-week lows than highs on the NYSE on Jan. 30 (the first time this has happened since Nov. 15). Equity market weakness sometimes serves to increase the safety bid for gold, though this is by no means always the case. In many cases, both gold and equity prices fall in tandem as a rush to cash is the highest priority for investors in the immediate term. With this in mind, gold bulls should be careful of assuming that any additional weakness in the stock market will necessarily result in immediate safe-haven demand for gold.

Although gold's intermediate-term (3-9 month) outlook remains positive, the immediate-term trend is coming under attack. This is due mainly due to the ongoing attempt of the U.S. dollar index to establish a temporary bottom. The gold bulls are thus fighting for control of the immediate-term trend as delineated by the 15-day moving average. As long as the gold price remains above this trend line, the bulls will have maintained control over the immediate trend. For now, I recommend that gold investors refrain from initiating new long positions in the yellow metal until the bulls consolidate their control over the immediate trend. A close under the $1,340 level in the April gold contract will also serve as the exit signal on immediate-term trading positions.

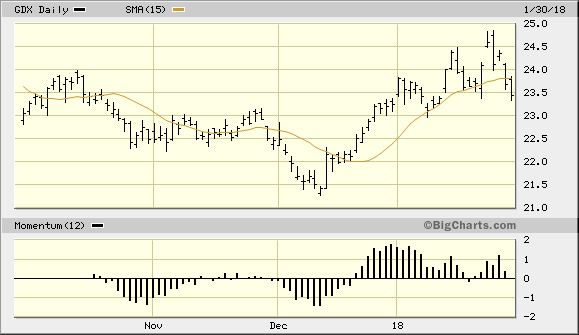

Turning our attention to the mining stocks, the actively traded gold shares have come under heavy selling pressure this week. Losses among some of the blue chip mining shares have averaged about 4% since Monday. Mining stocks have actually shown relative weakness when compared with the gold price. Shown here is the latest graph of the VanEck Vectors Gold Miners ETF (GDX), which is my favorite proxy for the gold stocks as a group.

Source: www.BigCharts.com

In view of the fact that GDX closed under the $23.50 level on Tuesday, I was stopped out of the remaining part of my trading position in this ETF. GDX confirmed an immediate-term buy signal on Dec. 20 when it closed two days higher above the 15-day moving average, with an initial entry price of $22.50. As GDX closed the Jan. 30 trading session at $23.45, this represents a small profit from our initial entry in this trading position. GDX didn't quite reach my anticipated upside target of $25.50 but as is always the case with ETF trading, price objectives are always a best guess and never an absolute certainty.

Although the internal momentum profile for the actively traded gold mining stocks remains positive, since GDX has violated my recommended stop loss I have no new trading recommendations in the gold stocks right now. Traders are advised to remain in a cash position until the next entry signal is confirmed per the rules of my technical trading discipline.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.