Gold ETF Assets Climb to Highest Since 2013

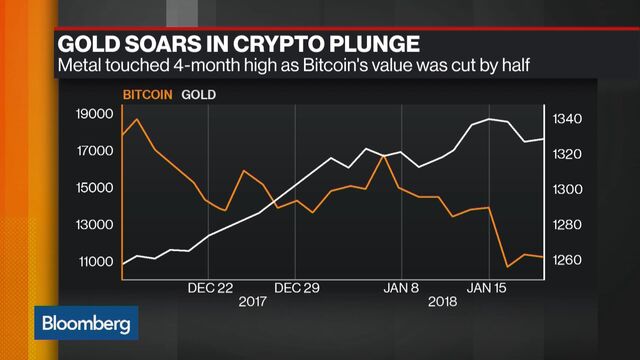

Gold Soars as Crypto Currencies Plunge

Gold Soars as Crypto Currencies PlungeInvestors are piling into exchange-traded funds backed by gold, pushing assets to the highest in more than four years.

Holdings climbed to 2,250 tons on Monday, the highest since May 2013, according to data compiled by Bloomberg. The rise in ETFs comes after the metal’s best year since 2010 and as bulls are bolstered by a weakening dollar.

Gold’s rally is holding up even as global stock markets surge to records and yields on U.S. Treasuries rise. Demand for the metal as a store of value has been underpinned by geopolitical turmoil, bets on rising inflation and uncertainty over policies in the U.S., which shut down the government earlier this week.

Gold prices rose after the U.S. shutdown ended because “the problem has not been finally resolved and the next few weeks are likely to see further disputes,” analysts at Commerzbank AG including Daniel Briesemann said in a note to clients on Tuesday.

Gold futures for February delivery advanced 0.4 percent to settle at $1,336.70 an ounce at 1:35 p.m. on the Comex in New York. The metal last week touched the highest since September.

An index of the dollar, which has posted six straight weekly declines, fell as much as 0.2 percent on Tuesday.

Read more: Dollar weakens on trade fears after U.S. imposes tariffs

Traders are also mindful of recent price gains as the underlying pace of U.S. inflation unexpectedly accelerated in December.

“Investors are once again looking to gold as a potential inflation hedge,” Suki Cooper, an analyst at Standard Chartered Plc, said in a note to clients Tuesday. “Gold tends to perform well as an inflation hedge if it is bought before inflation picks up and in periods of high inflation.”

In other metals:

Get in touch with our reporters.Most Read