Gold Edging Higher

Barry Dawes of Martin Place Securities takes a look at the gold market to explain where he believes it is headed.

Barry Dawes of Martin Place Securities takes a look at the gold market to explain where he believes it is headed.

Gold is moving quietly ahead and should soon start accelerating. This is unlike earlier bull markets in gold, where price rises were sharp and volatility high.

The slow rise is probably indicative of just the early stages. The corporate action in the gold sector is showing that the capital markets are freeing up in the resources sector and this should be just the beginning.

Producing companies are being bought for operating cashflows now, so it is the price of buying gold production.

Soon, it will be the price of gold resources in the ground.

Silver is moving higher, and its parabolic move is now proceeding. Gently for now. Accelerating soon.

Spike intraday high:

Held on to intraday spike again:

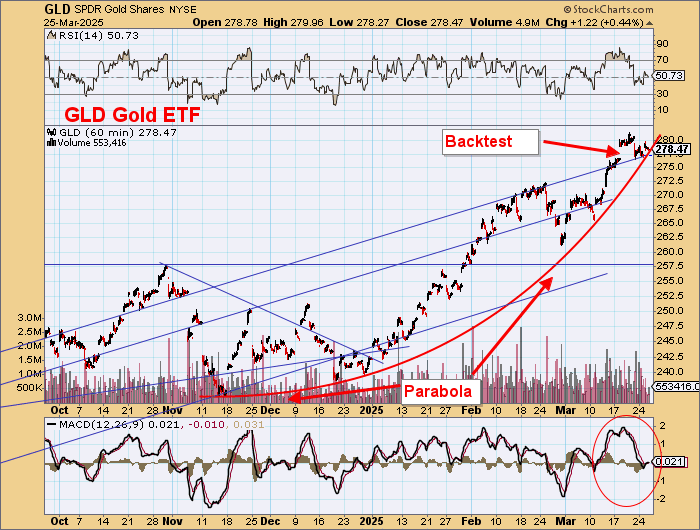

Gold is back-testing on both the trendline and the parabola.

You can see the parabola developing here.

Gold and Silver Stocks

Silver stocks are leading gold stocks. No silver producers in Australia yet outside of S32.

Broken Hill Mines is coming up soon, though.

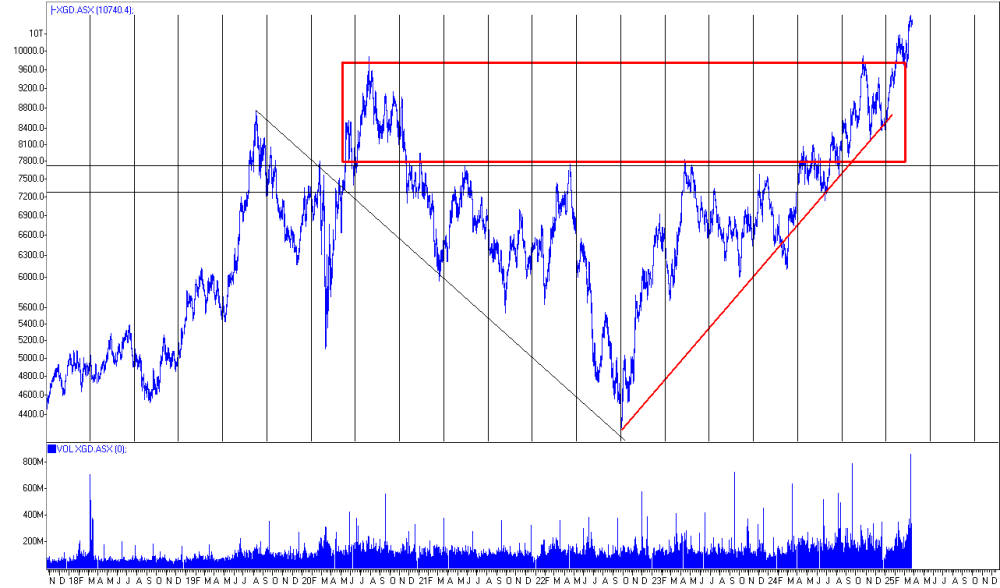

Gold stocks made a new rally high here and are just breaking out.

Silver stocks have already broken out of the box.

ASX Gold Index

It won't be long to 11,000.

US$

Backtest and island reversal:

| Want to be the first to know about interestingGold andSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.