Gold Needs Some Support From Silver

Institutional analysts are warming to gold, but not too much.

Accordingly, gold's longer-term investor sentiment profile is still positive.

The only immediate-term "fly in the ointment" is the silver price.

Gold remains locked in a long-term trading range that stretches back to 2013. The parameters of this range are roughly the $1,050 and $1,415 levels. For institutional analysts the gold price outlook is modest at best - some of them are outright bearish on the yellow metal's prospects. There does appear to be a tilting consensus in favor of higher prices in the coming year, however, though not by much.

One such high-profile example is provided by Goldman Sachs. The widely watched institutional firm forecast in a recent report that the gold price could rise to the $1,375 level by 2020 on increasing emerging market demand. This would represent a gain of just 4% from current levels, however. What's more, it would only happen after gold has experienced a scary slide to around the $1,200 level by mid-2018.

Others are more sanguine on gold's 1-2 year prospects. John Hathaway of the Tocqueville Gold Fund told Barron's that "gold is looking strong, and not all of this rise is for the short term." Hathaway told Barron's reporter John Kimelman in the Jan. 8 issue that he sees gold heading "significantly higher over the next two to three years." His opinion is - thankfully, from a contrarian's perspective - not widely held among institutional analysts.

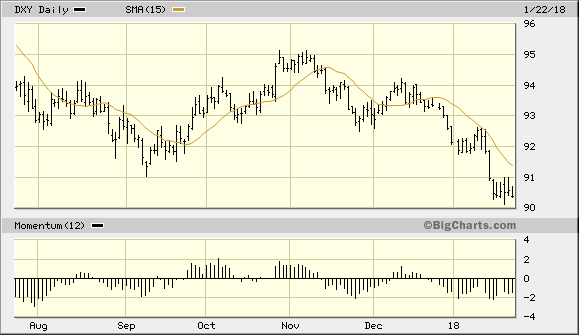

By far the most important factor underlying gold's improved prospects is the continued weakness in the dollar. The U.S. Dollar Index (DXY) graph shown below is a graphic piece of evidence which supports the bullish case for gold. As the dollar's value erodes, the currency components of the metal's price is strengthened and also serves as an incentive for investors to hedge against the dollar's declining purchasing power.

Source: www.BigCharts.com

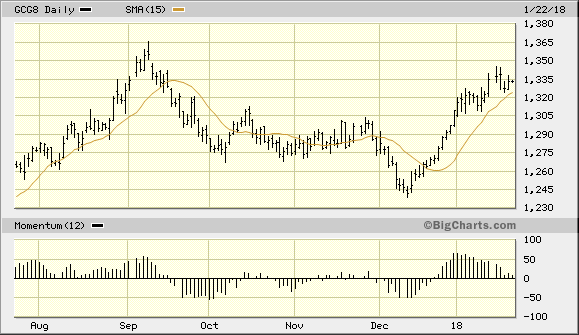

The next most important consideration from a technical trader's standpoint, however, is that gold's price is making higher highs and higher lows.

Gold remains above its 15-day moving average, which I use to identify the dominant immediate-term (1-4 week) trend. With the gold price now within reach of the previous high from September, many of the traders who purchased gold near that high will be tempted to take profits. As I explained in my previous commentary, small traders who hold onto their long positions during a decline are often tempted to get out at breakeven due to the emotional strain of watching their position lose money during the sell-off. Rather than continue to hold on and hope for a profit, many are content to sell after getting back to their initial purchase price.

For this reason, it's not uncommon to see the market hesitate around the old high as the uncommitted longs bail out. Once this crowd has fully exited the market, however, we should see a strengthening of the market after a brief consolidation. Ideally, the gold futures price (basis February) should remain above the $1,305 level through the duration of the consolidative pause in order to ensure the integrity of the intermediate-term (3-6 month) trend.

Source: www.BigCharts.com

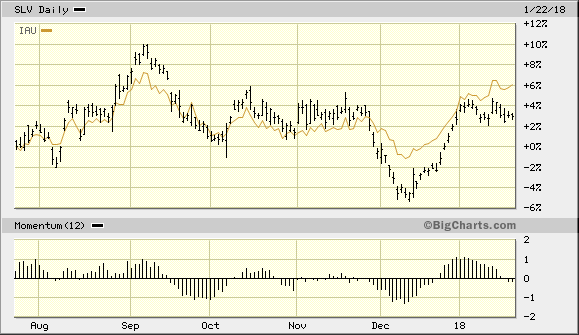

The interim gold outlook isn't without its concerns, however. One slightly troubling aspect of the current market is the price of silver. Silver has lagged the gold price for most of this month. Following is a graph showing the iShares Silver Trust ETF (SLV) relative to the iShares Gold Trust ETF price (IAU). Ideally, the white metal should be confirming gold's immediate strength. Even better is when the silver price shows relative strength vs. gold. With SLV currently under its 15-day moving average there is a touch of immediate-term weakness being reflected in the silver market. It's also disconcerting that while the gold price has rallied above its highs from Q4 2017, silver has yet to do so.

Source: www.BigCharts.com

Even without active confirmation from the silver price, gold's near-term path of least resistance remains up. For disclosure purposes, I'm remaining long my immediate-term trading position in the iShares Gold Trust (IAU) as long as the $12.70 level (stop) remains intact on a closing basis. I'm also currently long the VanEck Vectors Gold ETF (GDX), which is my favorite proxy for the actively traded gold mining stocks. I'm using the $23.50 level as the stop-loss for this trading position on a closing basis.

Disclosure: I am/we are long IAU, GDX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.