Gold Price Forecast: Down but not out

Gold is down despite risk aversion in the equities, but definitely not out and could witness a revival next week, technical charts indicate.

Currently, gold (XAU/USD) is trading at $1314/Oz - down 1.39 percent from last week's low of $1332.60. The rising yield led risk aversion in the global equities is boding well for anti-risk currencies like JPY and CHF. However, gold, despite being a classic safe haven, is losing altitude, possibly because it is zero yielding asset and hence there is less incentive to hold it when yields are on the rise.

But it is still a hedge against inflation and the current narrative in the market is that rising inflation along with a spike in bond yields is hurting the equities. So yellow metal could soon find strong hands.

The S&P 500 is still holding above its 200-day MA, also a significant majority believes the stock market is witnessing a healthy correction. However, panic could set in once the index sees a sustained moved below the 200-day MA. Such a move could happen next week if the US inflation (due on Wednesday) beats estimates and pushes the 10-year yield higher to 3 percent. Once panic sets in, gold will likely regain strong bid tone.

The technical charts indicate the metal could revisit $1340-$1350 levels next week.

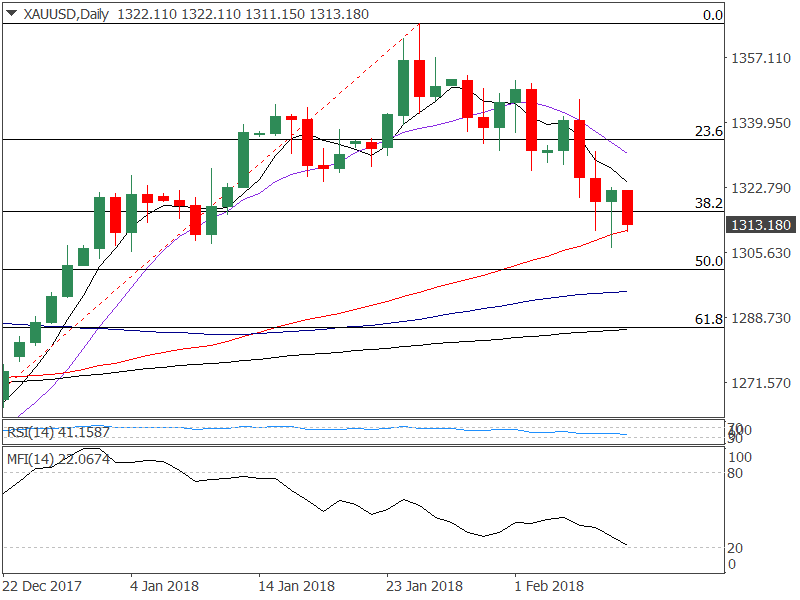

Daily chart

Short-term momentum studies - 5DMA, 10-DMA trend lower, indicate a bearish set up. The RSI is biased bearish, but quite close to oversold levels. However, yesterday's bullish hammer candle shows failure on the part of the pairs to keep the metal below the upward sloping (bullish bias) 50-day MA. Further, the 5MA and 10MA are trending northwards on the monthly chart, indicating a long-term bullish bias. The 5-MA is positioned at $1301 levels at a time when the RSI on the 4-hr is rising from the oversold territory. So, the bears will likely have a tough time keeping the metal bellow $1300.View

A daily close above $1322.83 (Thursday's high) would open doors for $1346 (Feb. 6 high) and $1350 levels. The base seems to have shifted higher to $1300. That said, consecutive end of the day closes below the psychological level would shift attention to $1285 (200-day MA) and $1365.5 (Nov. 3 low).Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these securities. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Forex involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility.