Gold Prices And A March Rate Hike: What's Next?

Rate hike odds soared after the latest FOMC meeting, and the upcoming March meeting looks "live".

Despite the threat of rising rates, gold is more strongly influenced by ex-US global growth.

Thanks to the Eurodollar system, Fed rate hikes have a limited impact on the dollar.

Following yesterday's statement from the Federal Reserve, the odds of a rate hike are soaring, according to the CME's FedWatch tool. The current market-implied probability for a hike on March 21, 2018 (the next Fed meeting) is 83.1%. One month ago, on December 29, 2017, the odds of a March hike were just 50.7%. According to prevailing wisdom, the Federal Reserve has significant control over monetary conditions. By raising interest rates, the Fed increases the cost of short-term borrowing, thereby making US dollars more expensive to borrow. All else being equal, the US dollar should strengthen accordingly. In turn, gold should weaken in response.

Given the history of gold and the US dollar, we argue that this simple logic is not particularly helpful when forecasting gold prices. For now, the US dollar remains in a bear market, and gold is likely to continue making new highs over the longer term as a result. Despite rising US yields, the dollar has been languishing relative to foreign currencies and commodities. As "nothing moves in a straight line", the gold bull market will certainly face speed bumps along the way. This being said, the overall trend for the precious metal remains bullish.

Strong ex-US growth + Easy financial conditions = US dollar bear market

In a previous article, we illustrated why the US dollar tends to sell off during global economic booms. In short, this is a natural occurrence given the US dollar's function as the world's reserve currency. More specifically, the US dollar is a liability currency, meaning it is borrowed heavily for cross-border investment purposes. Approximately 2/3rd of all cross-border lending is dominated in USD. When optimism for global growth accelerates, investors borrow US dollars and chase international investment opportunities. This issue is compounded by the fact that the currency is made available very cheaply via offshore lending markets (known as the "Eurodollar" market). When economic conditions are benign, Eurodollar credit taps flow freely. As more and more US dollars chase investment opportunities, the currency weakens relative to assets such as gold.

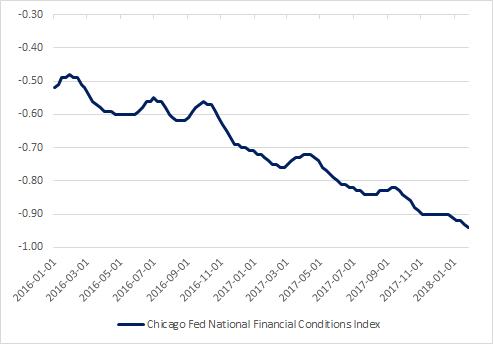

Despite the Fed's moves to make US dollars more expensive, this explains why financial conditions continue to become easier. An overview of the Chicago Fed's National Financial Conditions Index is shown below for reference:

Three rate hikes, but easier conditions

Source: Federal Reserve Bank of St. Louis

Looking at recent economic data from developed markets, forward-looking indicators such as manufacturing PMIs are at multi-year highs in regions such as the eurozone and Japan. Turning to emerging markets, rising commodity demand from countries such as China and India also points to accelerating growth. Due to its nature as a global reserve currency, the dollar is more likely to begin appreciating once global growth begins decelerating. This means that the outlook for gold remains positive.

What about rate hikes?

While the Federal Reserve can only indirectly influence financial conditions, the institution should not be ignored entirely. Looking at how gold and the US dollar traded in 2017, the precious metal tended to weaken ahead of an interest rate decision. After the Fed hiked rates, gold rallied in response. Looking at the pre-crisis era, a similar pattern emerged before and after the Fed's rate hikes in 2005 and 2006. While the Fed kept hiking rates, reactions in gold were limited, as the institution did not control the US dollar money supply (which was more strongly influenced by the banking system and offshore Eurodollar markets).

The reaction of gold following the Fed's last hike on December 13, 2017, is visually illustrated below. Note that gold rallied immediately after the Fed's interest rate decision and continued strengthening for the rest of the month.

That's it? Gold shrugs off the Fed

Source: TradingView, MarketsNow

In a recent article, we showed that gold is a particularly reliable monetary alarm signal. When financial conditions become too tight, gold tends to sell off, indicating the need for a monetary response. When financial conditions become too easy, gold rallies sharply as a result.

If the USD lending boom doesn't slow down, expect gold prices to keep strengthening

Prior to the last financial crisis, rising gold prices indicated that US dollars were far too easily available. While the Fed raised rates many times prior to the crisis, this only had a limited impact on the supply of the currency. Interestingly, gold's prediction was accurate, and the easy availability of Eurodollars greatly exacerbated the 2007-2008 financial crisis. Today, the Eurodollar issue has grown in size (based on data from the Bank for International Settlements), while global debt is at all-time highs.

While upcoming rate hikes will force the ongoing gold rally to hit pause, strong ex-US economic data will keep gold prices in a bullish trend. Unless the Federal Reserve directly addresses the Eurodollar issue and gains more control over the global supply of US dollars, gold prices are likely to keep rising.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: The author maintains a permanent allocation to gold in his retirement portfolio.