Gold Resource Corporation: Focus On Switchback

Exiting 2016, GORO's most promising deposit, the Switchback, had a strike length of 300m and P&P reserves of 203,500 tonnes.

Drilling through 2017 and into January of 2018 has tripled the strike length and greatly increased confidence in the continuity and commercial value of the deposit.

The idea that the Switchback may be a larger deposit than GORO's cash cow Arista deposit is now very plausible.

The market hasn't yet recalibrated its assessment of GORO due to these stellar Switchback results, but I believe that will change in 2018 as Switchback enters commercial production.

Gold Resource Corporation (GORO) is the operator of two mines in Mexico, the large Arista mine and a smaller satellite mine known as Mirador (on the Alta Gracia property). It is also developing four "high-grade gold properties" in its Nevada Mining Unit. In its recent presentation at Noblecon14, the company highlighted its expectations that gold prices would increase, and therefore, emphasized the potential of its prospective gold properties in Nevada. However, I think this is a strategic mistake as it downplays the company's most important and most imminent-to-production property: the Switchback, which is a deposit adjacent to, but distinct from, the Arista mine.

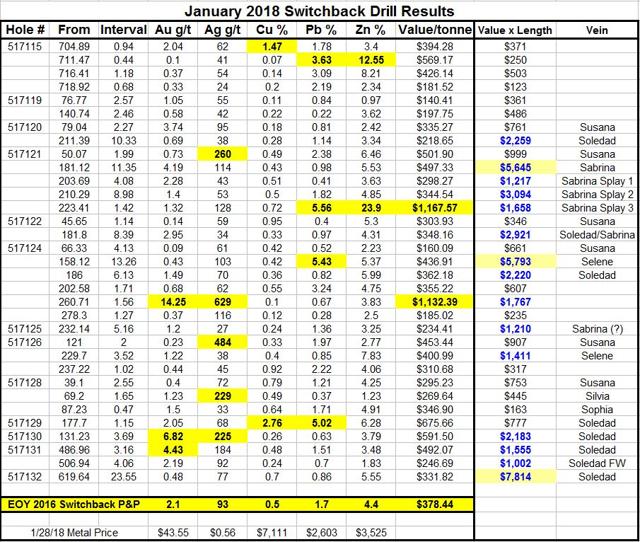

As with Arista, the Switchback is a poly-metallic deposit with meaningful amounts of gold, silver, copper, lead, and zinc. As of the end of 2016 (which is the date of the latest reserve report), the property had proven and probable reserves of 203,500 tonnes grading 2.1 g/t Au, 93 g/t Ag, 0.5% Cu, 1.7% Pb, and 4.4% Zn. At metal prices from the end of January 2018, the per tonne value was $378.44 and the breakdown by metallic components was $91 of Au, $52 of Ag, $36 of Cu, $44 of Pb, and $155 of Zn. Thus, the zinc component value is larger than the precious metals value (i.e. greater than the combined gold and silver content), and the overall base metals value constitutes 62% of the total ore value.

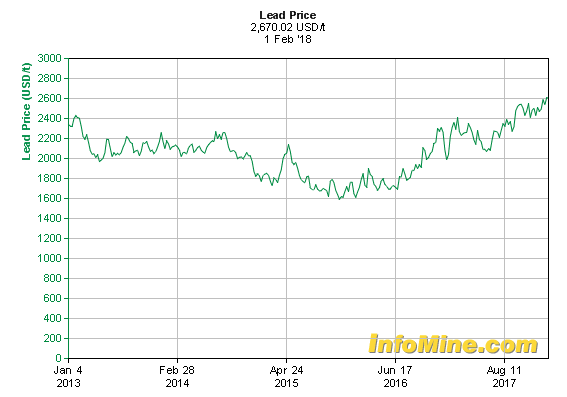

To understand why, perhaps, the company doesn't emphasize the base metals value of its property, we not only have to understand the "gold bug" mentality (see Noblecon presentation for example) but we also have to appreciate how base metal prices have changed over the past five years relative to precious metals. The five charts below help accomplish this (sourced from macrotrends.net except lead which is from infomine.com):

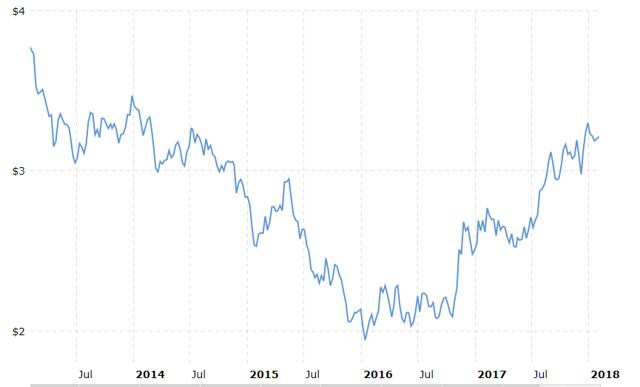

Gold 5 Year

Silver 5 Year

Copper 5 Year

Lead 5 Year

Zinc 5 Year

The takeaway is that while gold and silver have been in bear markets, the industrial metals have either remained flat, or in the case of zinc, almost doubled in price. Since the zinc content of the Switchback is so high (4.4%), what used to be just a smelter credit has become the primary value driver of the future mine.

So with the idea that Switchback is a poly-metallic deposit with more base metal than precious metal content, let's look at the developments since the 2016 reserve report was issued.

Switchback Developments

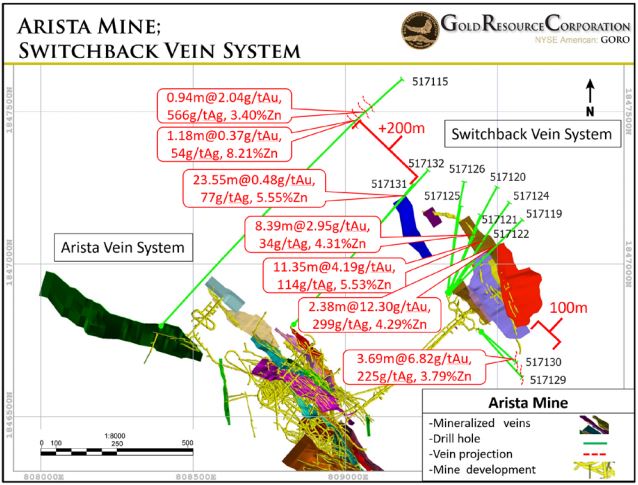

In July 2017, I examined and summarized a number of 2017 drill results that greatly expanded and in-filled the 2016 Switchback proven and probable (P&P) reserves of 203,500 tonnes. In particular, the Soledad vein was shown to have valuable intercepts (as measured by my value proxy of interval length times the ore value per tonne). At the time, I opined that the 959,000 tonnes of mineralized and indicated (M&I) resource in the 2016 reserve report would be converted to P&P reserves. I also highlighted a 275m step out from the previous deposit limits.

On Jan. 23, 2018, GORO released another series of highly encouraging Switchback drill results. In the table below, I've used my standard format to highlight any intercepts with more than double the P&P average grades or total ore value as well as highlighting any intercepts whose product of grade and length is noteworthy.

These results are extremely positive, not only because of the number of new veins that have been found but most importantly because three veins (Sabrina, Selene & Soledad) show value X intercept products that are very high (over $5,000). This begins to speak to the potential profitability of future mining operations in a number of primary veins of the system.

The drill results are also critical because they further extend the strike length of the deposit by 300m (200m to the NW, 100m to the SE).

Adding these extensions to those discussed in my mid 2017 article gives a total 625m extension of the deposit since the reserve report dated Dec. 31, 2016! In other words, the strike length has tripled from approximately 300m to about 900m all in one year of drilling.

It's no wonder that in this latest drill result press release, GORO's CEO opined (my emphasis):

It will take time to delineate this new expansion and the Switchback vein system in general, but it looks highly probable the Switchback vein system could become larger than the Arista vein system.

But what exactly does this imply?

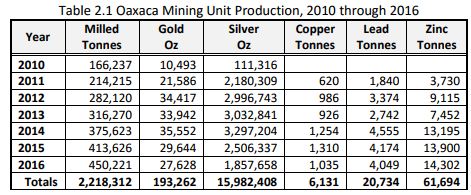

Well, here are the Arista mine production figures through 2016 taken from the reserve report:

If we disregard the 2010 figures which were from the open pit and then add in another 450,000 tonnes from 2016 production (my extrapolation from 3Q results), we get about 2.5M tonnes of deposit (which doesn't include any of the as yet unmined Arista P&P and M&I ore). This is more than ten times larger than the 2016 P&P Switchback reserves of 203,500 tonnes!

I will perform more detailed calculations once the 2017 reserve report comes out (typically end of Feb through March), but in the meantime, I believe that the 2017 & 2018 drill results at Switchback warrant a substantial upward price target for GORO which I now set at $15-20 over the next 4 years.

2018 will mark the beginning of commercial exploitation of Switchback, and as the production numbers begin to come in, and as infill drilling becomes easier due to development of the deposit, I think the market will completely recalibrate its assessment of GORO - finally awarding Switchback its status as a second deposit equal to the Arista deposit that has made GORO a profitable miner for half a decade now. I continue to be long and will opportunistically add to my position.

Disclosure: I am/we are long GORO.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I actively trade around core positions.