Gold Takes Off Again As Mnuchin Talks Down The Dollar At Davos

Gold investors awoke to another jump in the precious metals complex as Trump administration officials talk down the US$ at Davos.

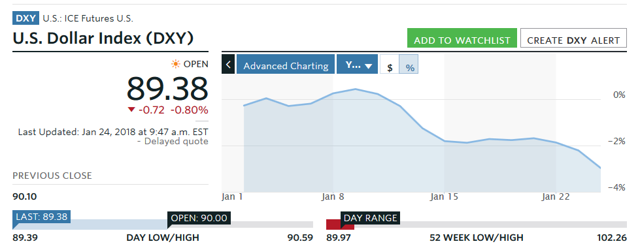

The US$ is now down ~3% YTD and is hitting 3-year lows.

With trade wars looming and the possibility of more deficit and debt spending, the outlook for gold remains the best I have seen in many years.

Bloomberg reported this morning that the Trump team at Davos made comments supporting a weaker US$ and upped the trade war rhetoric. Treasury Secretary Mnuchin was quoted as saying:

Obviously a weaker dollar is good for us as it relates to trade and opportunities ... (the US dollar's short term value is) not a concern of ours at all.

As a result, the US dollar is diving dramatically this morning:

Source: Market Watch

Source: Market Watch

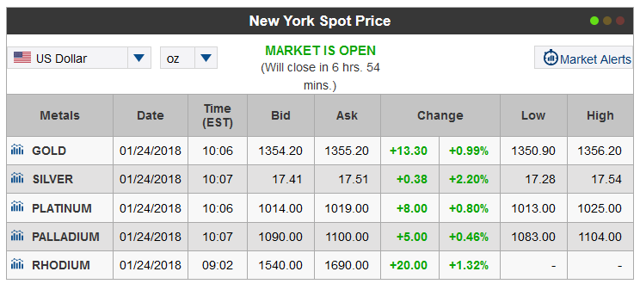

Meantime, the entire precious metals complex is rallying strongly, with silver leading the charge up 2.2%:

Source: Kitco

Source: Kitco

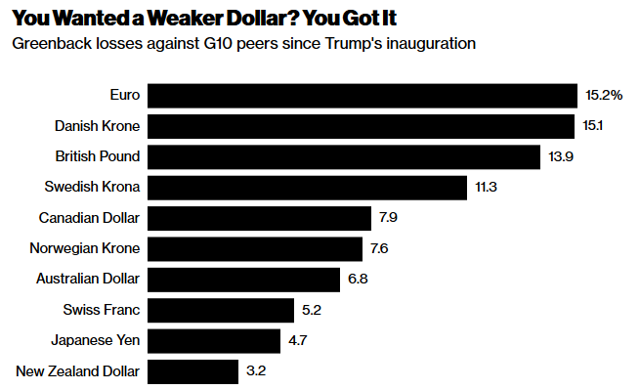

The U.S. dollar has fallen off a cliff since Trump took office. This was to be expected after the campaign rhetoric on trade and is one reason I wrote the Seeking Alpha article: Gold: The Possibility of a Trump Induced Bull-Run during the gold sell-off after the election.

Source: Bloomberg

Source: Bloomberg

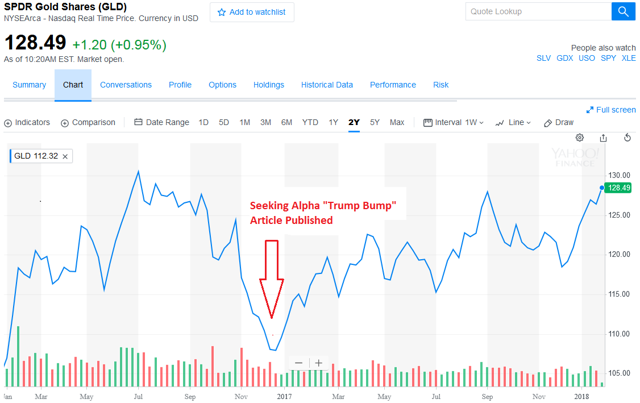

And while gold is now up nearly $200/oz since that article was published (17%), note that a falling U.S. dollar and rising political uncertainty were only part of the bullish thesis supporting gold. The other - more U.S. deficit spending and debt - is also firmly in place and we have yet to see the budget for authorizations for increased military spending, the $20 billion "wall," spending on climate-related recovery efforts, and infrastructure. Those issues I discussed in a recent update on the outlook for gold (Gold: What to Expect In 2018) and expect those spending bills to push gold up to a minimum of $1600/oz before the end of this year.

Source: Yahoo Finance

Source: Yahoo Finance

Throw in geopolitical uncertainty with respect to North Korea, the Russia investigation, as well as trade war concerns with China and a possible roll-back of the NAFTA trade agreement and you've got the perfect environment for gold to move higher.

There are a number of ways to invest in gold. The easiest to get in and out of and requiring no storage (with the drawback that it is "paper gold") is to buy the Spider Gold Trust ETF (GLD). Other options are the iShares Gold Trust (IAU) or the ProShares Ultra Gold Fund (UGL). UGL is a 2x performer as compared to the gold bullion price in London.

Bottom line is that the outlook for gold has never been better in my opinion. Not only do I reiterate my $1600 year-end price target, I believe that gold will - this time around - hold its value unlike during the 2008-2009 economic recession (some would say depression) that occurred at the end of George Bush's term.

During that event, global money flocked into the U.S. causing the U.S. dollar index to rise. There was also a liquidity crisis causing investors to sell gold to raise money. Next time will be different as I have my doubts about both those dynamics occurring again. Next time, gold will do what it has always done: been a safe haven and a store of value when all else is falling apart.

Note my $1600 price target for gold bullion equates to an estimated 18% rise in the GLD ETF, or to $150.

Disclosure: I am/we are long GLD.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am an engineer, not a qualified investment advisor. While the information and data presented in my articles are obtained from company documents and/or sources believed to be reliable, they have not been independently verified. Therefore, I cannot guarantee its accuracy. I advise investors conduct their own research and/or consult a qualified investment advisor. I explicitly disclaim any liability that may arise from investment decisions you make based on my articles. Thanks for reading and I wish you much success with your investments.