Gold Weekly: Forget GLD, Go For IAU!

Gold is under pressure at the start of the week on a stronger dollar.

Speculators lifted their net long positions in gold for a 6th straight week over Jan 16-23, the CFTC shows.

ETF investors bought gold for a 2nd straight week, according to FastMarkets' estimates.

I decided to change slightly my trading positioning due to the long-term nature of my positive gold view.

I am now long IAU.

Introduction

Welcome to my Gold Weekly.

In this report, I wish to discuss mainly my views about the gold market.

To do so, I analyze the recent changes in net speculative positions on the Comex (based on) and ETF holdings (based on FastMarkets' estimates) and draw some interpretations about investor and speculator behavior. I conclude the report by sharing my trading positioning.

While the CFTC statistics are public and free, the data about gold ETF holdings are from FastMarkets, an independent metals agency which tracks ETF holdings across the precious metals complex.

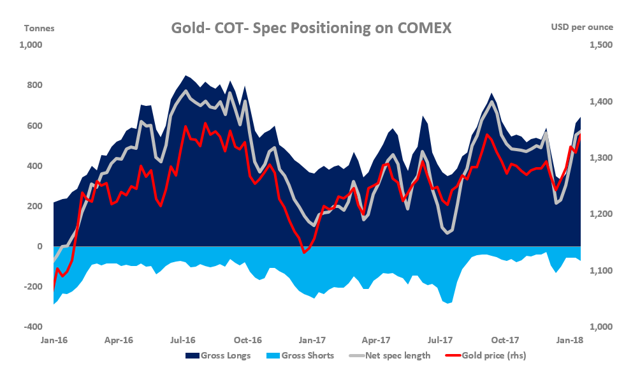

Speculative positioning

Source: CFTC.

According to the latest Commitment of Traders report (COTR) provided by the CFTC, money managers lifted their net long position for a 6th week in a row over the reporting period (Jan. 16-23) but spot gold prices edged up 0.1% from $1,341 per oz to $1,342 over the corresponding period.

The net long fund position - at 594.02 tonnes as of January 23 - increased 22.69 tonnes or 4% from the previous week (w/w). This was driven exclusively by long accumulation (for a 5th straight week) of 24.47 tonnes, while shorts lifted their exposure (for a 2nd straight week) by 1.77 tonnes.

The net long fund position has increased by a substantial 288.54 tonnes or 95% since the start of the year after rising 182.55 tonnes or 149% in the whole of 2017.

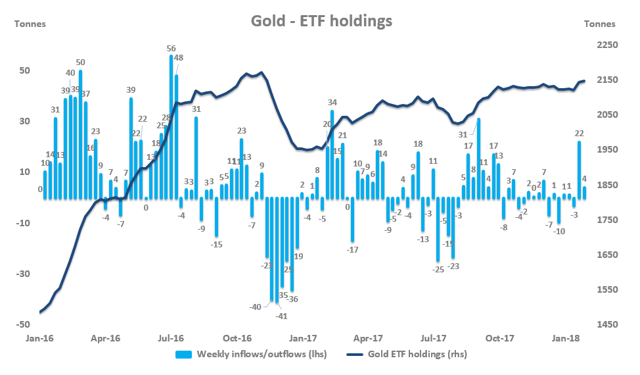

Investment positioning

Source: FastMarkets.

ETF investors bought 4.13 tonnes of gold over Jan 19-26, while spot gold prices strengthened 1.3% from $1,332 per oz to $1,349 over the corresponding period. This was marked a 2nd straight week of net inflows in gold ETFs.

Inflows into gold ETFs were steady over the past week although a bout of profit-taking occurred on Wednesday January 24 when ETF investors sold a net 3.87 tonnes after gold prices reached a fresh 2018 high of $1,366 per oz.

The iShares Gold Trust ETF (IAU) received the largest part of inflows last week by collecting 4.67 tonnes, followed by the SPDR GLD ETF (+1.48 tonnes).

ETF investors are net buyers of gold in the tune of 24.37 tonnes since the start of the year, which corresponds to an increase of 1% in total gold ETFs. In the whole of 2017, ETF investors were net buyers of 173.38 tonnes of gold, which represents an increase of 8.8% in gold ETF holdings.

As of January 26, 2017, gold ETF holdings totaled 2,147.51 tonnes, according to FastMarkets' estimates.

Trading positioning

I decided to change slightly the way I get exposure to the fluctuations of gold prices.

As a reminder, I decided to build a long position in the SPDR Gold Trust ETF GLD on June 05, 2017. As can be seen in the table at the very end of this report, my entry point was at $120.74 and my stop-loss level at $112.00 (~-9% from my entry level) with a potential target profit at $190 (~+57% from my entry level). This position is a very long-term position, being aware that this trade could take several years before materializing.

Given the long-term nature of this position, I came to the conclusion that the SPDR Gold Trust ETF GLD was not the best financial product to play my positive gold view due to its relatively elevated expense ratio, which is the net total fee charged by the issuer, of 0.40%.

In this regard, I decided to close out my long GLD position and open instead a long position in the iShares Gold Trust ETF IAU, offering an expense ratio of just 0.25%. Although liquidity conditions of the iShares Gold Trust ETF (NYSEARCA:IAU) are poorer than that of the SPDR Gold Trust ETF, the size of my position (i.e., less than $10,000 dollars), does not constraint me whatsoever. The slight change in my trading positioning is disclosed in the "Trade summary" table as well as on my Twitter feed and does not reflect a fundamental change in my view on gold prices. My bullish case remains intact.

Let's have a look at the technical picture of IAU.

Source: Trading View.

As can be seen in the monthly chart above, IAU broke above its major downtrend line from its all-time high in July 2017, portending the start of a new bull market. Since then IAU has pushed higher, finding support at its steady rising 20 monthly moving average.

Importantly, IAU managed to set a yearly high of $13.11 at the start of 2018, surpassing the 2017 high of $12.98. The next major resistance lies at the 2016 high of $13.25. A firm break above this level would boost even further my bullish conviction.

Here are the current parameters of my long IAU position:

Entry point: $12.89 - built on Monday 29 January, 2018

Stop-loss: $10.81 (-16% from my entry point), which corresponds to the 2016 low

Profit target: $19.00 (+48% from my entry point), which roughly corresponds to the all-time high.

Risk of the position: 3% of the Fund

Reward-to-risk ratio: 3

For the sake of transparency, I will update my trading activity on my Twitter account and post my trade summary at the end of each report.

Final note

My dear friends, thank so much for showing your support by pressing the "Follow" button and sharing this article. I look forward to reading your comments below.

![]()

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.