Gold Weekly: Set To Become In Vogue

Gold enjoyed a 2% rally last month amid a pretty volatile October.

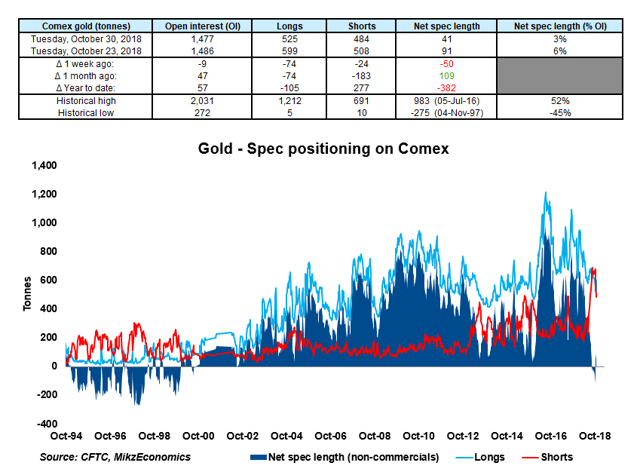

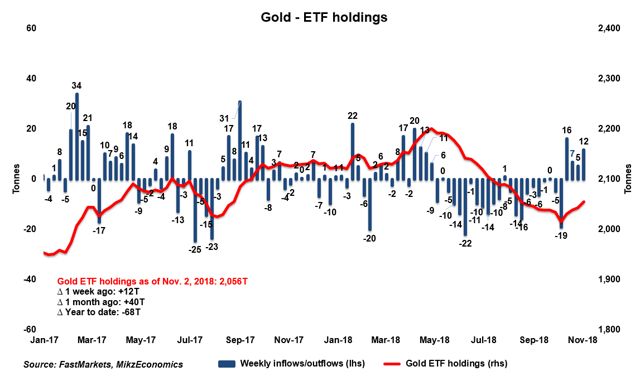

Speculators hold a very small net long position in Comex gold, CFTC data shows. ETF investors boosted their gold holdings, albeit at a moderate pace, according to FastMarkets.

Although October lived up to its reputation for risk assets, investors did not rush into gold.

Given the Fed's determination to tighten its policy, investors are likely to take a fresh look at gold as a haven asset.

I expect gold to become increasingly in vogue in the course of 2019.

Deliciously In Vogue, Brent Baker (Saatchi art)

Introduction

Welcome to my Gold Weekly.

In this report, I wish to discuss mainly my views about the gold market through the GraniteShares Gold Trust ETF (BAR). BAR is directly impacted by the vagaries of gold spot prices because the fund physically holds gold bars in a London vault in the custody of ICBC Standard Bank.

To do so, I analyse the recent changes in speculative positions on the Comex (based on the CFTC) and ETF holdings (based on FastMarkets' estimates) in a bid to draw some interpretations about investor and speculator behavior. Then, I discuss my global macro view and the implications for monetary demand for gold. I conclude the report by sharing my trading positioning.

Speculative positions on the Comex

The CFTC statistics are public and free. The CFTC publishes its Commitment of Traders report (COTR) every Friday, which covers data from the week ending the previous Tuesday. In this COTR, I analyze the speculative positioning, that is, the positions held by the speculative community, called "non-commercials" in the legacy COTR, which tracks data from 1986.

It is important to note that the changes in speculative positioning in the gold futures contracts do not involve physical flows because it is very uncommon for speculators to take delivery of physical on the futures contracts that they trade. Due to the use of leverage by speculators, the changes in speculative positions in gold futures contracts tend to be much greater than the changes in other components of gold demand like ETFs or jewellery.

As a result, the impact on gold spot prices tends to be relatively more important and volatile, which, in turn, affect the value of BAR because the latter physically holds the metal in vaults in London and therefore, have a direct exposure to spot gold prices.

Gold ETF positions

The data about gold ETF holdings are from FastMarkets, an independent metals agency which tracks ETF holdings across the precious metals complex. FastMarkets tracks on a daily basis a total of 21 gold ETFs, which represent the majority of total gold ETF holdings. The largest gold ETFs tracked by FastMarkets are the SPDR (R) Gold Shares (NYSEARCA:GLD), whose holdings represent nearly 40% of total gold ETF holdings, and the iShares Gold Trust (IAU), whose holdings represent roughly 15% of total gold ETF holdings.

Speculative positioning

Source: CFTC

According to the latest Commitment of Traders report provided by the CFTC, non-commercials were net long Comex gold by 41 tonnes as of November 2, having cut about 50 tonnes of net long positions over the latest reporting period of October 23-30.

However, non-commercials have lifted their net long positions in Comex gold by 109 tonnes over the past month, reflecting a positive swing in speculative sentiment.

Because the net speculative length is still extremely low based on historical standards, I am willing to believe that there is plenty of room for short-covering and/or long accumulation in the near to medium term, especially if the macro environment remains friendly for the precious metals complex, that is, the dollar and US real rates experience additional downward pressure.

Bottom line: A positive swing in speculative sentiment seems to have started since the start of Q4. I expect much more speculative buying in favour of Comex gold into the year-end, which is set to produce a considerable rally in Comex spot gold prices. In turn, the value of GraniteShares Gold Trust ETF (BAR) should increase remarkably.

Investment positioning

Source: FastMarkets

ETF investors held around 2,056 tonnes of gold across various ETFs as of November 2, according to FastMarkets' estimates.

Over the latest reporting period of October 26-November 2, ETF investors boosted their gold holdings by around 12 tonnes, marking a fourth straight week of net inflows.

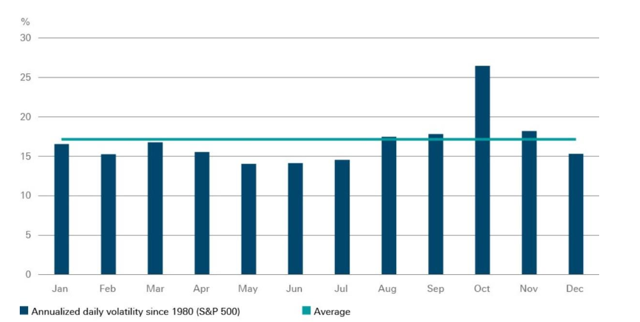

Although the pace of gold ETF flows was rather small last month, it was constantly positive due to a volatile October for risk assets. In this respect, US equities (SPX) registered their largest decline since September 2011.

Nevertheless, investors refrained themselves from panicking because the historical behavior of US equities suggests that October tends to be most volatile month of the year, as the chart below from Deutsche Bank illustrates elegantly. October 1987 and October 2008 are in most investors' minds.

Source: Deutsche Bank

Against this backdrop, it is logical that investors did not rush to have assets like gold; rather, they preferred to raise temporary their cash position until the end of the storm.

While a rebound in risk sentiment in on the cards as macro tensions abate, investors should look at the longer-term picture. The Fed is firmly determined to continue its gradual tightening policy in the face of robust domestic economic data. Worryingly, history shows us that each previous Fed tightening cycle has led to a financial event, whether at home (in the US) or in the rest of the world (most often in emerging markets).

The incremental tightening of US financial conditions is likely to lead to increased volatility in risk assets, leading me to believe that the bout of volatility that we experienced in October is likely to be more frequent than most investors are willing to realize in the course of 2019.

In such a scenario, haven assets like gold, hitherto out of vogue, are likely to become increasingly in vogue in the coming months as investors will need to rely on hedges against tail risk in the construction of their portfolios.

Bottom line: I expect gold ETF inflows to become increasingly positive in the course of 2019 as investors need to adapt to a more volatile environment.

Trading positioning

To play a likely rally in spot gold prices into year-end, I have a long position in the GraniteShares Gold Trust ETF (NYSEARCA: BAR).

Source: Seeking Alpha

BAR looks increasingly constructive from a technical perspective. The momentum is in positive territory while the 20 DMA has bottomed out, exerting upward pressure on BAR.

This reinforces my view that the 2018 low is behind us, with BAR set to move gradually higher into year-end.

BAR - GraniteShares - Review

BAR is directly impacted by the vagaries of gold spot prices because the Funds physically holds gold bars in a London vault and custodied by ICBC Standard Bank. The investment objective of the Fund is to replicate the performance of the price of gold, less trust expenses (0.20%), according to BAR's prospectus.

The physically-backed methodology prevents investors from getting hurt by the contango structure of the gold market, contrary to ETFs using futures contracts.

Also, the structure of a grantor trust protects investors since trustees cannot lend the gold bars.

BAR provides exposure which is identical to established competitors like GLD and IAU, which are nevertheless much more costly to hold over a long period of time. Indeed, BAR offers an expense ratio of just 0.20% while GLD and IAU have an expense ratio of 0.25% and 0.50%, respectively.

As of November 2, BAR traded at a slight premium of $0.11 per share to its net asset value, which has occurred around 25% of the time (in term of number of days) since its inception. This compares with a premium of $0.03 per share a week ago. I expect any deviation from the net asset value to narrow on the back of arbitrage opportunities.

BAR's average spread (over the past 60 trading days) is 0.02%, which is lower than that of its competitor IAU, at 0.09%, or SPDR Gold MiniShares Trust (GLDM), at 0.08%.

As a result, BAR offers the lowest total cost of ownership (expense ratio + spread) among gold ETFs.

BAR's average daily volume (over the past 45 trading days) is ~$2 million, which is much lower than that of IAU, at ~$126 million.

As of November 2, 2018, BAR's assets under management totalled $290 million, with 2.4 million shares. BAR's gold holdings were at 7.32 tonnes. In contrast, IAU's assets under management amounted to $10.295 billion, with 983.5 million shares. IAU's gold holdings were at around 270 tonnes.

For the sake of transparency, I will update my trading activity on my Twitter account.

Final note

Dear friends, if you enjoy reading my research, thank you for showing your support by clicking the "Follow" orange button beside my name on the top of the page and sharing/liking this article. I look forward to reading your comments below.

Disclosure: I am/we are long BAR.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Boris Mikanikrezai and get email alerts