Gold Weekly: The Best Is Yet To Come

Gold is supported by friendlier macro forces in spite of fading risk aversion.

Speculators cut their net long positions for a 3rd week in a row, the CFTC shows.

ETF investors rebuild long positions in gold, albeit at a small pace, according to FastMarkets' estimates.

Expect gold to remain in an uptrend thanks to friendlier macro forces in the months ahead.

I am long IAU with a very long-term approach (>12m).

Introduction

Welcome to my Gold Weekly.

In this report, I wish to discuss mainly my views about the gold market.

To do so, I analyse the recent changes in net speculative positions on the Comex (based on the CFTC) and ETF holdings (based on FastMarkets' estimates) and draw some interpretations about investor and speculator behavior. I conclude the report by sharing my trading positioning.

While the CFTC statistics are public and free, the data about gold ETF holdings are from FastMarkets, an independent metals agency which tracks ETF holdings across the precious metals complex.

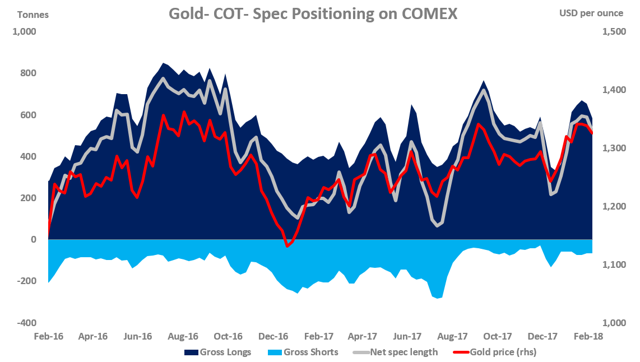

Speculative positioning

Source: CFTC.

According to the latest Commitment of Traders report provided by the CFTC, money managers cut their net long position for a third straight week over the reporting period (February 06-13), during which spot gold prices edged 0.5% higher from $1,325 per oz to $1,332.

The net long fund position - at 481.25 tonnes as of February 13 - dropped 37.34 tonnes or 7% from the previous week (w/w). This was driven exclusively by long liquidation (for a 3rd week in a row) of 57.25 tonnes, but counterbalanced by short-covering of 19.91 tonnes.

The net long fund position remains up a solid 175.76 tonnes or 58% since the start of the year, after rising 182.55 tonnes or 149% in the whole of 2017.

Gold's spec positioning is still quite long, with its net spec length at 62% of its historical record.

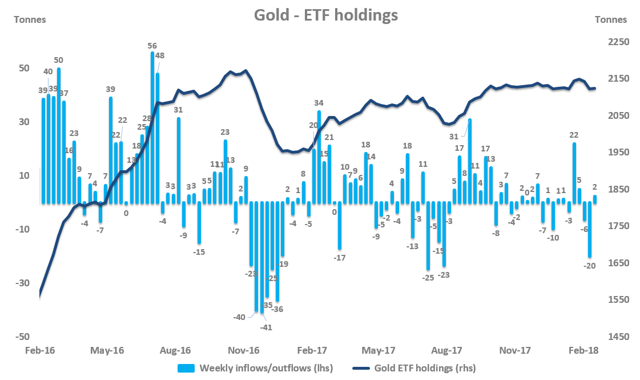

Investment positioning

Source: FastMarkets.

ETF investors bought a small 2 tonnes of gold over February 09-16, while spot gold prices rallied 2.3% from $1,316 per oz to $1,332 over the corresponding period.

This was the first weekly net inflow in three weeks but the amount of net buying was too small to offset the combined 26 tonnes of net selling over the preceding two weeks.

The largest part of last week's inflows came from the GLD (+3.84 tonnes or 0.5% w/w). But the ETF buying/selling was much less intense than usual with daily changes ranging from -3 tonnes to +3 tonnes, which is indicative of lack of conviction from ETF investors to build sizable positions. Most ETF investors were on the sidelines last week.

ETF investors have sold about 21 tonnes since the start of February after buying 22 tonnes in January, leaving gold ETF holdings little changed on the year.

Last year, ETF investors were net buyers of 173.38 tonnes of gold, corresponding to an increase of 8.8% in gold ETF holdings from 2016.

As of February 16, 2018, gold ETF holdings totaled 2,124 tonnes, according to FastMarkets' estimates.

Macro backdrop for gold

Although risk aversion has faded, as evident from the slump in the VIX since it reached a peak of 50 on February 6, the macro backdrop for gold has not turned unfriendly.

Source: Trading View.

Indeed, what matters for gold is the dollar and US real rates. Over a long period of time, the (negative) correlation between gold prices and the dollar (DXY as a proxy), US real rates (10-year US TIPS yield) is strong whereas the correlation between gold prices and risk aversion (VIX as a proxy) is rather weak.

And interestingly, the dollar has moved lower since the financial markets returned to normality on February 6, while US real rates have been capped as nominal yields have ceased to grind higher.

Source: Bloomberg.

Even though risk aversion continues to diminish, gold may enjoy further upward pressure as long as the dollar and US real rates work lower.

I think this will be the case due to growing inflationary pressure stemming from the US fiscal stimulus. The recent US CPI print for January (+0.5% m/m vs. +0.3% expected, marking the strongest monthly increase in 5 months) confirmed that inflation was back, which should thereby exert downward pressure on the dollar and US real rates (i.e., nominal minus inflation expectations). Although one could argue that the Fed may respond to stronger inflation dynamics, I am inclined to think that it will be forced to stick with its gradual tightening approach, principally because the FOMC does not want to exacerbate the rise in yields.

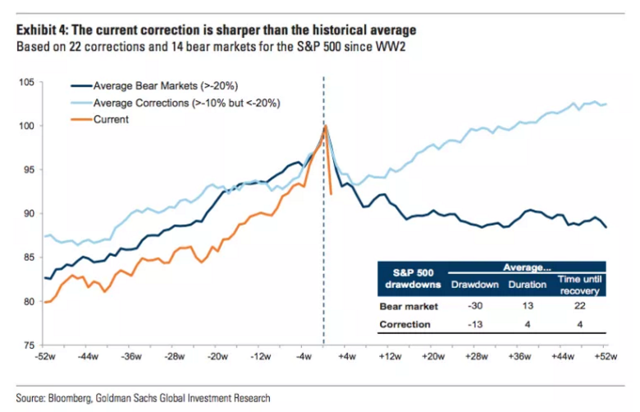

Regarding the recent pullback in global risk assets, I am strongly of the view that the correction is not complete. As Goldman Sachs (NYSE:GS) estimated in a recent note, an average correction lasts around 3 months and the drawdown is 13%. In the present case, the drawdown was just 10% and lasted less than one month.

Source: GS.

Given the sharp run-up in equities in previous years, it is fair to argue that equities could surprise to the downside this year. While I concur that the recent sell-off in equities was purely technical, namely the result of the blowup in short-volatility related VIX exchange-traded products, this could be just a glimpse of the coming rise in volatility this year and thus a more pronounced correction in risk assets on the horizon.

In this case, the Fed could revise lower its expected path of the Fed Funds rates, which would in turn make the macro backdrop for gold friendlier, as a result of a weaker dollar and lower US real rates.

Under this scenario, I expect gold to be heavily bid, reflected in an increase in speculative and ETF demand for the yellow metal.

Trading positioning

Since I believe that the macro backdrop for gold will become increasingly friendly in the course of 2018 and beyond, I maintain my long position in the iShares Gold Trust ETF (IAU), a position that I implemented on Monday, January 29, 2018, at $12.89.

Source: Trading View.

I set a stop-loss level at $10.81 (i.e., -16% from my entry point), which corresponds to the 2016 low. My stop-loss is relatively wide because I cannot rule out a retest of the major downtrend line from the all-time high (blue line) after the bullish breakout in the summer of 2017. Although this is not my base case, I prefer to remain conservative.

I see a maximum downside for the year at ~$12, which corresponds to the uptrend from the 2017 low (red line). IAU could retest this key level should macro forces turn materially negative - a more hawkish Fed (unlikely) could be the driver.

My profit target is at $19.00 (+48% from my entry point), which corresponds to the all-time high. This profit target reflects my conjecture that a new bull market has begun. But I expect my profit target to be hit in the next few years rather than in the next few months.

This position has a reward-to-risk-ratio of 3, which is skewed in my favor. This position seems to me relatively safe, with a very long-term philosophy.

For the sake of transparency, I will update my trading activity on my Twitter account and post my trade summary at the end of each report.

Final note

My dear friends, thank so much for showing your support by pressing the "Follow" button and sharing this article. I look forward to reading your comments below.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.