Gold Would Benefit From Infrastructure Spending

Continued dollar weakness is keeping gold's turnaround alive.

Infrastructure spending would likely benefit gold as well.

Other major factors remain supportive for the intermediate-term outlook.

As the gold price continues its three-week-old lateral consolidation, sentiment remains mixed between those who believe the dollar is long overdue a relief rally and those who see the dollar's decline continuing apace. The former scenario would undoubtedly put downward pressure on the price of gold while the latter would benefit it. Here we'll review the evidence which points to the gold bulls still having an advantage. I'll also explain how the latest developments in the political realm as it pertains to the U.S. dollar should allow the gold price to maintain its upward trend.

On the precious metals front, my favorite gold proxy, the iShares Gold Trust ETF (IAU), jumped to a one-week high on Thursday as investors bought bullion after the Federal Reserve held interest rates steady at its latest policy meeting. The Fed asserted that the U.S. economy is gaining strength, expressing some concern that inflation may be rising. The gold price reversed earlier weakness in the wake of Wednesday's FOMC meeting to close higher for the day, followed by a follow-through rally on Thursday. Although spot gold was down 0.01 percent on Feb. 1, April gold futures gained $4.80, or 0.4 percent, to close the first day of the new month at $1,348.

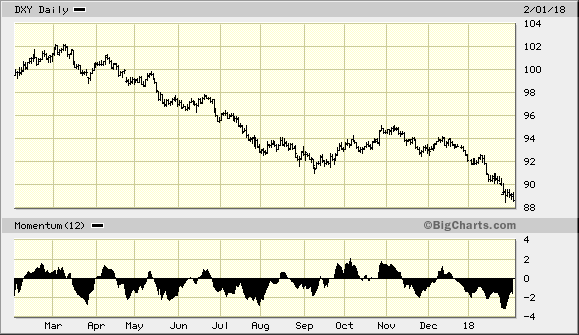

Meanwhile on the currency front, the U.S. dollar index fell 0.51% to a new yearly low on Feb. 1 while stocks continued to show signs of internal weakness. These moves were exacerbated by concerns that the Trump Administration's desire for $1.5 trillion in infrastructure spending could add additional downside pressure to the sinking dollar. The dollar index is now at its lowest point since 2014 after making yet another 52-week low on Feb. 1 (below). Thus a case could be made that the proposed spending policy would likely boost the price of gold.

Source: www.BigCharts.com

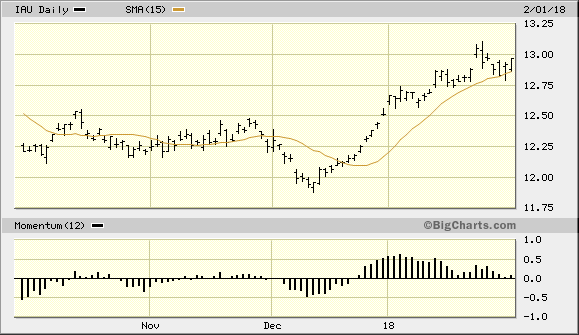

If the dollar continues to erode from here it would likely turn to gold's immediate advantage with a resumption of the upward trend which began in early December. Notice in the chart of the iShares Gold Trust (IAU) below that at no time during the recent lateral consolidation did the IAU price line violate its 15-day moving average. This confirms that the bulls still technically control the immediate trend. Further dollar weakness could turn the gold rally into something more substantial beyond the immediate term. In particular, a further dollar index decline would likely cause undue stress to the traders who sold gold short during the pause of the last few days. In other words, a further dollar decline would almost certainly catalyze a gold short-covering rally which would be expected to push the gold price to a new 52-week high.

Source: www.BigCharts.com

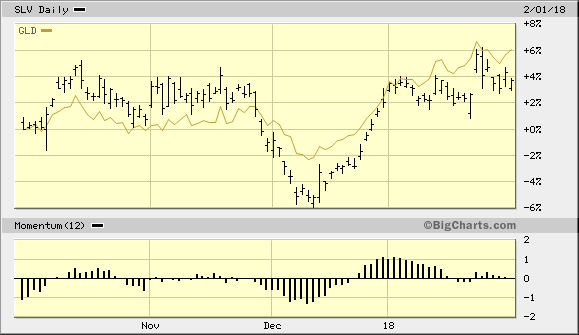

While gold is trying to push its way ahead to a new high, silver is still lagging behind a bit. As I've stated in previous commentaries, it's preferable if silver leads the gold price or at least confirm its immediate-term strength. Shown here is the daily chart for the iShares Silver Trust ETF (SLV), my favorite silver price proxy. The SLV price remains firm but should ideally catch up with the gold price in the days immediately ahead. This would let us know that the gold rally remains on a solid technical footing.

Source: www.BigCharts.com

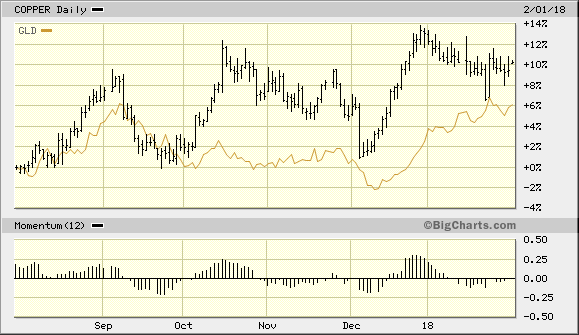

By contrast, helping to bolster the near-term outlook for the precious metals is the latent strength in the industrial metals including copper and steel. Copper has shown a fair degree of relative strength versus gold for the last four months and the following graph suggests the metal is consolidating prior to another forward thrust. This accounts for the outperformance of the precious metals mining stocks with heavy exposure to copper, including Freeport (FCX) and Teck Resources (TECK).

Source: www.BigCharts.com

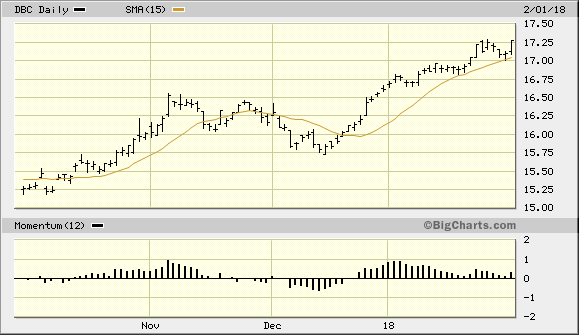

The overall commodities outlook also has been supportive for gold's intermediate-term recovery effort, as can be seen in the chart below. This shows the progression of the PowerShares Commodity Tracking ETF (DBC), which is in a rising trend above its 15-day moving average. This also technically confirms that commodities have been in a bull market of intermediate-term proportions per the rules of our trading discipline. Whenever DBC is in a sustained rising trend, it often serves to attract the attention of money managers who will then look to increase their exposure to the most inflation-sensitive commodities, including gold.

Source: www.BigCharts.com

On a related note, my favorite trading vehicle for gold, the above mentioned IAU, closed just slightly above its 15-day moving average on Tuesday, Jan. 30. This barely kept the immediate-term uptrend intact for IAU. I continue to urge traders to closely monitor the 12.75 level from here since this is the "line in the sand" for the trading positions in IAU which was recommended in December. A close under the 12.75 level in IAU would violate my stop-loss and thus confirm an exit signal on the remainder of our trading position in this ETF. (I recommended on Jan. 5 taking some profit after IAU's 5% rally from the December entry point). For now I recommend remaining long IAU since the immediate-term uptrend is still intact.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.