Gold and Precious Metals Getting Some More Life

Barry Dawes of Martin Place Securities shares his thoughts on the current state of the market, taking a close look at gold and silver.

Barry Dawes of Martin Place Securities shares his thoughts on the current state of the market, taking a close look at gold and silver.

Well, it is now finally happening. That 16-year bear market for gold against stocks is finally over. Also, the 16-year bear market of gold stocks against gold is over.

All that misery for the holders of small-cap resource companies is now ending. We all know the value of these stocks. We are just dismayed at the price and dismayed that the marketplace doesn't recognize the value.

Well, the cyclical changes are underway. You can buy all those microcaps now with confidence. The equity market bears are certainly growling again, but I don't think this bull market is over yet.

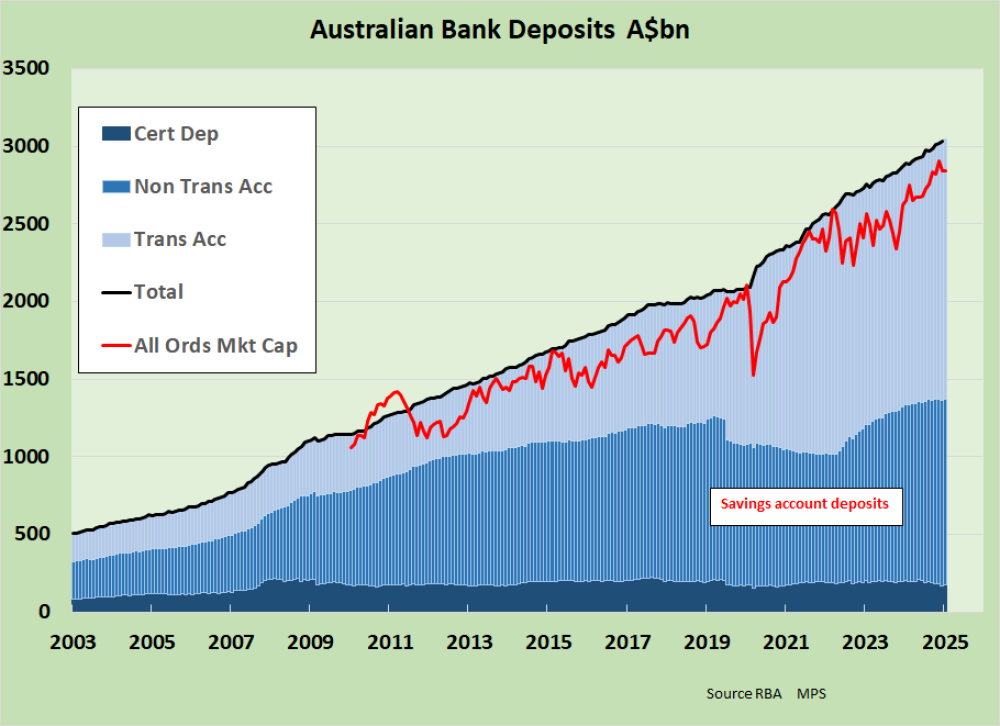

The world's biggest bull market is unlikely to end with so much cash on the sidelines and so much pessimism in the marketplace.

The world should be rejoicing.

Finally, the U.S. has decided to tackle its budget deficit. The most important action since Aug 1971 was the abandonment of the Bretton Woods Agreement and a gold standard.

The bond market is ready for a very big rally.

The theft, fraud, and waste in the U.S. budget are being revealed, and they are surely replicated right around the world, so this is just the beginning.

Here in Australia, we've got an election coming up, and there is good evidence that Australians have woken up to the NET ZERO BS and all the other dubious programs that spend our money.

Change is coming.

In Australia, term deposits peaked in May 2024 and have fallen 17% to AU$172 billion, while total cash continues to rise to AU$1.6 trillion in nontransaction (savings) accounts.

The All Ords should bounce off about 8000 and resume its bull market.

Gold

It seems we've got the bounce off the uptrend channels of gold in euros and other currencies so we should see a rising gold price and a stronger U.S. dollar from here.

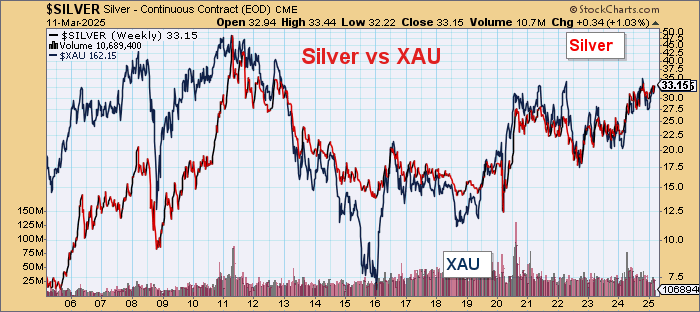

The big news, of course, is the break out of gold and gold stocks against the S&P 500.

This should mean that gold and gold stocks rise strongly and not necessarily mean that the stock market falls.

But it really doesn't matter if you are in this sector because it will outperform general stocks.

These are very important moves.

Gold itself is looking good. Gold is bouncing off those uptrends in other currencies.

Stronger gold and stronger US$.

Gold Stocks

Australia

AU$ is probably bottoming.

The writing is on the wall for Albo.

Sort-term pullback.

AU$1.6 trillion in savings accounts.

BHP is in a good technical position.

Head the markets.

| Want to be the first to know about interestingSilver andGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Barry Dawes: I, or members of my immediate household or family, own securities of: BHP Group Limited. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.