Gold lower amid firmer dollar

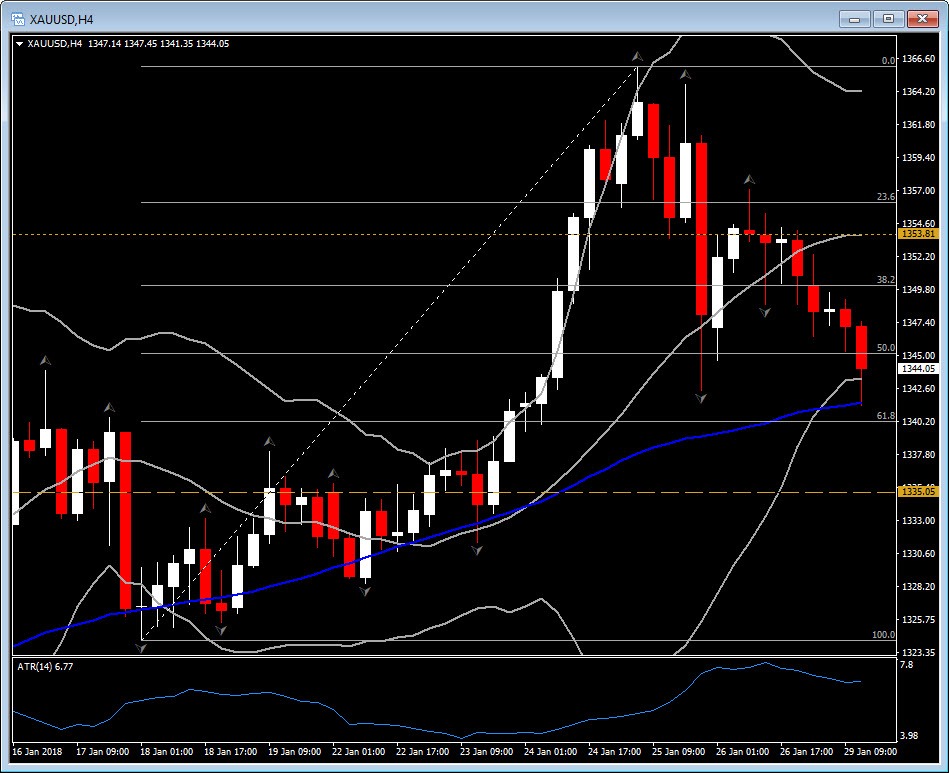

XAUUSD, H4

U.S. personal income and consumption each rose 0.4% in December. The 0.3% rise in income was not revised, but the 0.6% jump in spending was revised higher to 0.8% (and the 0.2% October gain was nudged to 0.3%). Compensation was up 0.4%, the same as in November. Wages and salaries increased 0.5% after the prior 0.4% gain. Disposable income was up 0.3%, as was the case in November (revised down from 0.4%). The savings rate slid to 2.4% from 2.5% (revised way down from 2.9%). The December chain price index inched up 0.1% from 0.2%, and slowed to 1.7% y/y versus 1.8% y/y. The core rate was up 0.2% from 0.1% and was steady at 1.5%.

Gold fell back to $1,341.35 lows, after printing 18-month highs of $1,365.40 last Thursday. The move lower comes as the dollar recovers some poise, leaving the USDIndex at 89.37 versus Friday’s three-plus year low at 88.73. The generally firmer dollar as markets look for a possible hawkish nudge from the Fed at this week’s FOMC, has weighed.

The commodity, on USD slight recover today, broke in the 4-hour chart, the 50-period EMA, along with the strong swing low seen on Thursday and the 50% Fibonacci level set since January 18. It is currently traded between 50-61.8% Fibonacci level ,which consider be a retracement area. Hence a break below $1340.00, which is the confluence of 61.8% fib. level, the low Fractal and the 50-period MA, could confirm that weakness will continue. Intra-day support now comes in at $1,335.00-1,337.00, and the daily one at the 20-Day moving average, at $1,331.00.

Conversely, to the upside, the next level to have in mind is the $1,353.80 key level, which is halfway the downtrend seen since Thursday and also the 20-period SMA in the 4-hour chart.

Disclaimer: Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of purchase or sale of any financial instrument.