Gold opens 2019 with fanfare as warning signs flash on growth

Gold's year-end rally is pushing into 2019, with bullion advancing for a fifth straight day as equities posted fresh losses after the worst year since the financial crisis.

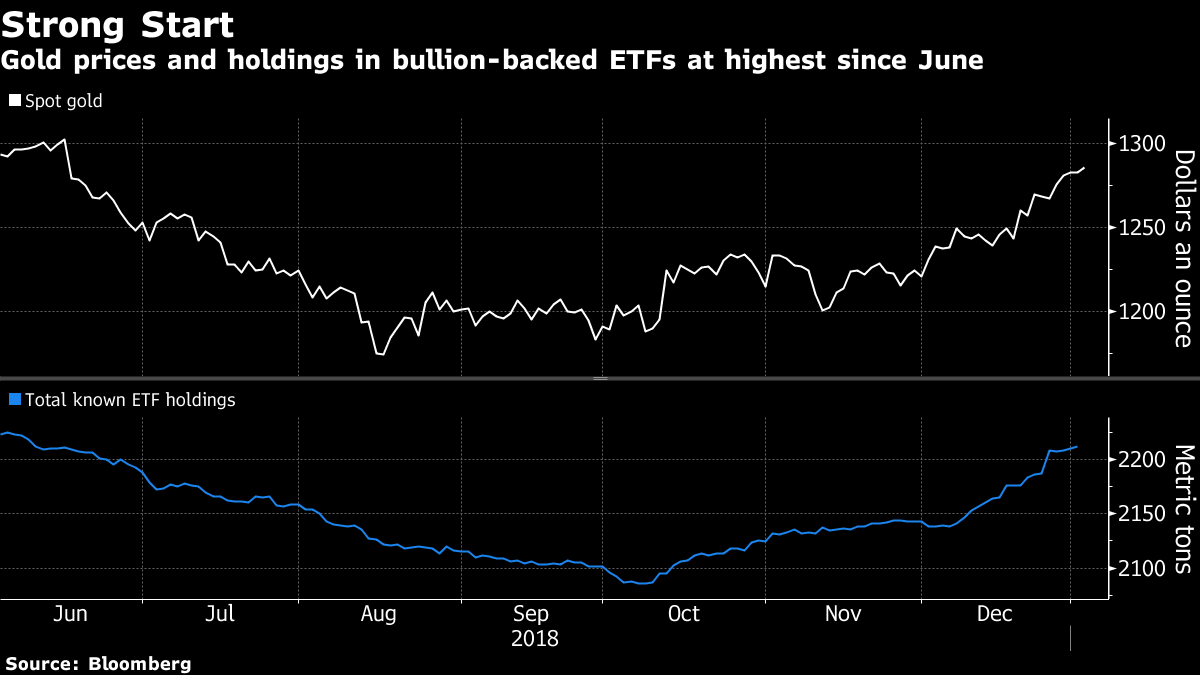

The metal hit a six-month high nearing $1,300 an ounce, even as some daily technical indicators highlighted the potential for a reversal after recent gains. The advance came as fresh figures showed China manufacturing shrinking and U.S. equity futures tumbled as stocks slumped across Europe and Asia.

"Mostly people are moving toward safe-haven assets, such as gold, because of the volatility in the equity markets," Gnanasekar Thiagarajan, director at Commtrendz Risk Management Services, said by phone. The U.S. government shutdown "will only further create more uncertainty, so that will be supportive," he said."Mostly people are moving toward safe-haven assets, such as gold, because of the volatility in the equity markets"

Gold surged in the final quarter of 2018 as investors positioned themselves for a global slowdown, with fewer rate hikes expected from the U.S. Federal Reserve, and as a steep sell-off in the global equities spurred demand for havens. Worldwide holdings in gold-backed exchange-traded funds have jumped. Wednesday's gains came even as President Donald Trump signaled the possibility of making a deal to end the partial U.S. government closure.

"Gold is building towards a crescendo" in the first quarter, said Eily Ong, a metals and mining analyst at Bloomberg Intelligence.

Spot gold climbed as much as 0.5 percent to $1,288.83 an ounce, the highest since June 15, and traded at $1,286.86 at 11:25 a.m. in London, according to Bloomberg generic pricing. In December, bullion capped the biggest quarterly rise since March 2017. After that rally, its 14-day relative strength index is well above 70, a level that can indicate a pullback to some investors.

President Trump invited top congressional leaders from both parties to a White House briefing on Wednesday, offering an opportunity to break the stalemate. However, risk aversion lingered as growth indicators faltered in other parts of the world. In China, the Caixin Media and IHS Markit PMI fell to 49.7, its lowest since May 2017, confirming a trend seen in the official PMI on Monday. A reading below 50 signals contraction.

There was another jolt as figures showed Singapore's growth slowed to an annualized 1.6 percent in the final quarter of 2018. That's below the median forecast for a 3.6 percent expansion. As one of Asia's most export-reliant nations, Singapore's outlook is closely tied to global trade and growth.

In other precious metals, silver lost 0.2 percent, platinum dropped 0.4 percent, while palladium added 0.3 percent after hitting a record last month.

(By Ranjeetha Pakiam and Rupert Rowling)