Gold Comes Come Back Into Favor As Volatility Soars In 2018

Stocks have been showing wild swings and volatility.

Increased volatility is great for precious metals.

The real key is preserving the wealth during times of crises.

A real gold discovery can take a junior trading for pennies into a major producer.

Don't forget forty year cycle for gold rushes we may be on the verge of the next one!

Is gold finally about to breakout from a 5 year base and hit new highs? This is something we need to ask as gold closes in on the $1400 mark. Gold could soon be hitting levels not seen in many years and breaking out of a major base.

Stocks have been showing wild swings and volatility measured by the VIX in 2018 after rising significantly since the 2008 Credit Crisis and the printing of trillions of dollars. Increased volatility is great for precious metals as investors seek safety.

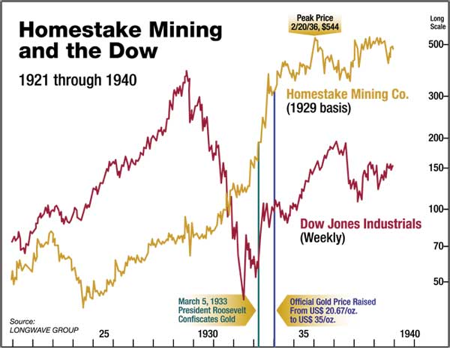

There is a secret that the masses do not know in the investing world. Most people think the way to get rich is by making lots of money. However, the real key is preserving the wealth during times of crises. During the 30's, gold investors avoiding the 1929 crash were flying around in private jets while the masses saw their fortunes blow up.

The Hearst and Guggenheim families wealth were made by gold and silver discoveries right here in America during times of panic. While stocks sank gold explorers soared.

There was a major gold rush in the 30's leading up to WW2 when gold mining was banned. Then the next gold rush came in late 70's-80's after Nixon let devalued the U.S. dollar. This started a major gold rush when some of the big Nevada mines like Goldstrike were discovered and new cities like Elko, Nevada emerged. This discovery made companies like Barrick (ABX) move from a penny Canadian junior to a $15 billion company today!

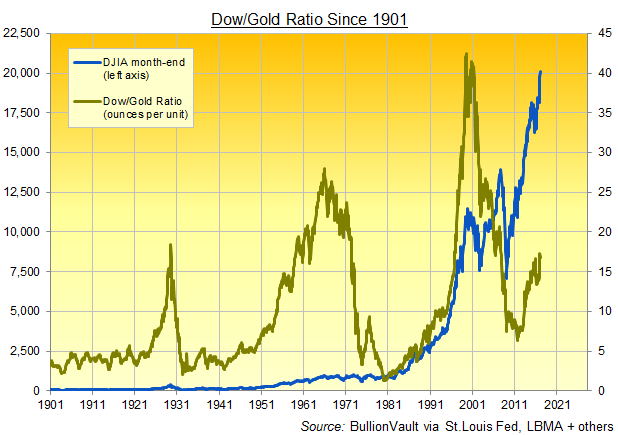

Basically mining is counter cyclical to the stock markets as measured by the Dow Jones Industrial Average (DIA). Gold moves the opposite of stocks. When the general market is in favor, gold stock investors are out of luck. From the dot com crash in 2000 up until the credit crisis in 2008, gold stocks and commodities were the place to be.

However, from the credit crisis to present, general equities, real estate and bonds have been in a huge uptrend while gold stocks and precious metals have been in a bear market.

However, that ratio according may be finally turning in favor of precious metals and commodities in 2018. The VIX has soared, interest rates are climbing higher, inflation is picking up and Big Banks are showing signs of cracking like Wells Fargo (WFC) with recent sanctions and class action suits.

Don't forget the forty year cycle. The last time gold hit new all time highs was back in the early eighties. I wouldn't be surprised by early 2020's to see new highs in both gold and silver. That's how I'm playing it.

I see a breakout at $1400 on gold which is new multiyear highs the catalyst to cause a huge tsunami of capital to come into the junior gold and silver mining sector.

What is so funny is that so many investors have been diverted away from the sector including some major banks into crazy speculative areas like cryptocurrency or cannabis.

A few months ago I went to gold conferences and all the talking heads were talking about blockchain. This is just like the dot com bubble I thought and instead bought the best financings offered with real proven management teams with track records.

I think we are on the verge of another gold rush starting possibly this year if gold breaks $1400 as I expect. If we get the breakout I expect I would not be surprised for possibly 7-10% daily moves higher like we saw with bitcoin back in 2017. The only difference is that the move in gold will be real as it is a tangible currency, well known all over the world and a store of value in times of panic for thousands of years unlike cryptocurrencies which have no track record and which simply I don't get!

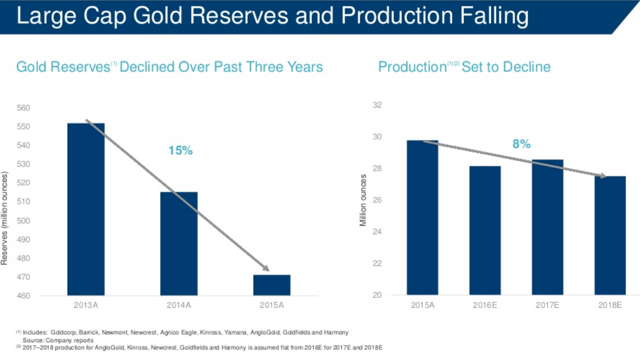

I think the next gold rush should be bigger than the 70's more like the 30's. The miners will start booming after the $1400 breakout and if we get some big 10% moves higher. The producers reserves have been in free fall, grades are declining, production is smaller and not much exploration success in recent years.

I wouldn't be surprised to see a quick move to $1750.

Year to date, the VanEck Vectors Junior Gold Miners ETF (GDXJ) is underperforming while the SPDR Gold Trust ETF (GLD) has climbed 3.8%. That should adjust when gold break through $1400 area.

I'm currently avoiding the royalty companies such as Wheaton Precious Metals (WPM) and Franco Nevada (FNV) as I believe the equity markets will open up once again. The juniors will not want to sell royalties in a bull cycle. In this early part of the cycle I am looking for the lowest cost operators with best growth profiles with least amount of debt. Also look at management which is the most important factor in a gold miners success.

Look for what the major and mid-tiers want which is high grade deposits with upside potential in mining friendly jurisdictions. Gold and silver are still way below their all time highs yet some base metals like zinc and copper are already breaking out.

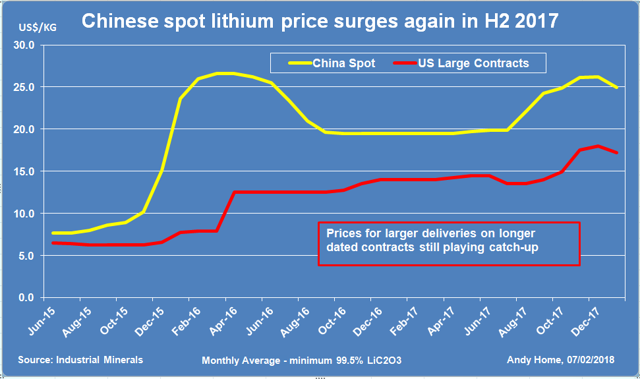

Battery metals like lithium and cobalt they are already soaring in value as car makers plan to make the internal combustion engine obsolete. More electric vehicles were sold last year than any prior year.

I recently went to the Money Show conference in Orlando and saw a lot of buzz around crypto currency and cannabis but very little about lithium, cobalt, zinc, copper and precious metals. Notice the pricing in lithium and cobalt is surging.

Remember the days struggling companies would change there names to dot coms? Now they are adding blockchain to their names to dupe investors into the latest fad. Well I'm not falling for it and either should you! Stick to the metals and commodities just beginning to breakout into multi year highs. Look to early stage explorers and developers known as junior miners with top tier assets and management teams with track records and are debt free.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.