Gold Finally Gets Some Institutional Support

Short-term headwinds remain, but gold's interim prospects are better.

Falling Treasury yields bode well for gold demand.

Gold is also getting some institutional and central bank support.

Although gold still faces strong short-term obstacles in the form of a strong dollar and a weak crude oil price, the prospects for an intermediate-term turnaround are still strong. Along with diminishing competition from rising Treasury yields, institutional and central bank interest in the metal is increasing. As we'll talk about in today's report, this has the potential to boost the gold price in the coming months.

The gold price remained near the upper boundary of its November range after Federal Reserve Chairman Jerome Powell's latest comments reassured investors that the Fed would likely moderate the pace of interest rate increases in 2019.

After pulling back sharply earlier in the week, the gold price rebounded strongly after Powell indicated that he viewed the Fed funds rate as being "just below" normal. This contradicted his previous statement from earlier last month in which he stated that interest rates were "a long way from neutral." This provided investors an excuse to buy stocks along with precious metals. Silver also saw buying interest while palladium hit a record high due to a supply shortage.

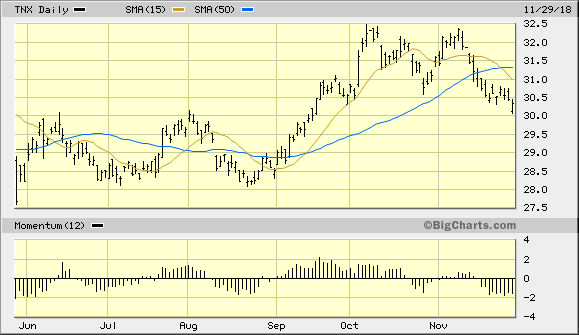

Also benefiting gold lately has been the continued pullback in U.S. Treasury bond yields. The decline in the 10-Year Treasury Note Yield Index (TNX), which has decisively penetrated below its widely watched 50-day moving average, has been good news for gold. It indicates that yields aren't providing as much competition for the yellow metal. Fears of a global economic slowdown are the primary catalyst behind the recent decline in T-bond yields, as well as the Fed's softening stance on interest rates.

Source: BigCharts

In the previous report, we talked about the importance of the crude oil price as a leading indicator for gold. A firming oil price typically bodes well for gold, especially when accompanied by dollar weakness. As can be seen in the January crude oil graph, the oil price remains under selling pressure but is trying to establish an immediate-term bottom. A revival of oil price strength would send a vital message to commodity fund managers that the market's perception of global economic weakness is overblown and that demand for inflation-sensitive commodities is returning. This in turn would likely pique their interest in gold.

Source: BigCharts

For now, crude oil is trying to stay above the $50 level but so far hasn't had any success in reversing its immediate-term downward trend. Until it does, the gold price is likely to remain within the parameters of its 4-month sideways trading range.

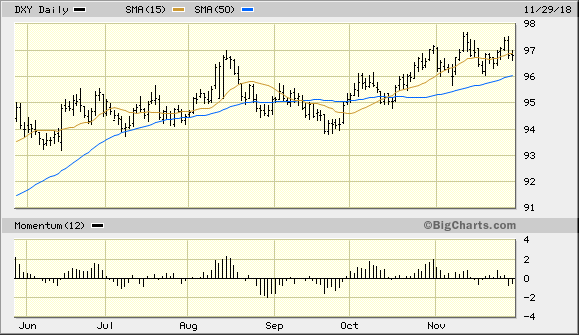

Meanwhile, gold's biggest headwind continues to be the U.S. dollar index (DXY). The dollar has remained stubbornly above its 15-day moving average on a weekly closing basis, but may finally be on the verge of closing below this immediate-term trend line on Friday (below). Even more importantly from a technical standpoint, however, would be a decisive penetration below the 50-day MA in the dollar index. This would finally have the effect of pushing gold out of its multi-month lateral trading range and would give the gold bulls the impetus they need to take charge of the intermediate-term (3-9 month) trend.

Source: BigCharts

Despite the resilience of the dollar's strength, the gold bulls have another reason to be optimistic about the metal's intermediate-term outlook. Along with the recent increase in short interest to record levels, institutional sentiment towards gold is apparently taking a bullish turn. One of the most influential investment banks, Goldman Sachs, has published a report which reveals a positive outlook on the yellow metal for next year. Goldman analysts point out that demand for gold among the world's central banks is on the rise, with some central banks having purchased the metal this year for the first time since 2012.

Along with central bank demand, an important longer-term driver of the gold price, Goldman analysts also suggested that the metal has diversification value for investors, particularly if U.S. economic growth slows next year as the investment bank expects.

What makes Goldman's positive spin on gold's year-ahead outlook so important? While its analysts have been wrong on gold's short-term outlook at times, the investment bank's historical record of mostly being on the correct side of gold's longer-term trend is worthy of our attention. Certainly the latest report from Goldman can't be lightly dismissed and should be viewed by investors as an encouraging sign that market-moving institutional investors are giving gold a serious look.

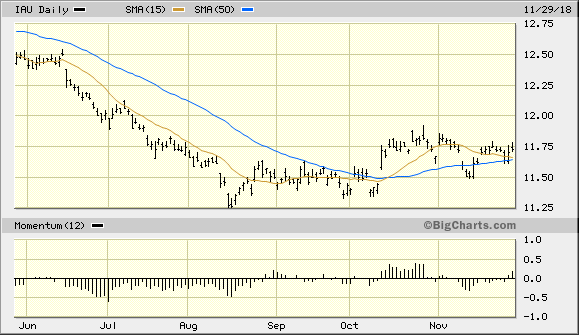

On the ETF front, after technically confirming an immediate-term speculative buy signal, the iShares Gold Trust ETF (IAU) still remains on a buy and appears still to be in strong hands. IAU recovered late last week to finish above both its 15-day and 50-day moving averages on a weekly closing basis, which is technically positive. A close above the late Oct. 26 high at $11.92 would confirm a trading range breakout for IAU and would likely result in some serious short covering. I still recommend using an intraday stop-loss at the $11.37 level (the Aug. 23 closing low) for this open trading position. IAU is clearly trying to establish a stair-stepping pattern of higher lows, which suggests that the ETF is laying the groundwork to eventually reverse its April-August decline.

Source: BigCharts

While the gold price is still facing some serious short-term headwinds from a strong dollar and a weak crude oil price, its intermediate-to-longer-term prospects are improving. Institutional sentiment towards gold is on the upswing, while speculators - who tend to be on the wrong side of the market in most cases - are extremely pessimistic on the metal. As discussed in recent reports, this creates a potential catalyst for a short-covering rally which could finally break the gold price out of its 4-month trading range in the coming weeks. For now, investors should walk slowly and expect a continuation of the lateral range in the gold price for a while longer. Traders can remain long the gold ETF mentioned above, while long-term investors should hold off on initiating new long positions in gold until the dollar index shows greater weakness.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Follow Clif Droke and get email alerts