Gold: Improving Sentiment Likely To Drive Prices Higher

Gold has underperformed many assets in recent months and years.

This is not surprising as sentiment surrounding the yellow metal has been atrocious lately.

However, some fundamental elements appear supportive of higher gold prices going forward.

The Fed's tightening path appears limited, and as economic growth slows further, the Fed may need to cease tightening or reverse monetary policy all together.

As the sentiment pendulum swings from one extreme to the other, much higher gold prices are very likely to materialize.

Source: Kitco.com

Source: Kitco.com

Gold: Improving Sentiment Likely To Drive Prices Higher

It's been a difficult year for Gold/SPDR Gold Shares (GLD). In fact, the yellow metal had been down by as much as 15% from its 52-week highs and, despite the slight rebound, remains lower by 10%.

However, sentiment in the gold market appears to be shifting to a more positive tone, and plenty of fundamental factors support higher prices going forward. Given the underlying fundamental, technical, and psychological setup, gold is very likely to appreciate into 2019 and beyond.

About GLD

GLD is the largest, physically-backed (reportedly) gold exchange-traded fund in the world, with roughly $29.5 billion worth of net assets. It offers market participants an efficient way to access the gold market. The ETF is an attractive alternative to trading gold futures, as it can be traded much like a stock on the NYSE Arca exchange instead of dealing with alternative exchanges and trading requirements pertaining to futures contracts.

Furthermore, it is an appealing alternative to trading physical gold, as investors get exposure to the same price action as the metal but can buy and sell gold with great fluidity using GLD. This way, investors bypass the inconvenience of having to take physical delivery of the asset.

Since the ETF mimics the price of gold almost identically, I will refer to GLD and gold interchangeably throughout this article.

Speculators Still Very Bearish on Gold, For Now

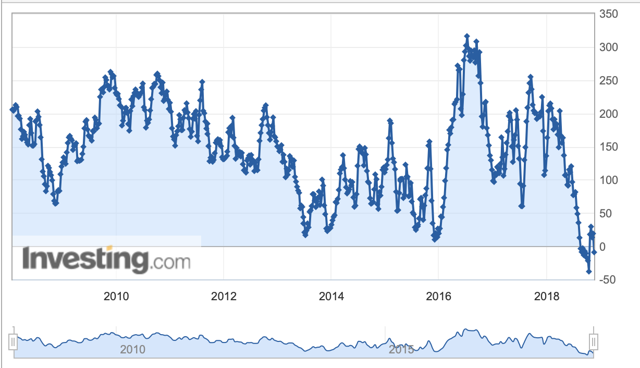

Despite the recent bounce back off the lows, speculative positions still paint a very bearish picture in the gold market. Sentiment remains poor, but is starting to show signs of improvement. An important element to note is that, according to the COT report, gold is just starting to come out of its most depressed period sentiment wise in decades.

COT 10-Years

Prior to a very recent improvement, gold's net speculative positions had been negative for 9 straight weeks, suggesting a level of bearishness not witnessed in several decades. This can be viewed as a solid counter indicator that a switch to a much more positive tone sentiment wise is likely to occur.

After all, when so many market participants are negative about something, there is a great deal of skeptics to convert. There are also an incredible number of short positions to close out and go long instead.

The Fed's Stance

The Fed's actions have been instrumental in influencing gold prices in recent years. As the Fed raises rates, the dollar typically strengthens, which then causes weakness in gold. However, more recently, the Fed's actions have had a more muted impact on gold prices. This may imply that the market believes that the Fed's tightening capacity is extremely limited now, and even if the Fed continues to hike rates, it may need to stop or possibly even reverse policy soon.

The Fed is in a very tight spot now, as the economy is clearly weakening, and part of the weakness is due to the Fed's tightening stance. Therefore, if the Fed continues to increase rates, it risks completely stalling the U.S. economy, and thus bringing on market turmoil and a recession. However, if the Fed takes an easier stance, it risks letting inflation get out of hand.

Either scenario is ultimately bullish for gold, as it will lead to a lower dollar due to a slower and easier tightening path, or a flat-out reversal in monetary policy. Another factor that could be bullish for gold is further stock market turmoil, which is likely to follow if the Fed continues its relatively aggressive tightening path.

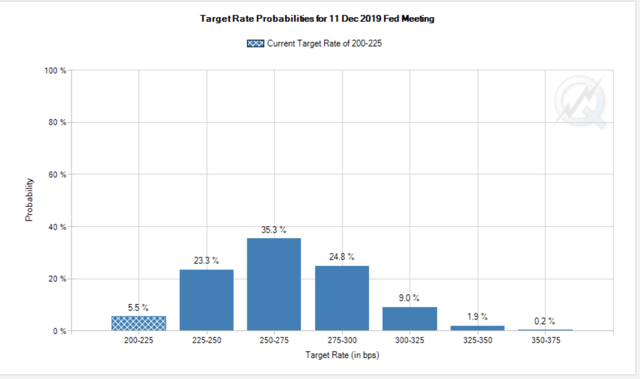

So, essentially, any scenario will likely be bullish for gold in the intermediate to longer-term. For now, market participants believe the Fed will take its foot of the tightening pedal. According to CME's Fed watch tool, there is about a 35% chance, the Fed will not increase rates at its next meeting. This is up from just 17% one month ago. Furthermore, next year's hike path appears relatively modest, as the Fed is expected to have rates at 2.5-2.75% by the end of 2019.

Rate Probabilities Dec. 2019

Source: CMEGroup.com

This is just a 0.25-0.5% higher than where rates are today, which is largely insignificant and likely mostly priced into the market by now. Additionally, this is based on the predicate of an expanding economy and relatively healthy market conditions. You can probably expect to see rates even lower if economic weakness persists into next year.

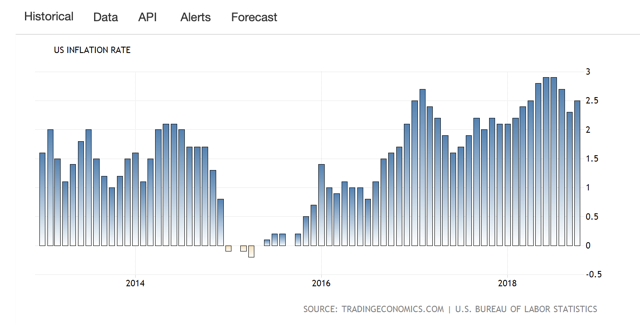

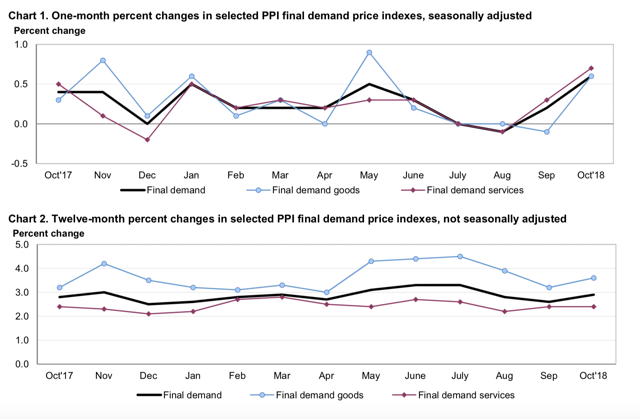

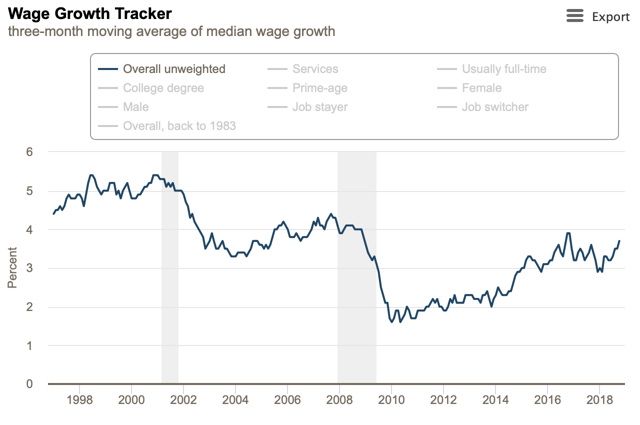

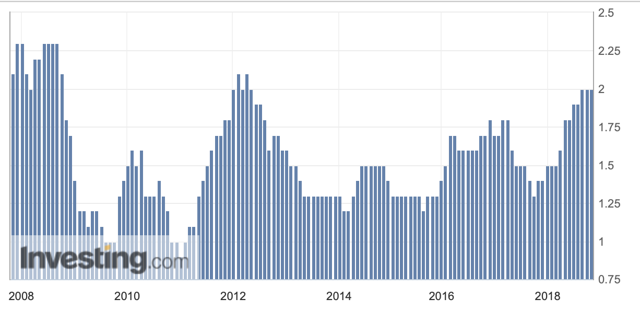

The Inflation Image

On the other side of this equation, inflation is beginning to heat up substantially. If we look at the CPI, inflation is between 2.5 and 3% and clearly trending higher. The PPI is around 3-4%, final demand goods PPI is trending between 3 and 5% and could be headed higher. Last month's wage growth came in at 3.7%, one of the highest readings over the past 10 years. And even the Fed's trusted PCE is bumping up against 2% and threatening to go higher.

U.S. Inflation CPI 5 Years

Source: TradingEconomics.com

PPI Past Year

Source: bls.gov

Source: frbatlanta.org

PCE 10-Year

Source: Investing.com

The underlying inflation indicators are all showing inflation at some of its highest levels over the past 10 years and are signaling that inflation is likely to continue its trend higher from here.

Also, this is all happening while the Fed is tightening rates, relatively aggressively over the past 2 years. What will happen when the Fed is forced to move back from its ultra-tight policy, or even easy rates going forward?

The dollar could crater, and Inflation will likely spike significantly higher, which would likely propel gold prices much higher from current levels as well. This is very likely to happen, because we are in late stage economic cycle, the Fed's tightening path is nearly exhausted, and inflationary pressures from tax cuts, trade tariffs, record amounts of debt, and nearly a decade of extremely easy monetary policy should continue to materialize.

The Bottom Line: Look for Sentiment to Shift

Gold has been a relatively disappointing investment over the past few years, it has underperformed many assets, and sentiment in this space has been abysmal. Just compare the sentiment that was witnessed near the top of the gold market in 2011, when most market participants expected gold to continue its path higher to $2,000 and beyond, and in recent months and years, when many market participants believed gold is almost pointless as an investment and is likely to go below $1,000.

According to the COT report, gold speculators have not been this bearish in decades, and it's only recently that a slight shift in sentiment has become noticeable. Additionally, the Fed has a very limited tightening path from here. In fact, as the economy continues to slow, the Fed will likely have to cease tightening and may need to reverse monitory course relatively soon. Unfortunately, inflation will likely continue to rise and could spike once the Fed stops tightening or reverses.

This economic scenario should be very favorable for gold prices, and as more market participants begin to realize the likelihood of it materializing, sentiment should begin to change. Right now, the sentiment pendulum is still close to as far negative as it can go, but with time, this tectonic shift should bring it to the other extreme. Therefore, as market participants become more and more positive on gold over time, its price is likely to move substantially higher.

Thank you for taking the time to read my article. If you enjoyed reading my work please hit the "Like" button, and if you'd like to be notified about my future ideas, hit that "Follow" link.

Disclaimer: This article expresses solely my opinions, is produced for informational purposes only, and is not a recommendation to buy or sell any securities. Investing comes with substantial risk to loss of principal. Please conduct your own research, consult a professional, and consider your investment decisions very carefully before putting any capital at risk.

Want more? Want full articles that include technical analyses, trade triggers, trading strategies, portfolio insight, option ideas, price targets, and much more? To learn how to best position yourself for a rally in Gold please consider joining Albright Investment Group.

Subscribe now and receive the best of both worlds, deep value insight coupled with top-performing growth strategies.Enjoy access to AIG's top-performing portfolio that has outperformed the S&P 500 by 40% over the past year.Take Advantage of the limited time 2-week free trial offer now and receive 20% off your introductory subscription pricing. Click here to learn more.Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am long various gold and metals related stocks and SLV.

Follow Victor Dergunov and get email alerts