Has Gold's Recovery Reached Its Limit?

Latest employment report provides excuse for gold profit-taking.

That same report contains seeds of gold's future demand, however.

Two-year gold price recovery remains intact despite recent weakness.

There's an old saying on Wall Street to the effect that when the stock market is stricken with panic, everything suffers in the ensuing decline. This includes even commodities and other non-equity assets. This was certainly the case last week when the price of gold took a hit during the stock market rout. While many traders assume that gold as a safe haven asset is immune from such declines, that's not always the case. Here, we'll look at gold's near-term prospects in the wake of the latest market sell-off. I'll also answer the question, "Would a major stock market correction jeopardize gold's two-year recovery effort?"

Gold prices declined by about 1 percent on Friday as the dollar index strengthened after U.S. jobs data showed an increase in jobs and wages for the month of January. Non-farm payrolls rose by 200,000 jobs in January, according to the Labor Department. This number beat the consensus expectation of 180,000 and was the largest annual gain in more than 8- 1/2 years. This was ostensibly listed by mainstream financial reporters as a big factor behind gold's decline on Friday.

The real focus of the latest employment report, though, was the 0.3% jump in average hourly earnings which left earnings up 2.9% year over year - the highest growth rate since May 2009. Gold subsequently finished last week 1.1 percent lower after rising in six out of the last seven weeks and hitting its highest level in 17 months last week at $1,366. While the jobs report may have been treated as a profit-taking excuse among gold traders, the longer-term implications of this report are actually bullish as I'll explain here.

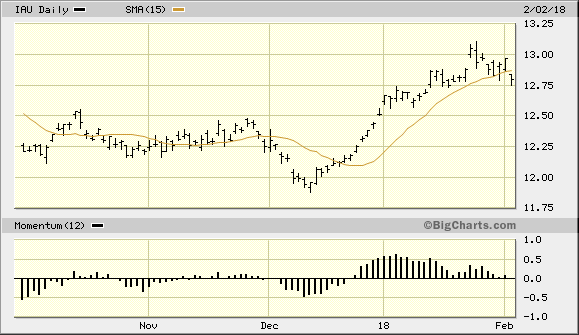

Gold's immediate-term (1-4 week) trend is being seriously tested entering the week of Feb. 5 and may be broken. Below is the daily graph of the iShares Gold Trust ETF (IAU), which is my most widely used proxy for the gold price. Here you can see that the IAU price closed Feb. 2 under its 15-day moving average. I use the 15-day MA to delineate the immediate-term trend and consider a violation of this moving average, especially on a weekly closing basis, to be indicative of a break of the immediate-term uptrend. Thus, gold has formally entered what looks to be a period of correcting and/or consolidation as its latest rally has likely terminated.

Source: www.BigCharts.com

The break below the 15-day moving average need not spell doom for the intermediate-term recovery of the gold ETF, however. A period of rest and consolidation is just what gold needs after the vigorous rally of the last six weeks. As long as the IAU price doesn't violate the 12.75 level on a closing, I will maintain my immediate-term trading position in the ETF which was initiated soon after the December rally commenced. In the event that the 12.75 level is broken, however, we'll need to watch for potential support at the next chart benchmark at about the 12.50 level. This level can be seen in the above chart as having served in prior months as a pivotal reversal point for several rally attempts in IAU (which in turn underscores its technical significance as a potential support for the latest decline).

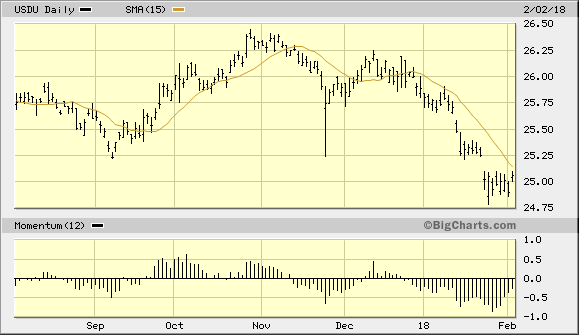

Another consideration for gold's immediate outlook is its currency component. The dollar index is showing signs of bottoming in the very near term. Shown below is a graph of the WisdomTree Bloomberg US Dollar Bullish Fund (NYSEARCA:USDU), which can be used as a tradable proxy for the dollar index. As previously noted in my Jan. 26 commentary, the dollar signaled a potential "key reversal" on Jan. 25 when it reversed sharply on an intraday basis. This type of big intraday move often serves as a prelude to a short-term reversal of the prevailing downward trend. It occurred after President Trump told CNBC in an interview that the U.S. economy is strengthening and that "the dollar is going to get stronger and stronger."

Source: www.BigCharts.com

There is an obvious political importance behind the Jan. 25 dollar reversal, which provides us with a reason for expecting a dollar relief rally in the very near term. A close above the 15-day moving average in USDU graph shown above would confirm that a short-covering rally has begun for the dollar. This in turn would be expected to put additional downside pressure on the gold price.

Immediate-term weakness aside, the broader recovery for gold which began in early 2016 (see chart below) should remain firmly intact. When gold formally ended its 2011-2015 bear market in Jan. '16, the impetus behind the recovery hasn't been investors' concerns over the fragility of the economy (as was the case in the years following the credit crash). Quite the contrary, gold's two-year recovery has been predicated on the gradual return of inflation in the U.S. and global economy, as I've argued previously. With wages and commodity prices both making sustained recoveries, it's clear that inflation is indeed making a slow-but-steady comeback. When eventually the inflation rate increase becomes more evident, gold will benefit as investors look to the yellow metal as a hedge against inflation.

Source: www.Barchart.com

For trading purposes, I'll reiterate that the $12.75 level in my favorite trading vehicle for gold, the iShares Gold Trust, must not be violated in order for the long position I recommended on Jan. 5 to remain intact. I consider $12.75 to be the proverbial "line in the sand" for the IAU trading positions, which was recommended in December. A close under this level in IAU would violate my stop-loss and thus confirm an exit signal on the remainder of our trading position in this ETF. (I recommended on Jan. 5 taking some profit after IAU's 5% rally from the December entry point). For now, I recommend remaining long IAU since the immediate-term uptrend is still intact, but stay close to the market.

Disclosure: I am/we are long IAU.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.