Here is why these mining and metals companies left the TSX

An increased number of mergers and acquisitions in the mining industry was the main reason why more than 10% of the companies listed on the Toronto Stock Exchange and Toronto Venture Exchange vanished between 2014 and 2015, a new report shows.

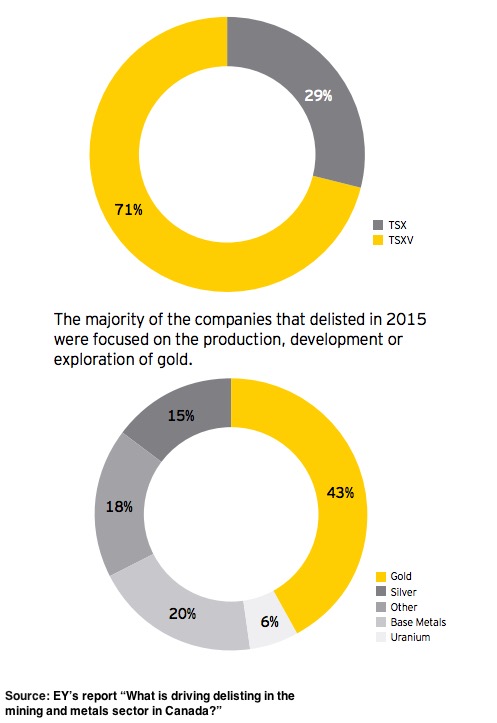

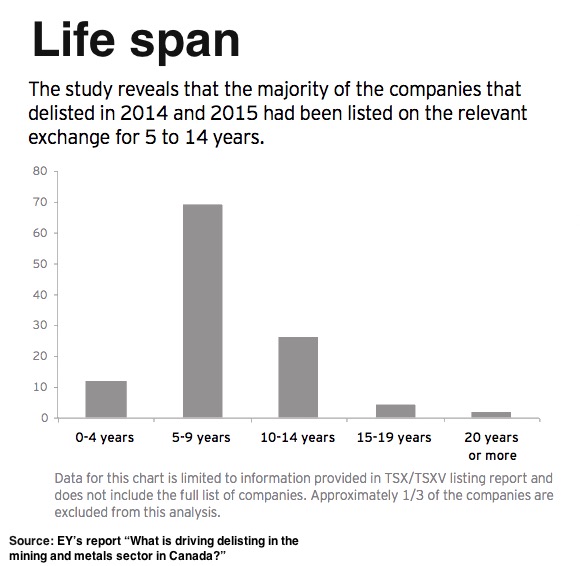

According to Ernst & Young's latest study, 49 mining and metals companies delisted from the TSX and TSX-V in 2014 and a further 172 companies delisted in 2015.

Several deals involved multiple listed companies joining together under one new public entity, and most included companies focused on gold. Other reasons for delisting varied:

40% due to M&A activity37% on a voluntary basis14% for a failure to meet continuous listing arrangements9% due to formal insolvency proceedings"One thing we learned from our research is that Canadian stock exchanges are still viewed as an important place for juniors to raise capital," says Michelle Grant, EY's Mining & Metals Transactions Leader in British Columbia.

"For those who delist, our study shows that companies aren't turning to formal insolvency proceedings. They're moving to less prominent exchanges to preserve the ability to access the public markets," she notes.

The study found out there was a 25% increase in delisting activity last year due to M&As when compared to 2014. Several of the deals involved multiple listed companies joining together under one new public vehicle, and most of those deals involved gold juniors.

E&Y also identified that the majority of the companies that delisted in 2015 were headquartered in BC, which is not surprising as 50% of Canada's mining and metals firms are headquartered in that province.