History Says This Retail Stock is Cheap

The security has pulled back to a trio of supportive trendlines

The security has pulled back to a trio of supportive trendlines

Dollar General Corp. (NYSE:DG) on Tuesday cut its full-year guidance, citing hurricane costs and potential tariff ramifications. As such, DG shares dropped 6.8% that day -- their worst session since May. However, the security is flashing a trio of historical buy signals, suggesting now may be time to pick up DG on sale.

The equity is back within one standard deviation of its 52-week moving average, after being north of this trendline at least 80% of the time over the past 20 weeks. There have been nine similar retreats to this moving average, after which DG went on to average a one-month gain of nearly 5%, and was higher 78% of the time, per data from Schaeffer's Senior Quantitative Analyst Rocky White.

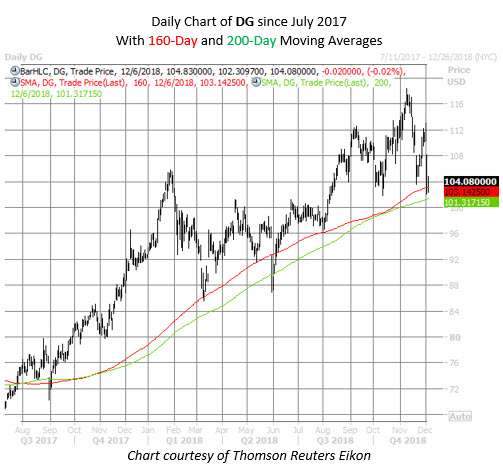

From a slightly shorter-term perspective, DG is also back within one standard deviation of its 160-day and 200-day moving averages. There have been four similar pullbacks to the 160-day, after which the equity was higher by 5.91%, on average, a month out. Retreats to the 200-day have preceded an even healthier average one-month gain of 9.51%. What's more, Dollar General stock was higher 100% of the time after pullbacks to both trendlines.

The security is now trading around $104.08, fractionally lower on the day. The stock seems to have found support in the $102 region, which also contained a retreat in mid-October, and is in the area of a 10% year-to-date gain for DG. Another 9.51% gain for the retail issue would place it around $114 to start the new year.

Meanwhile, Dollar General's Schaeffer's put/call open interest ratio (SOIR) of 1.73 registers in the 92nd percentile of its annual range. This suggests near-term options traders are much more put-heavy than usual right now. Should DG extend its trend of bouncing off technical support, an unwinding of pessimism in the options pits could help propel the security's rebound.