How to Trade Facebook Stock's 'Buy' Signal

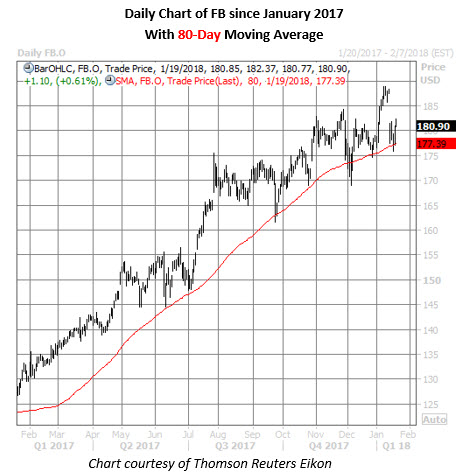

On Thursday, Facebook Inc (NASDAQ:FB) snapped its six-session losing streak -- its longest since December 2016. This negative price action came after FB stock topped out at a record high of $188.90 on Jan. 8, and was exacerbated by a rare downgrade following news of changes to the company's News Feed. However, the equity is now stabilizing above a key trendline.

Specifically, FB is currently trading within one standard deviation of its 80-day moving average, after trading above this trendline for a significant amount of time. According to Schaeffer's Senior Quantitative Analyst Rocky White, in the past 12 pullbacks to this moving average in the last three years, the security has averaged a one-month gain of 4.28%, and a 91% win rate. Based on Facebook stock's current price of $181.48, a move of this magnitude would put it near $189.25 -- in record-high territory.

Options traders in recent weeks have been quick to bet on more upside for FB stock. At the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), speculative players have bought to open 287,485 calls in the last 10 sessions, compared to 136,510 puts. The resultant call/put volume ratio of 2.11 ranks in the elevated 71st annual percentile, meaning the rate of call buying relative to put buying is unusual.

Meanwhile, those currently purchasing premium on short-term options are paying for elevated volatility expectations, considering Facebook is expected to report earnings the evening of Wednesday, Jan. 31. This is according to the stock's 30-day at-the-money implied volatility of 31.6%, which ranks in the 98th annual percentile.

While this could make it more of a challenge for premium buyers to maximize the benefits of leverage, an alternative strategy for those wanting to bet on new highs for the FAANG stock would be a bull call spread. In this two-legged options trade, a FB speculator would sell to open a higher-strike call to offset the purchase of a lower-strike call.