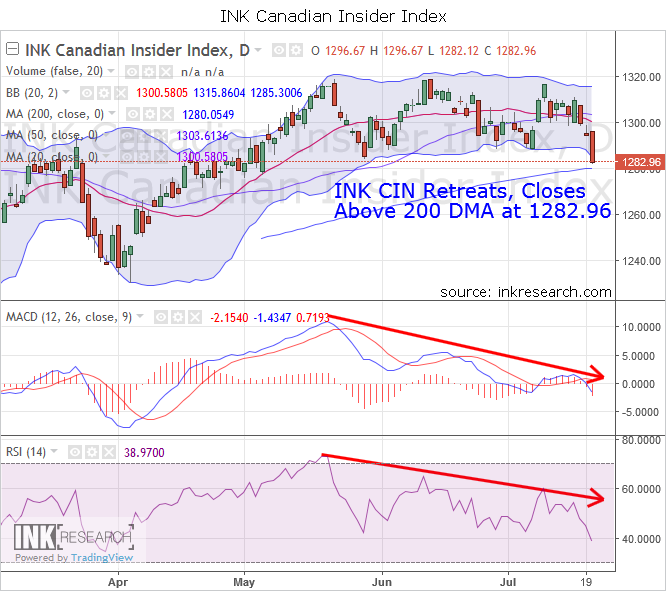

INK Canadian Insider Index falls nearly 2%, closes above 200-day moving average

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. Last week, the INK CIN Index appeared to run out of gas and, after stalling at 1308-1311, the Index rolled over and shed 25.82 points or nearly 2%, on its way to close at 1282.96.

Our short-term momentum indicator RSI tumbled 14.66 points to 38.97. Our long-term momentum indicator MACD slumped 3.5 points to -2.15. And MACD switched back onto a sell signal.

Support is now at 1280 (200-day moving average) and 1271. Resistance is at 1308 and 1300.

The INK CIN is now oversold and near enough its 200-day moving average where it can make a decent bounce. Of course, the main culprit for weakness in commodities and the INK CIN continues to be the US Dollar which has managed to maintain its grasp on its throne. However, the bony grip of King Dollar appears more and more tenuous. For one thing, we note that at the time of the last major US Dollar top last November, the greenback took about 6 weeks to fully break down and hit the skids. At present, we are about 7 weeks into similar divergences suggesting a US Dollar top is upon us once again. What's more, on Thursday afternoon, President Donald Trump was seen on CNBC complaining about US dollar strength and rising interest rates hurting the US economy. As a result, we saw a flush in the greenback and a 2% rise in copper and 0.58% rise in gold as the week ended. We will soon see if Trump's comments prove to be the final catalyst for a dollar correction and a reversal in the INK CIN, gold, copper and other oversold commodities.