INK Canadian Insider Index holds key support, awaits further US dollar weakness

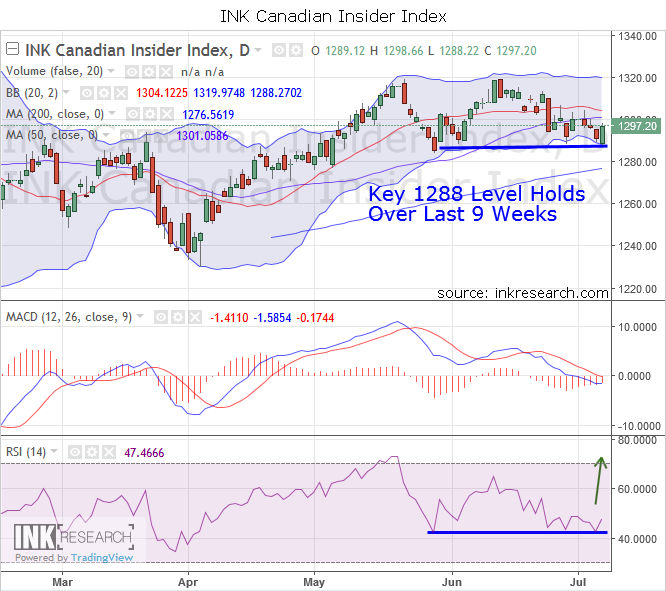

Thank you for joining us in a weekly technical look at the mid-cap oriented INK Canadian Insider (CIN) Index. The Index had another week of what I would consider a continued sideways consolidation. The Index made a push higher but was turned back at a high of 1304.89 and ended the week down a nominal 3.47 points at 1297.20.

MACD rose 0.70 points to -1.41. RSI fell 1.4 points to 47.5. Interestingly, in recent weeks RSI has not made a new low. Instead it looks to be hammering out a base in the low 40s from which the INK CIN can stage a significant rally.

Support is at 1288 and 1300. Resistance is at 1310 and 1315.

The US Dollar which has been a major headwind to the INK CIN and commodities in recent months, has finally begun to head downwards as I suggested. We are now watching closely to see if the US dollar's downside momentum snowballs and boosts the fortunes of The INK CIN as well as metals like gold and silver. The Index has held the 1288 level since the end of May and each week this support zone holds, the stronger the prospects for the INK Canadian Insider Index appear.