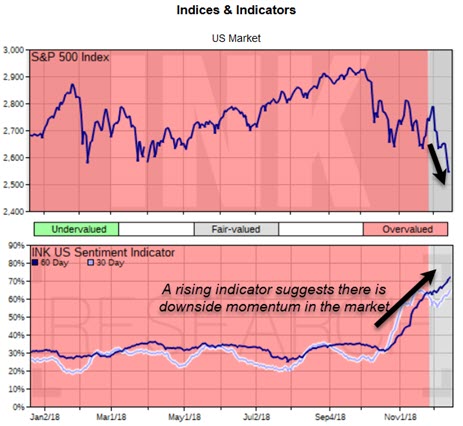

Insider sentiment signals US stocks still likely to get cheaper

American insider sentiment is climbing which suggests the trend is for stocks to become cheaper. That is good news for investors with patient cash and looking for bargains, but bad news for long bulls who hunger for a quick turnaround in stocks.

The near-term path for stocks may well depend on what the Federal Reserve does with interest rates Wednesday and the approach it sets for the next few months. However, short of cutting interest rates, we are skeptical that stocks are poised to build a meaningful base this week which would serve as a spring board to attempt new highs.

Of course, an oversold short-term rally is a distinct possibility. At the sector level, we continue to have the Financials and Industrials sectors on watch for an upgrade to undervalued and fair-valued respectively. Telecom is on watch for a downgrade to overvalued.

This is an excerpt from the December 19th U.S. Market INK report. The full version was made available to INK Research subscribers before the open.