Is This Gold Stock One To Watch?

Barry Dawes of Martin Place Securities explains why he believes Tolu Minerals Ltd. (TOK :ASX) is being recognized as a high-potential gold company and is now heading higher.

Barry Dawes of Martin Place Securities explains why he believes Tolu Minerals Ltd. (TOK :ASX) is being recognized as a high-potential gold company and is now heading higher.

Considerable progress has now been achieved at Tolu Minerals Ltd.'s (TOK:ASX) Tolukuma Gold Mine. Market rerating process well in train Nine hole shallow on surface diamond drill program completed along Taula vein structure.

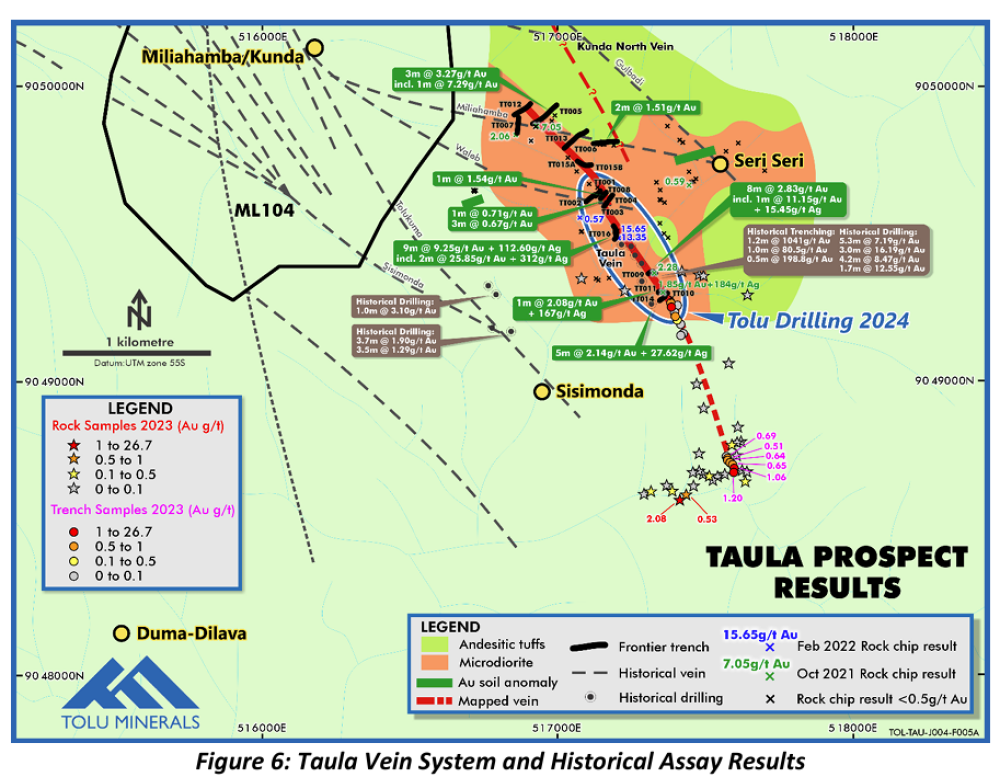

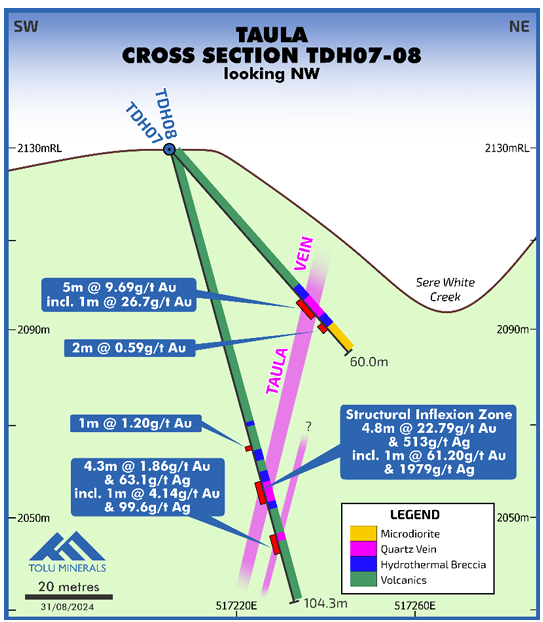

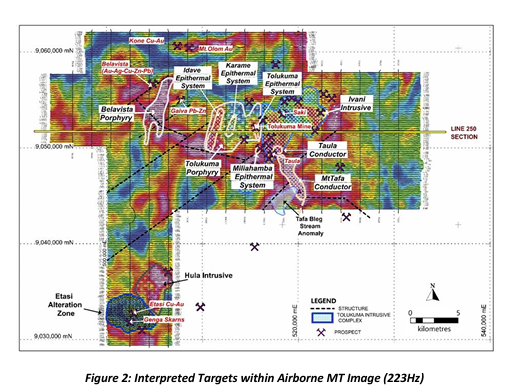

Taula system extends 1500m from evidence from surface trench and rock chip samples, open to north and south. Evaluation of recent drilling covering 450m section along Taula system will lead to a maiden JORC resource. Strong confirmation of drill-indicated mineralization indications from AirborneMT and 3D IP surveys.

There is encouraging mineralization around structural inflection points replicates key features of high grades in earlier Tolukuma mining. Onsite progress has been impressive, with new gravity plant ready for installation and commissioning for first gold pour before the end December.

Existing legacy plant and electrical systems have been refurbished, with new generators now on sit.e First road transport on new 70km access road to be achieved in December. Engineering studies for the refurbishment of hydropower stations are progressing. Two phase dewatering program well underway

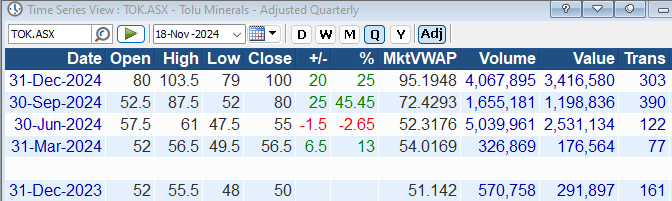

Phase 1 dewatering achieved through siphoningPhase 2 through new bottom access drive to be underway in 2025The company has a market cap AU$167 million on 166.9m shares at AU$1.00.

Tolu Minerals Ltd. (TOK:ASX) is one to watch.

Tolukuma Gold Mine

The Tolukuma Gold Mine produced around 1 million ounced (moz) at 15 grams per tonne gold (g/t Au) with another 2 moz silver (Ag) over a roughly 20 year mine life at ~70kozpa Au developed on a high grade epithermal gold deposit discovered by Newmont in around 1990.

The mine was developed from an initial high grade open cut and fed into processing plant that was later expanded to 200ktpa to handle higher volumes from underground ores.

The mining equipment, processing plant, and associated mine and accommodation infrastructure were all flown in by helicopter.

The initial operation could be regarded as a truly heroic example of mining industry entrepreneurship, and the mine and process plant reflect this.

However, as with many old mines later taken over by new inexperienced operators, it ran out of capital to maintain sufficient developed resources to feed the mill and fund supporting infrastructure.

A big feature was the cost structure reflecting high water mine inflow and the helicopter supply run but Tolu Minerals will be completing the new road sections to have land transport access by year end.

The team at Tolu Minerals have thoroughly reviewed the site and the processing plant and envisage reopening the mine after bulk sampling stopes and eventually exceeding the rated capacity of 200ktpa ore treatment.

A key feature will be a fundamental reduction in the mine's historic cost structure by completion of the 70km of access road, refurbishment of the hydro power station and developing a bottom access and dewatering drive.

The bottom access dewatering drive is now fully funded and will further transform the Tolukuma Gold mine by removing water inflow pumping as a cost. It should also allow recovery of residual gold accumulated on the floors of stopes and drives.

This could deliver well over 20,000oz Au (A$80m in recoverable gold) in a recovery process attached to the dewatering drives.

TOK has successfully refurbished eight units of onsite mobile plant including two loaders, an excavator, an underground truck and two underground drill rigs.

A separate new 6tph modular gravity plant is being installed for the first gold pours from bulk sampling of stopes ahead of resuming production at a higher rate towards and beyond the 200ktpa capacity.

TOK also recognized the regional resource potential here and has followed up with the very important AirborneMT surveys and now diamond drill exploration.

The company has reported 500,000oz Au @ 10g/t Inferred Resource as in-mine resources with additional resources likely to be added soon with the availability of the two refurbished underground drill rigs.

It has also identified a 2-3moz target to the southeast as near-mine resources that will be accessible through the extension of the existing Miliahamba Drive.

The recent drilling in the Taula Zone in the southeast has been very encouraging and will lead to a maiden resource being determined there as well.

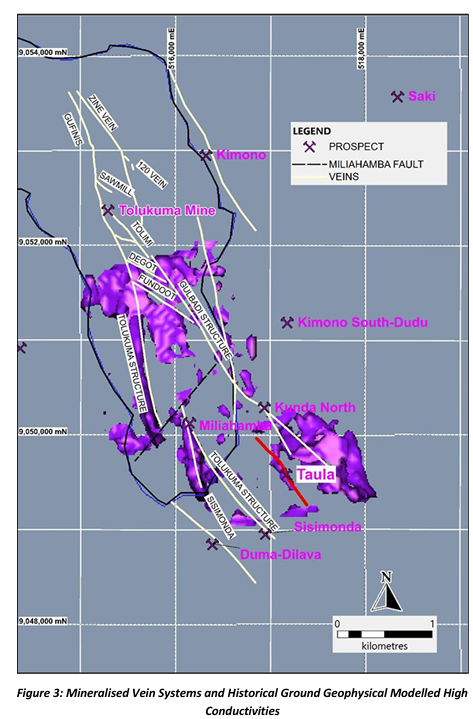

The Tolukuma Mine has significant `in- mine' potential for additional resources as well as `near-mine' potential as shown by previous and recent geophysics and rockchip sampling anf trenching.

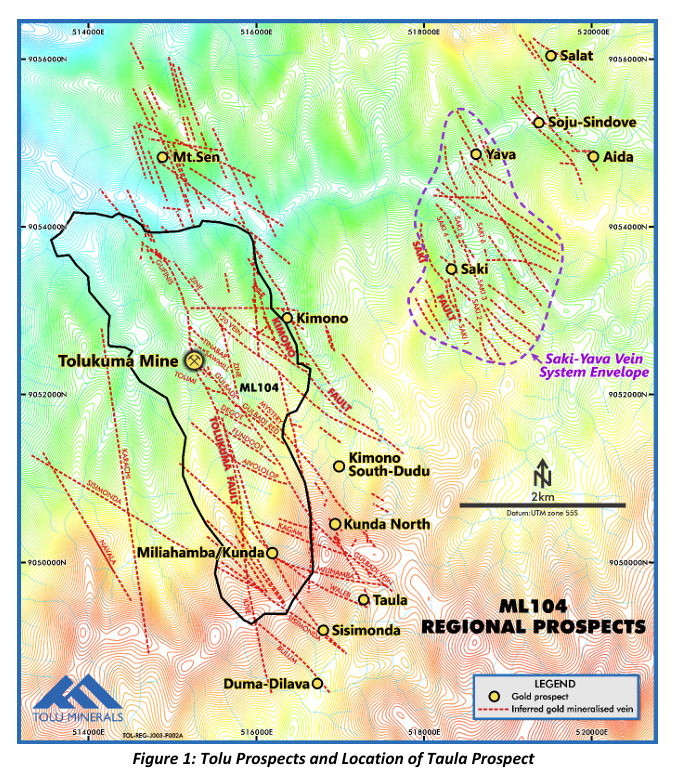

Immediately to the south of Tolukuma, TOK has recognised strong near-mine targets at

Miliahamba-KundaKunda NorthSisomondaTaulaThe most recent drilling was at Taula, where TOK's portable shallow diamond rig was utilised.

Tolu Minerals has also recognized very significant regional resource potential within the epithermal veining system.

The Saki target to the east has a 128koz resource with similar high-grade intersections to Tolukuma.

Considerably, earlier drilling and trenching took place along the Taula structure, so the road to a maiden resource here is not long.

The Taula vein outcrops at surface in hilly terrain over at least 1500m and will eventually be accessed from underground along extensions of the existing Miliahamba Drive.

Cross sections for diamond holes TDH07-08 and TDH06 show multiple near-vertical veins in the Taula structure.

The Taula structure has high potential back to the Tolukuma mine area but is just one target for immediate access that was suitable for the portable rig.

Other near-term explorations at Tolukuma will utilize the newly refurbished underground rigs for resource drilling within the mine as the dewatering program further progresses.

TOK will need to utilize other rigs with greater depth capability for surface exploration on other parts of the Tolukuma.

The Airborne MobileMT survey highlighted Tolukuma lookalike systems and at least two porphyry systems.

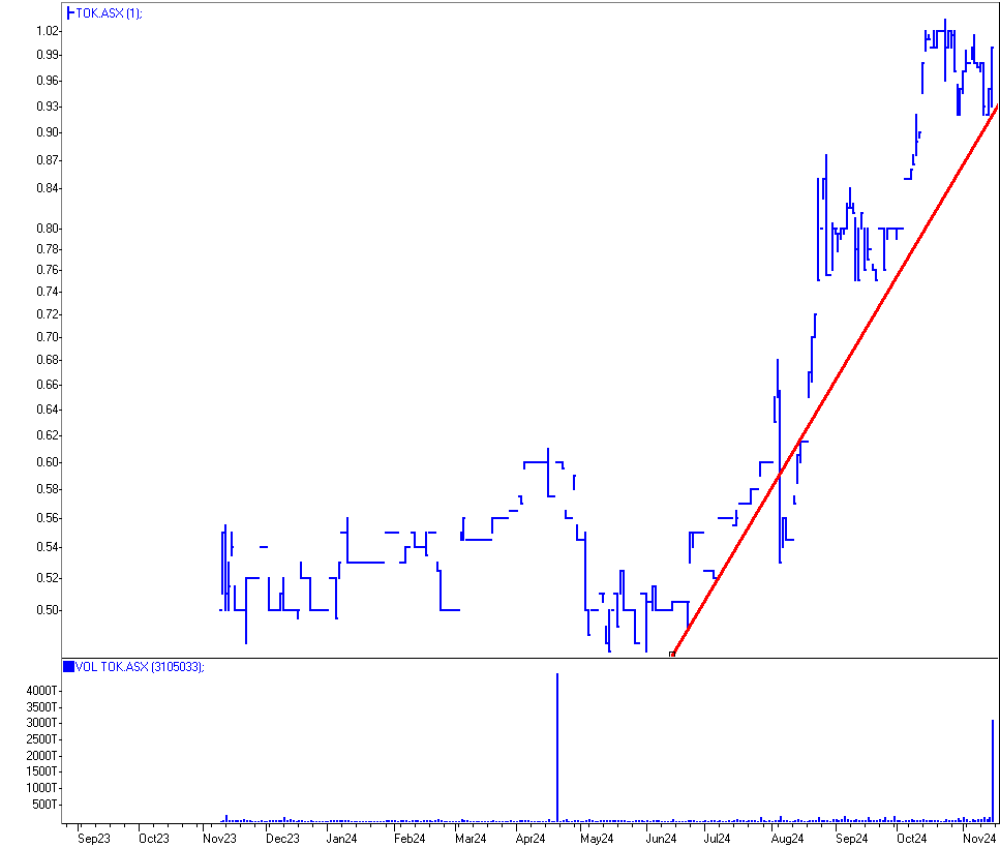

Liquidity is improving as TOK quality is being better appreciated.

TOK is being recognized as a high-potential gold company and is now heading higher.

Head the markets, not the commentators.

| Want to be the first to know about interestingGold andSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Barry Dawes: I, or members of my immediate household or family, own securities of: Tolu Minerals Ltd.I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.