Kinross Gold: The Tasiast Mine Spells Future Growth

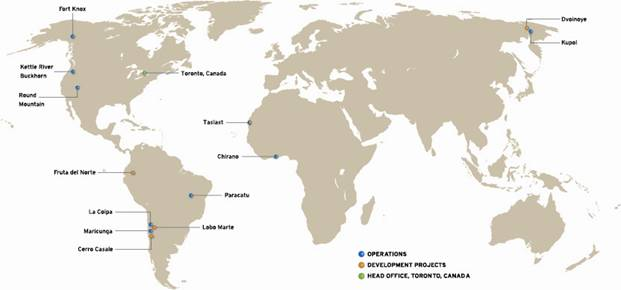

Kinross Gold, the world's fourth-largest gold miner, owns nine producing mines worldwide.

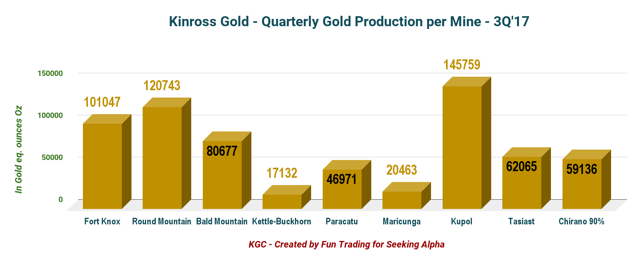

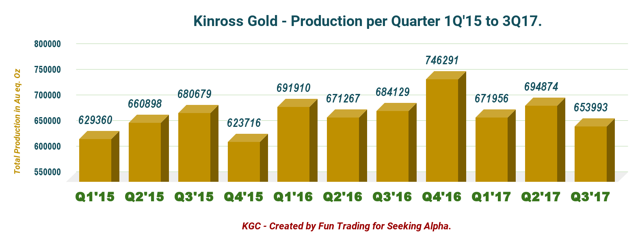

I estimate production for the 4Q'17 at around 630K Oz or a revenue of $810 million or down 2% sequentially.

Kinross Gold presents an exciting potential for future growth with the Tasiast Phase I nearly completed. It is important to perceive any stock weakness as an opportunity to accumulate.

Investment Thesis

Kinross Gold Corp. (NYSE: KGC) looks attractive and could be a promising turnaround opportunity given a solid project pipeline that is supporting the company's future growth. With its strong liquidity position, Kinross can invest in its future development opportunities without incurring new debt.

Kinross Gold is the world's fourth-largest gold miner, owns nine producing mines worldwide. The company experienced technical issues in the past, and it has been a difficult stock to own for long-term investors.

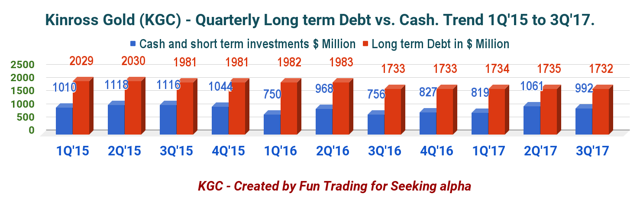

However, the balance sheet looks much better after the company made notable improvements, especially over the past two years.

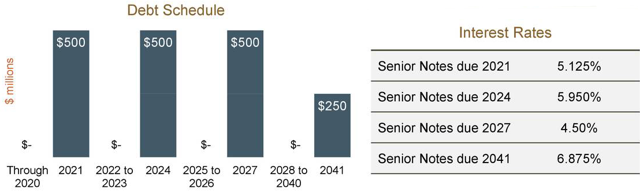

Kinross is showing long-term debt going down significantly, with no debt maturity until 2021, while carrying a strong cash position totaling $992 billion, with total liquidity of ~$2.5 billion.

Net debt to EBITDA as of October 1, 2017, was x0.62 (EBITDA TTM is $1,188.5 million) which is one of the lowest in the industry.

Recent Debt Offering

On July 6, 2017, Kinross closed its offering of debt securities, which consisted of $500.0 million principal amount of 4.50% Senior Notes due 2027.

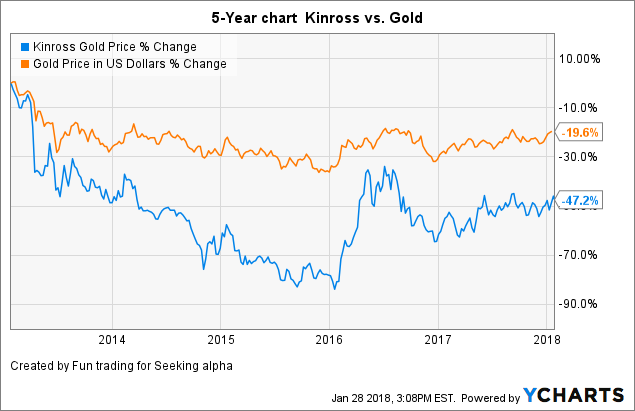

If we look at the long-term investment -- minimum 5-years -- we can see that Kinross Gold has underperformed the metal by about 28% and still is 47.2% lower than it was five years ago. I believe the company has turned around sufficiently to expect a notable improvement in 2018.

Presentation of the company

Note: Kinross Gold participated at the CIBC Whistler Institutional Investor Conference on January 24-26, 2018.

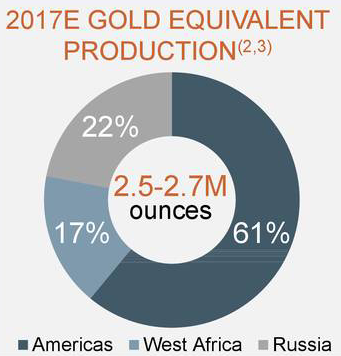

Production is spread in three geographic segments.

Source: KGC

Five projects are considered promising now:

Source: KGC

Tasiast mine Phase I. Tasiast mine in Mauritania started as a mediocre project riddled with problems - acquired in 2010 - but the prospect turned out to be finally an exciting endeavor, with Phase I on track to achieve full commercial production towards the end of Q2 2018. Tasiast has delivered 62,065 Au Oz in 3Q'17 and 246,694 Au Oz in the past four quarters. Recently, the company decided to move ahead of Tasiast Phase II, 25% completed as of September 31st, with annual production expected to be 812k Au Oz (2020-2024). Note: Tasiast Phase I expansion is progressing well and remains on budget and on schedule. Plant construction is now 77+% completed. More recently, Bald Mountain and Round Mountain Phase W, in Nevada. Mining of Phase W ore is expected to begin mid-2019. For Bald Mountain overall engineering is about 70% completed.

Note: Tasiast Phase I expansion is progressing well and remains on budget and on schedule. Plant construction is now 77+% completed. More recently, Bald Mountain and Round Mountain Phase W, in Nevada. Mining of Phase W ore is expected to begin mid-2019. For Bald Mountain overall engineering is about 70% completed. In Russia, the development of the twin declines at Moroshka satellite deposit located 4 Km East of Kupol (the company has completed the construction of surface infrastructure at Moroshka). Fort Know Gilmore. Update on the feasibility study in mid-2018.

In Russia, the development of the twin declines at Moroshka satellite deposit located 4 Km East of Kupol (the company has completed the construction of surface infrastructure at Moroshka). Fort Know Gilmore. Update on the feasibility study in mid-2018. La Coipa Phase 7 sectoral permits expected.

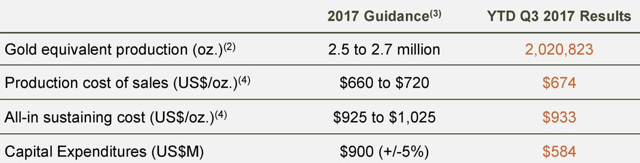

La Coipa Phase 7 sectoral permits expected. Kinross Gold 2017 Guidance

Source: KGC

I am expecting the high end of the guidance or about 630K Oz for 4Q'17.

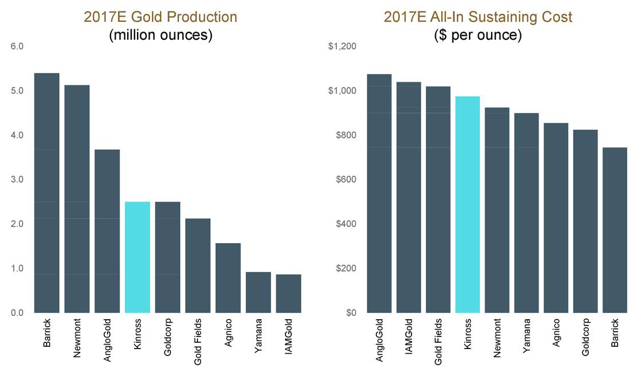

Gold Production for the three first quarters 2017 was 2,020,823 Oz, which means that Kinross expects a maximum of 630K oz for the fourth quarter 2017. It is interesting to look at KGC production, which is the fourth compared to its peers.

Kinross Gold is the fourth gold miner behind Barrick Gold (ABX), Newmont Mining (NEM) and AngloGold Ashanti (AU).

One important element that will play a positive role in KGC production is that Tasiast Phase I will be completed in 2Q 2018.

Kinross Gold: Balance Sheet

1 - Revenues

Revenue for the quarter was $828 million, beating Street expectations, but was down 9% from the year-ago quarter and 4.9% sequentially. Capital expenditures rose to $204.7 million in the quarter from $153.8 million in the prior-year quarter. I have estimated the 4Q'17 revenue at around $810 million based on $1,278 for gold and high-end of the forecast.

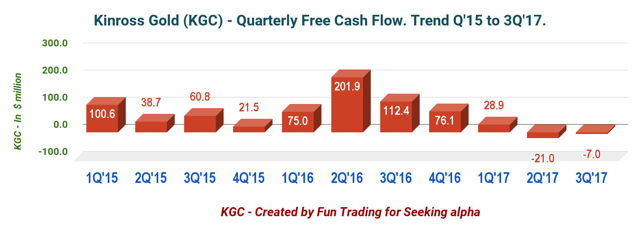

2 - Free Cash Flow

One important financial element that deserves some serious attention is the ability of the company to deliver sufficient free cash flow. On a yearly basis, FCF is now $77 million. However, in the last two quarters, FCF was negative.

Free cash flow is an important factor that should be always evaluated carefully when looking at a long-term investment. Basically, FCF should be sufficient and, of course, positive for the business model to be regarded as sound for a long-term investment.

KGC is not really passing the test here, in my opinion. We need to see if the company can improve this situation in 4Q'17 and particularly in early 2018 when Tasiast Phase I will be completed. The gold price will surely help in 4Q'17 with an average of $1,278 per ounce for the quarter and we may finally see a slight positive FCF.

Recommendation and Technical Analysis

Kinross Gold presents an exciting potential for future growth with the Tasiast Phase I nearly completed. It is important to perceive any stock weakness as an opportunity to accumulate, in my opinion.

However, short-term and mid-term, the stock is forming a descending triangle pattern with a support now around $4.30. The descending triangle pattern is a bearish formation that usually forms during a downtrend as a continuation pattern, which means we should expect KGC to re-test $4.30 at one point and if the first support is not holding we will be back to $3.80 (long-term support). On the positive side, the stock can confirm a double top at $4.90 (take partial profit).

However, it is of a paramount importance to study KGC in correlation with the future gold price. Often, gold price and gold stocks hit seasonal lows in late October before rallying higher, and I see this pattern possibly repeating itself this year as well.

Gold price will be dictated by the dollar strength, which means as we are experiencing a double top now for gold we should experience a retracement for KGC.

Gold Price in US Dollars data by YCharts

Gold Price in US Dollars data by YCharts

You can read my articles about 3Q results for Agnico Eagle (NYSE: AEM) here, Newmont Mining (NYSE: NEM) here and Barrick Gold (NYSE: ABX) here.

Important note: Do not forget to follow me on KGC and other gold stocks. Thank you for your support, it is appreciated.

Disclosure: I am/we are long KGC.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I trade the stock as well.