Lousy productivity keeps inflation risk alive

With the Fed expected to leave interest rates unchanged at its meeting today, short of a surprise hawkish approach towards inflation, we suspect factors other than changes in monetary policy will be driving gold stocks for the foreseeable future. With that in mind, we thought our comments contained in the March Top 20 Gold Stock report remain timely for investors.

One of the themes we continue to come across in Howe Street broadcasts that we feature on Canadian Insider is the idea that junior gold miners should benefit if the real price of gold increases. Both Bob Hoye and John Kaiser have come back to this topic in recent broadcasts on March 16th and February 22nd respectively, which we have reviewed. Mr. Hoye is basing his assessment on the behaviour in periods after major financial bubble peaks, which he terms post-bubble contractions. Mr. Kaiser focuses more on the geopolitical backdrop surrounding the American First policies of the Trump administration.

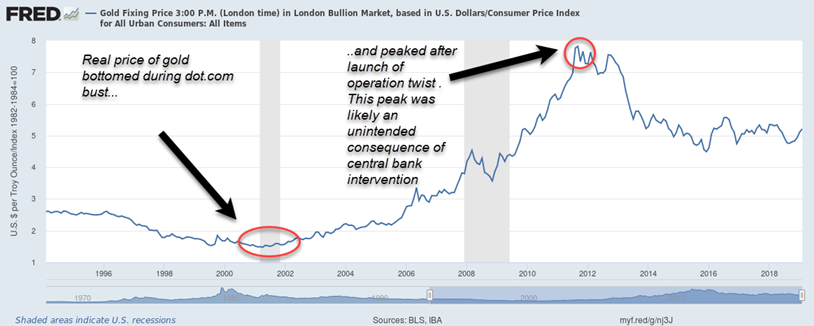

At this point, the real price of gold remains in a holding pattern, after peaking in 2011 before the onset of Operation Twist which involved the Fed selling short-dated fixed-income assets and buying long-dated bonds. At the time, we wrote that this was commodity negative as it signalled a floor on short-term rates. The unintended consequence of the policy was to put a top on commodity prices which made it even harder for the Fed to hit its beloved 2% inflation target.

We believe that commodities are more sensitive to short-term interest rates than long-term rates because storage positions tend to be financed on a short-term basis. Operation Twist is now well in the rear-view mirror, and so are the latest Fed rate hikes. With rates no longer holding back gold, the question about the direction of the real price of gold becomes even more important.

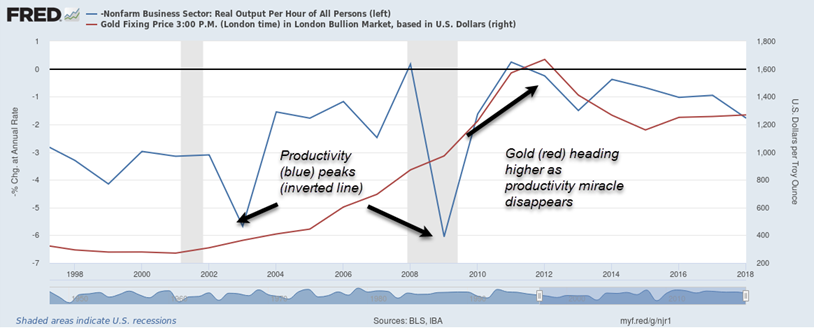

We will throw our hat into the ring and suggest that, in addition to history and geopolitics, lousy US productivity growth should also help support gold. With the exception of the jump in productivity at the end of the great recession which ended in 2009, productivity growth has been slowing as seen by the blue line in the chart below which is inverted (a rising blue line means falling productivity growth). Gold has been strong as the productivity miracle of the dot.com era has faded away. We suspect that this removes the fear that productivity-driven deflation will erode the case for holding gold as an inflation hedge. As a result, inflation clouds remain on the horizon, even if they have not rolled in. This environment should generally be positive as gold is seen as a hedge against inflation rolling in.

We should point out, that should inflation arrive full-blast, gold at that point could be vulnerable as investors start to believe the Fed will tighten similar to the Volcker experience. Clearly, we are nowhere near that point in time.

A shorter term positive development for gold stocks is the fact that all 20 stocks in our March Top 20 Gold report have sunny outlooks. Gold stocks are currently the hottest corner of the market with insiders.

To read our March Top 20 Gold Stock report in its entirety, join the Canadian Insider Club. Learn more here.