'Lunatic Stocks' Have Probably Bottomed

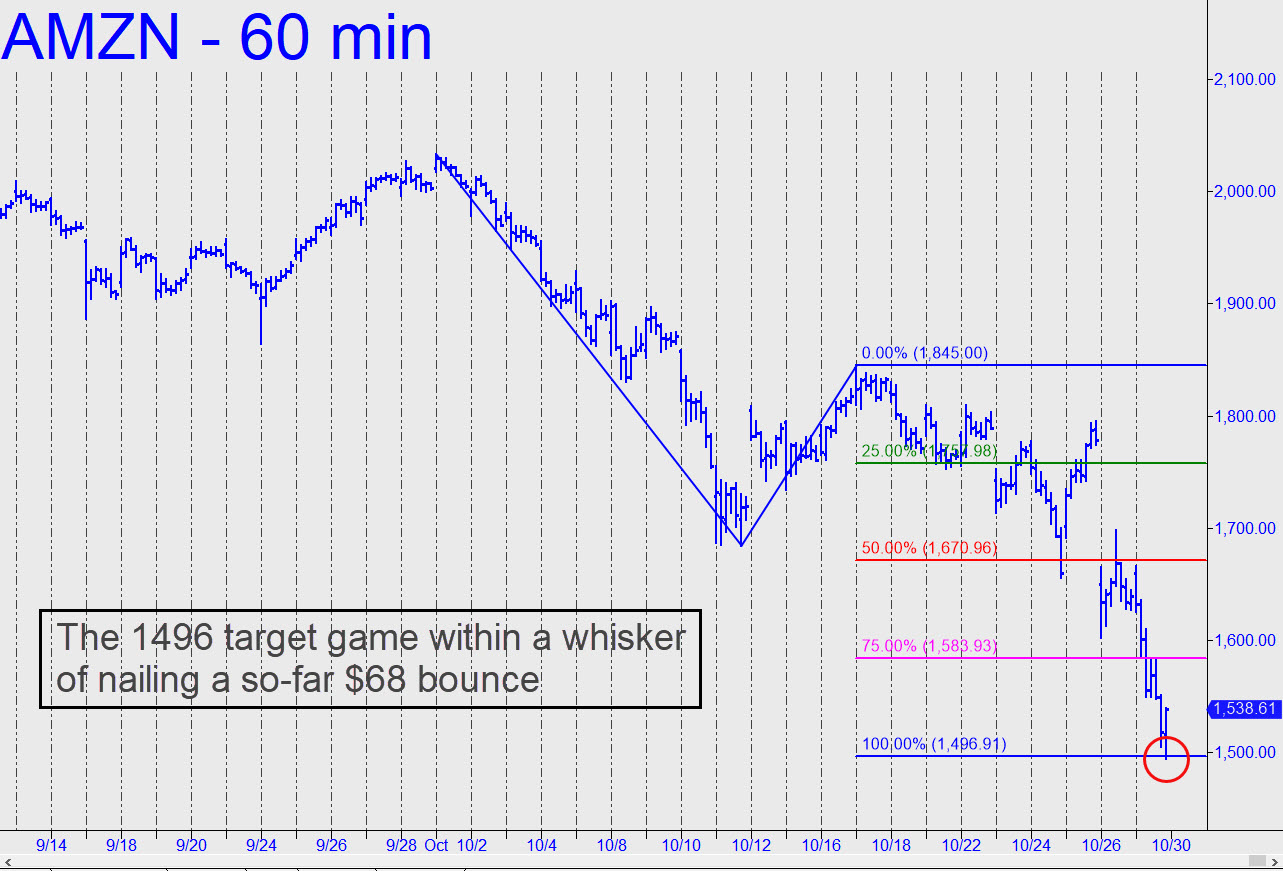

Yesterday's slow-motion selloff probably didn't generate much fear, but it probably exhausted sellers for a while. Although I've put out a somewhat lower target in the E-Mini S&Ps for Tuesday, the big moves in the FAANGs appear to be over, or very nearly so. Rick's Picks had been using a 1496 downside target in AMZN that caught the exact low of a so-far $68 bounce. (Click on the inset to see this graphically.) DaBoyz looked like they might want to revisit the low Monday evening, but they are going to have difficulty pushing the stock significantly beneath it, since it's a clear and compelling Hidden Pivot support. Similarly, AAPL hit a longstanding downside target at 208.04 before trampolining more than $6 from just beneath it. A relapse is unlikely to exceed the low by much, and that's why the issues I refer to as the lunatic stocks i.e., the ones most heavily owned by portfolio-managing chimpanzees should be supportive of the broad averages over the near term. Click here for a free two-week trial and head for the chat room, where great traders from around the world swap actionable ideas 24/7.