Market Volatility Bulletin: Equity Bulls Take Home The Gold This Week

US Stocks look to wrap up a strong week while VIX has been taken down a peg.

A reminder that volatility is symmetrical: big upside moves do not mean that vol is dead from a rote mechanical point of view.

The term structure is flat, and various measures of volatility are working their way lower.

Market Intro

CNBC: 2:45 EST

US stocks (SPY, DIA, QQQ, IWM) had a strong morning session, but gave back their gains during the afternoon. With an hour or so before the close stocks are trading mixed.

The USD (UUP) was able to firm today after getting pummeled on the CPI data on Wednesday. There was an important divergence between how FX reacted to the data print vs. stocks. This may provide an important context for volatility to reassert itself over the next several sessions.

Oil has managed to regain its composure. It has been interesting with the weaker dollar, the mostly strong economic data, and the big CPI figure have done little to aid the cause of black gold.

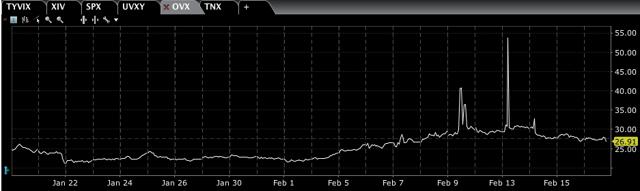

IB: Oil VIX

Other than a couple brief spikes, oil volatility has mostly ignored the flare-up in global equity vol.

Thoughts on Volatility

It happened so quickly! But it is important to remember that volatility is a symmetric concept. If the VIX prints in the 30s, big moves in either direction are quite likely.

The reality is that each day over the past week has witnessed quite high degrees of movement. Do you recall the almost endless periods last year where equities would not move by more than half a percent intraday? Despite the positive result, these past five trading sessions have shared little in common with the days of yore.

Selling theta reminds us that the VIX crush that has given short-vol positions like SVXY a life-line could really reverse itself on a moment's notice. Yes vol is on the decline, but there is no compelling reason that we must return to "normal" anytime too soon.

What I'm trying to say is that markets may be working vol products lower less on the basis of a broad read of existing conditions and more on muscle memory and "SPX higher = VIX lower" mentality that should not be treated as some rote mechanical relationship.

Low interest rates forced some pension funds into the short vol space to pick up the roll yield. While this is an interesting headline, I am not personally aware of any pension plan being severely damaged based on last week's activity. Articles like this speak both to the fact that hopefully many of these institutions are sizing their positions decently, and that rational agent behavior has changed as rates have been so low for so long. These changes in and of themselves may carry important implications in the months and years ahead.

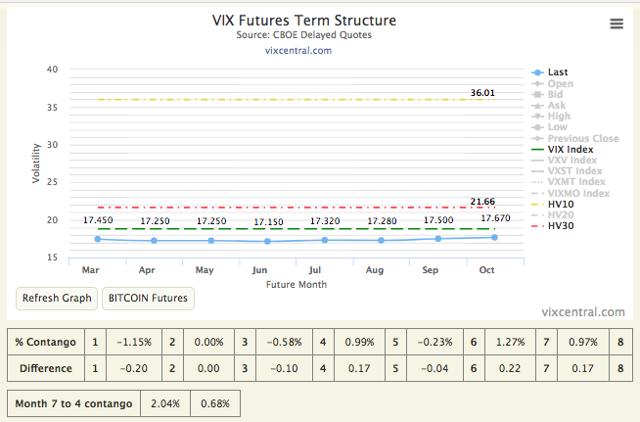

Term Structure

The entire term structure is printing 17s! The period of six straight gains (thus far) has spot and VX futures resting below both the 10 and the 30-day HVs. In fact, HV10 is more than double the term structure.

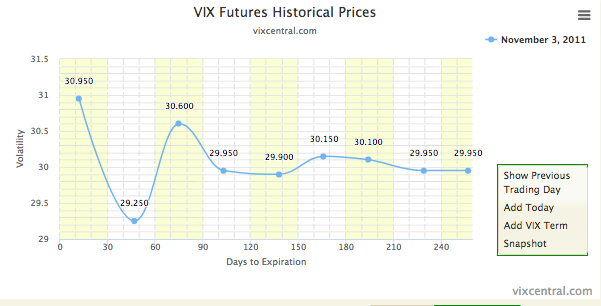

The last time that springs to mind where the term structure was quite that flat was back in late 2011 in the aftermath of the debt ceiling blowup:

I am sure there have been other times when VX was similarly trading even across the board, but that was a similarly dramatic time, and it did ultimately result in the markets calming down after about another month.

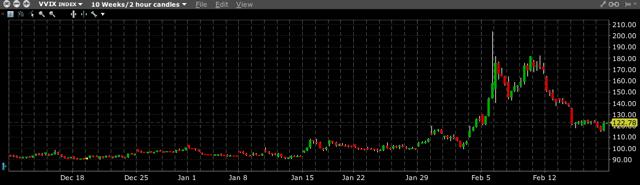

IB: VVIX

VVIX is also working its way to more of a neutral posture. Like VIX, the vol of vol wants to mellow, but still carries an elevated print.

IB: VXST

Finally, the short-term VIX is printing almost identically to spot VIX and the entirety of the actual term structure.

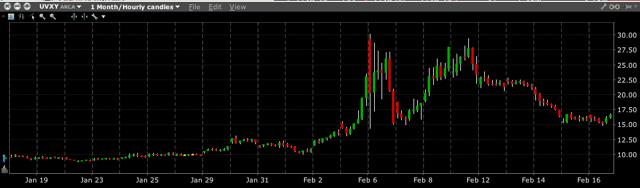

Ultimately, the last week has taken a heavy toll on long-vol ETPs (VXX, UVXY, TVIX):

IB: UVXY

This speaks to the importance of managing risk both from the long and the short vol end.

Conclusion

If this is your first time reading Market Volatility Bulletin, thanks for giving it a try. If you're a regular, we thank you for your ongoing contributions in the comments section.

I produced a couple pieces recently. One deals with the implications of the Trump Administration's relatively staid response to last week's crisis, while the other addresses freely available features from fund sponsor ProShares that help traders to understand the ins and outs of trading UVXY.

On a personal note, we've been enjoying Chinese New Year as a family in Penang, Malaysia. The population here is 25% Chinese, and it has been fun to see the firecrackers, and generally watch the people celebrate the occasion.

Thank you for reading.

Please consider following us.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I actively trade the futures and options markets, potentially taking multiple positions on any given day, both long and short. I also hold a more traditional portfolio of stocks and bonds that I do not "trade". I do believe the S&P 500 is priced for poor forward-looking returns over a long timeframe, and so my trading activity centers around a negative delta for hedging purposes.