Market Volatility Bulletin: XIV Gets Wiped Out, Equities Whipsaw Violently, Gold & Treasuries Nap

While equities bounce here there and everywhere, rates FX and precious metals stay fairly zen.

The popular short-vol ETN - XIV - will be liquidated on Feb 21.

We take a look at the VIX Term structure & S&P Organic Vol.

Market Intro

CNBC: 10:50 AM EST

For all the churning in equities (SPY, DIA, QQQ, IWM), movement in FX (UUP), rates (TLT, IEF, AGG) and PM (GLD, SLV) has been quite staid.

The S&P 500, which had made it twenty-three of the last twenty-four months without losses, has taken serious damage since topping near 2875:

IB: S&P 500

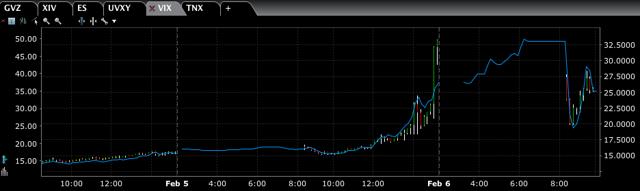

To show that the moves are not confined to implied volatility, but realized vol as well, we'll show the movement from the last three days:

IB: S&P 500 futures

This reflects 150-point moves in the span of a couple hours. If anything, one might argue that implied vols are taking the price action calmly.

IB: Gold VIX

I find it surprising that gold volatility, while elevated from December's ultralow levels, is more or less yawing through the tumult of risk-on assets. This is especially true in light of how brutalized the crypto currencies have been of late. If this kind of risk-on market behavior continues much longer, we think gold vol gets a bid.

Thoughts on Volatility

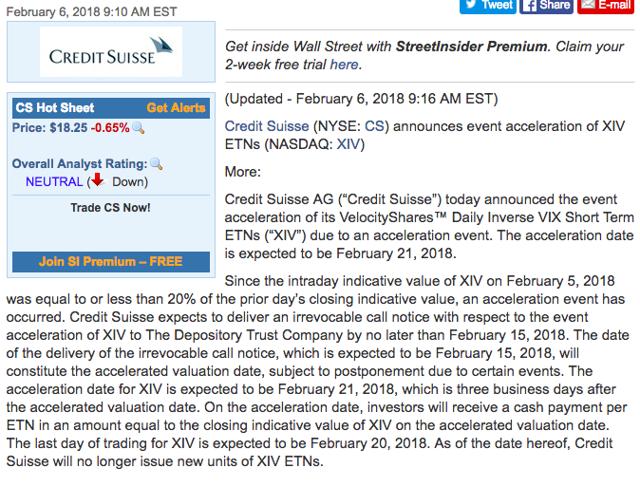

Credit Suisse (CS), the issuer of the popular short-vol ETN known as XIV, has announced that the shares will cease trading on February 21:

Source: StreetInsider.com

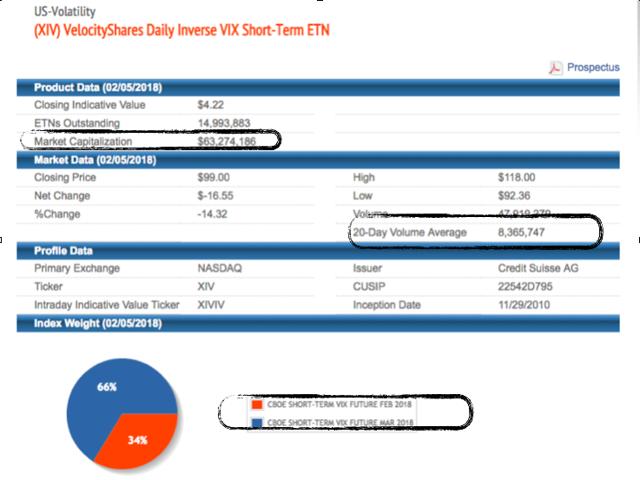

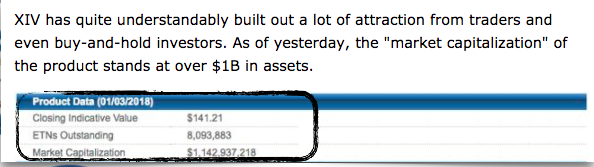

On January 4th, the very date that spot VIX bottomed, SA published an article we wrote entitled Can XIV Decouple From Equities? Contrast the market cap above with the screenshot from January 3.

Clearly, the answer to the question we posed was "Yes". Investors poured a great many assets both into XIV as well as SVXY just in January. That was consistent with very large fund flows into risk-on assets last month.

I confess that I'm a bit surprised that XIV will liquidate. There was clearly market demand for the products. Much of that demand may have been based on simple momentum or in some cases from investors who did not understand the ETP. But at this point all the retail demand will apparently flow into ProShares SVXY.

In any event, I suspect that the way the general public thinks about long vol (VXX, TVIX, UVXY) as being a dead-end trade, whereas short vol (XIV, SVXY, ZIV) is the real money is made, to be essentially nipped in the bud. Short vol products appear to be the proverbial "picking up nickels in front of a steam roller" play.

That does not mean that it's a bad trade or allocation for some portion of one's money. But it implies careful consideration to overall allocation and rebalancing. That was true for XIV, and it is also true for the survivor, SVXY.

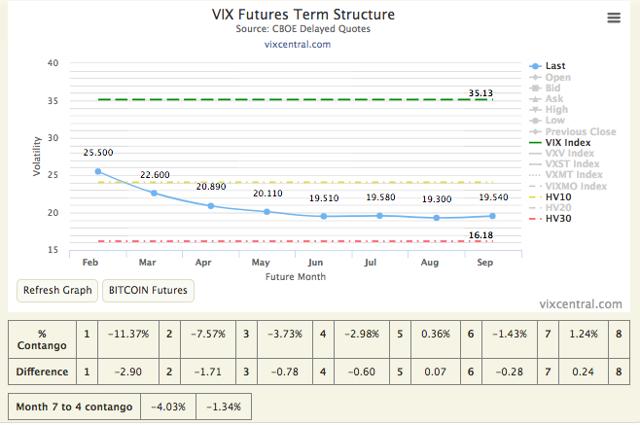

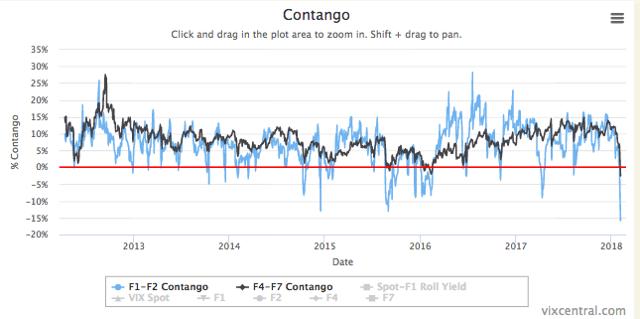

Term Structure

10-day historical S&P vol, which only in December was printing at insanely low levels (around 5), now quotes at 24. Most of the term structure rests between 10d HV and 30d HV.

Spot VIX, which headed into the morning session close on 50, at one point in early trade was nearly halved. The Feb futures trades about 5 vol points below where it was near the open:

IB: VX Feb contract (candles, RHS axis), VIX in blue

Current backwardation is about as pronounced as it has been since 2012 when this graphic begins. It certainly could be a coincidence, but the back of the VX term structure currently changes hands almost exactly at the long run average spot value.

I think that if there was some specific event that was clearly and unambiguously responsible for this, markets could look past it more easily. Sure rates are higher. But rates moved faster and to nearly the same levels right after the election and risk-on markets cheered the move.

As a result, we believe that vol will remain elevated longer than it otherwise would. This set-up is different from, say, Brexit. This feels more like panic for panic's own sake.

Organic Vol

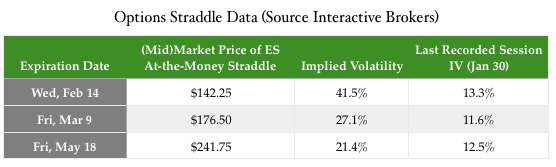

Organic at-the-money volatility, as measured by options on S&P 500 futures contracts, is priced sublimely high. First, the straddle bid-asks are extremely wide ($17 wide for the quarterly ATM stdl). Secondly, the market action is nothing short of furious on these options at present.

We would not recommend that you take a position unless you consider yourself an expert in this niche and/or the spreads come in some, as it is currently very costly to trade here.

Looking down the second column in the table above, the backwardation is very steep: the weekly contract is almost double the quarterly! Certainly we saw plenty of the reversal of this arrangement over the last several months (with weekly vol trolling down near 5.5, and quarterly perched at 9).

Like the VX futures, the ATM options are indicating that the next week or so should be chaos, with a gradual (but not too quick) return to greater normalcy.

If there were a trade here, I'd say it's buying some form of two-week/monthly calendar spread. There just appears plenty of room for those short-dated contracts to melt off. Again, watch your bid-asks and don't pursue any trades in this space unless you know what you're doing.

Conclusion

If this is your first time reading Market Volatility Bulletin, thanks for giving it a try. If you're a regular, we thank you for your ongoing contributions in the comments section.

We submitted a piece a few hours ago (prior to CS announcing the liquidation of XIV) relating to the potential for liquidation, and our perspective on the event as it relates to larger lessons. It's likely to be out in reasonably short order.

Also, we published a two-part series about three months ago relating to the prospects of an "Event Acceleration" for the XIV ETN

Praemonitus, Praemunitus: The XIV Event Acceleration Clause

Praemonitus, Praemunitus: Modeling Out The Likelihood of a One-day 80% drop in XIV

Finally, I want to thank our readers for not taking the opportunity to settle scores and jeer at others who frequent our postings. That's the last thing people who used the short vol products need right now, and it is such a pleasure connecting with a readership who stays above that kind of nonsense.

Thank you.

Please consider following us.

Disclosure: I/we have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I actively trade the futures and options markets, potentially taking multiple positions on any given day, both long and short. I also hold a more traditional portfolio of stocks and bonds that I do not "trade". I do believe the S&P 500 is priced for poor forward-looking returns over a long timeframe, and so my trading activity centers around a negative delta for hedging purposes.