Massive Cash on the Sidelines

Barry Dawes of Martin Place Securities shares his thoughts on the gold market and gold stocks. He noted small caps should make a move soon.

Barry Dawes of Martin Place Securities shares his thoughts on the gold market and gold stocks. He noted small caps should make a move soon.

Small cap stocks historically have had very strong growth rates that have allowed rapid market appreciation as new services and technologies appear in the marketplace.

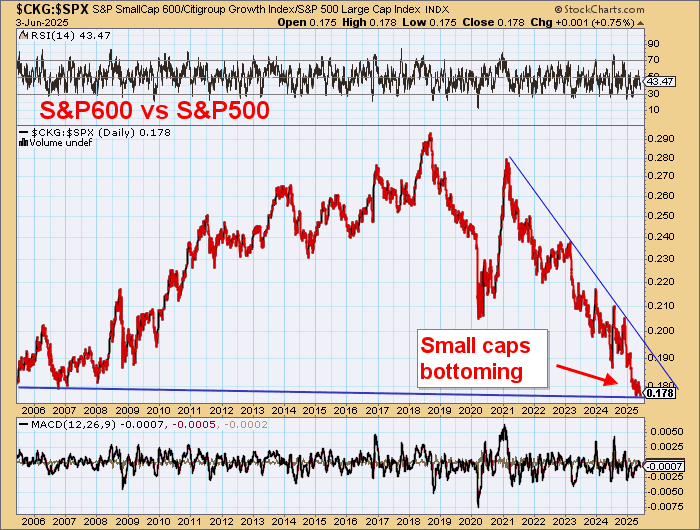

The small cap indices like the Russell 2000 and the S&P600 had significantly outperformed the broad market indices after the global financial crisis (GFC) in 2008/09, but took a dive after the Biden Administration held back some sectors and hindered a lot of M&A through tighter shareholder regulations.

From late 2021 these small cap indices declined by around 35%.

These small caps should now start to run higher and good gains might be made.

The Russell 2000 had a sharp fall in April but is now recovering and appears to be doing the right hand shoulder of a H&S reversal pattern that should drive it to a new high.

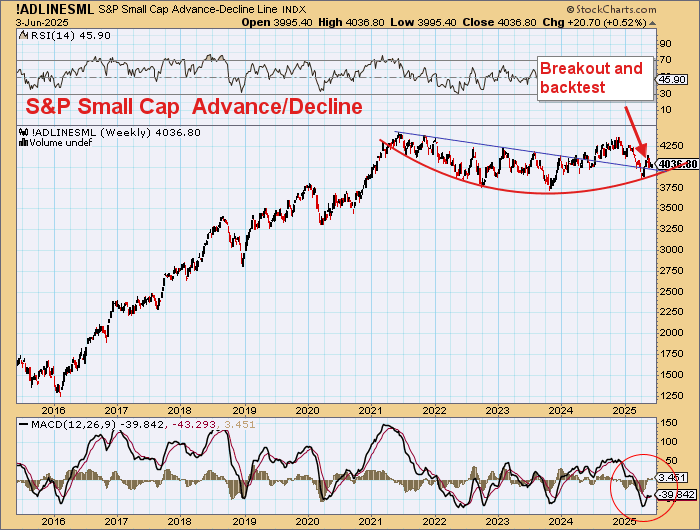

The Advance/Decline index is simply a sum of those stocks rising less the number falling and this index has travelled sideways now for almost four years.

This is an accumulation pattern and it appears to be ready to move up quite strongly.

What is good for small caps in the U.S. (i.e., large caps by Australian standards) will be good for small caps everywhere.

As has been noted here continually, the ASX indices run by S&P do not serve our markets very well.

The Small Cap Resources index for example has numerous +A$billion companies so has no meaning in our context.

I am still fighting with S&P to remove bauxite stock CAY from the ASX XGD Gold Index as I also had to get lithium stock Iris Metals removed a couple of years ago.

I have made comments about Moody's and S&P ratings services so their performances here haven't been too flash.

The CDNX Composite Index is the best global index to follow even though it is not just resources companies.

Making new 3-year highs

Completing 17-year bear market with an H&S reversal pattern

ASX small resources companies sectors we follow:

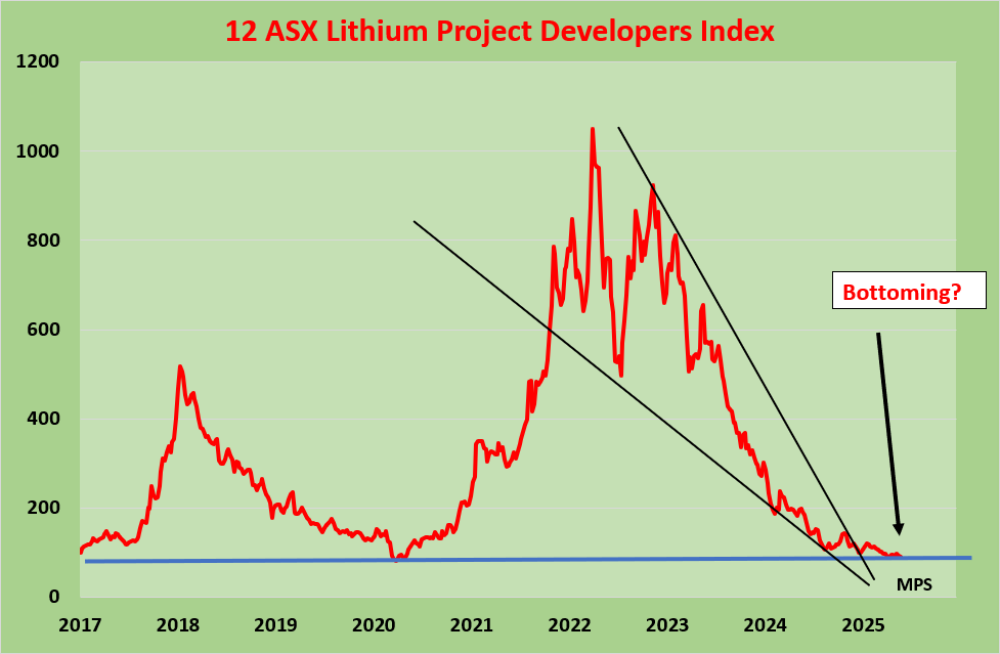

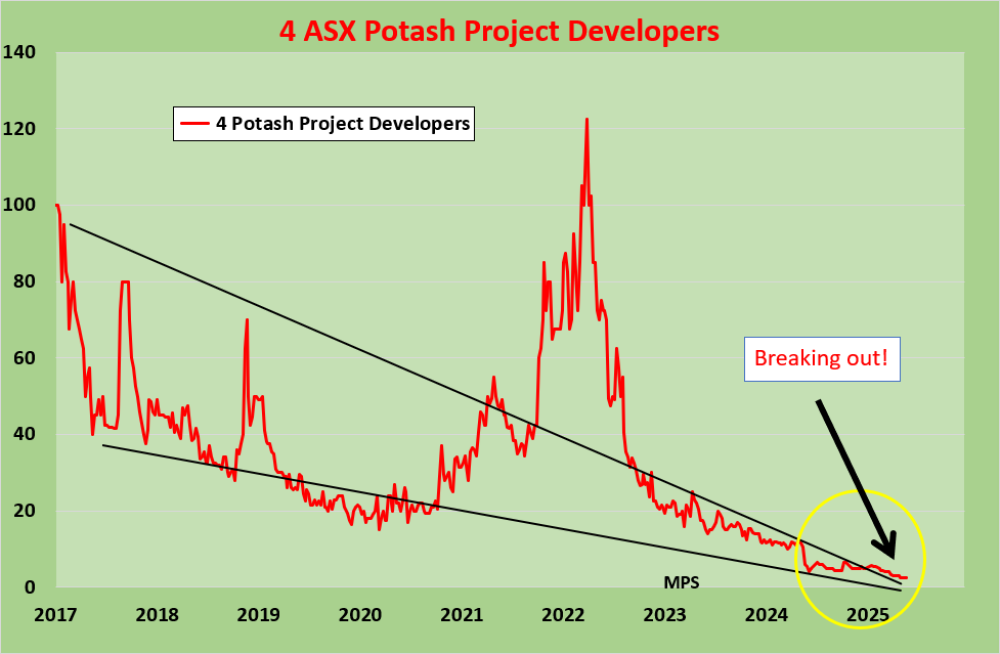

All these sectors are bottoming.

Gold is obviously leading but the rest are only just starting to move higher.

Uranium is a bit different.

Small caps I like:

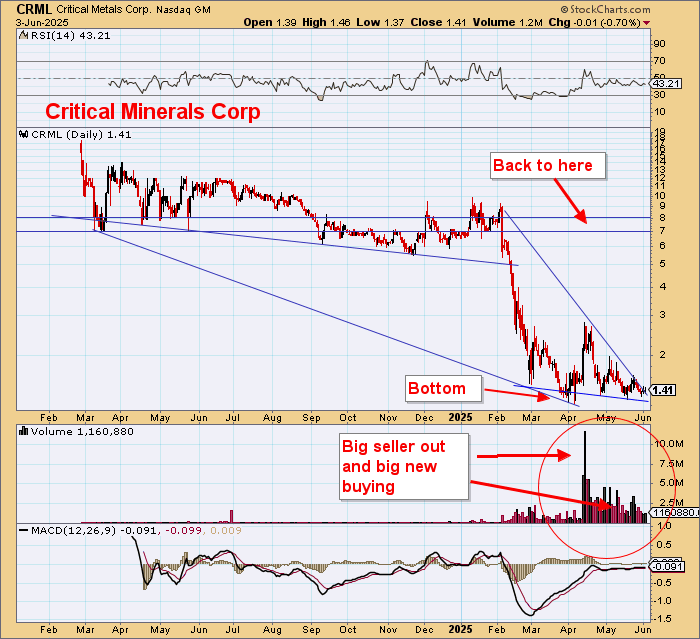

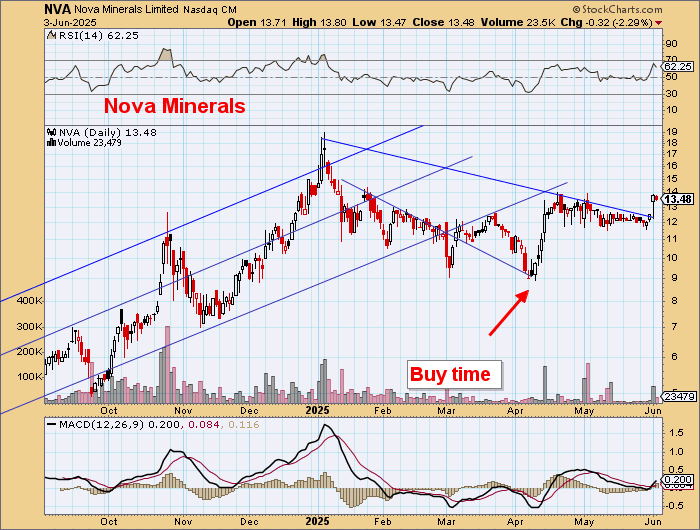

Nth American ASX stocks

EUR owns ~70% of this.

Ready to blast off soon.

WMG has 5 mt of contained nickel, and the nickel price ready to move higher.

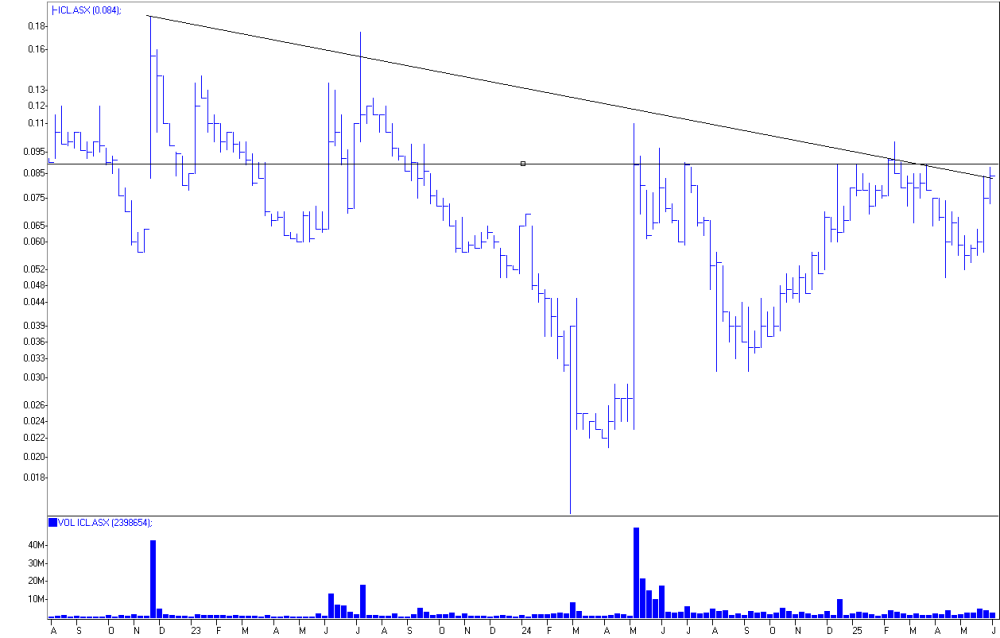

Iceni ICL has a big gold discovery coming up.

Siren Gold holds 14 million RUA shares.

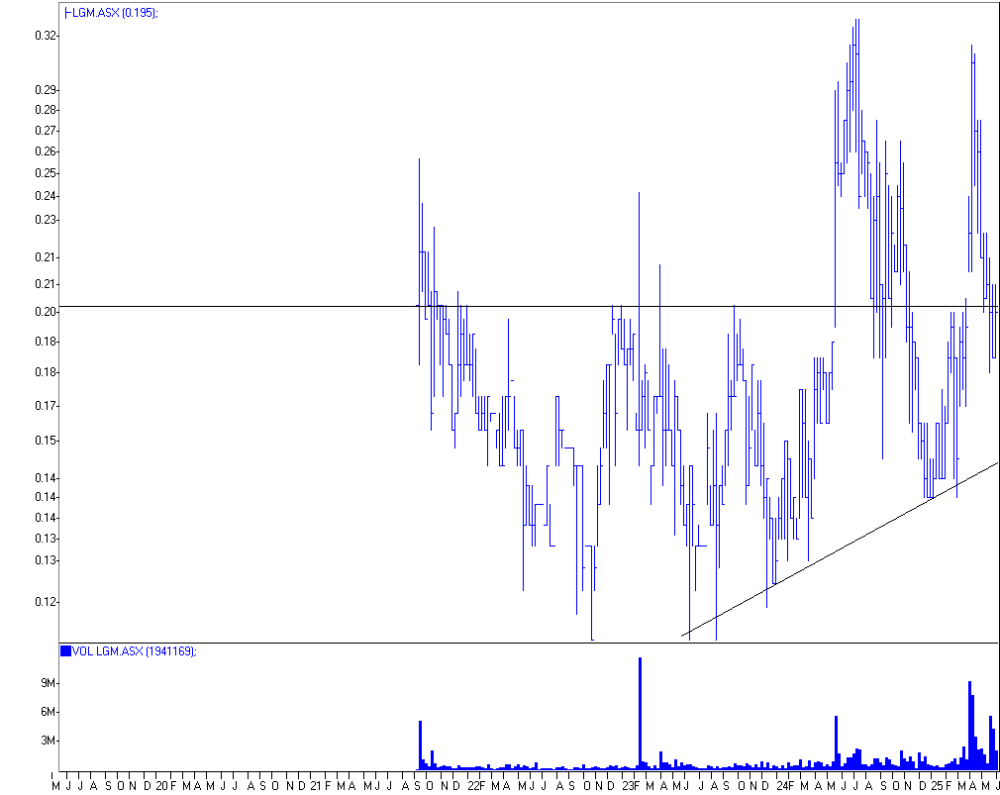

LGM Legacy explorer in NSW.

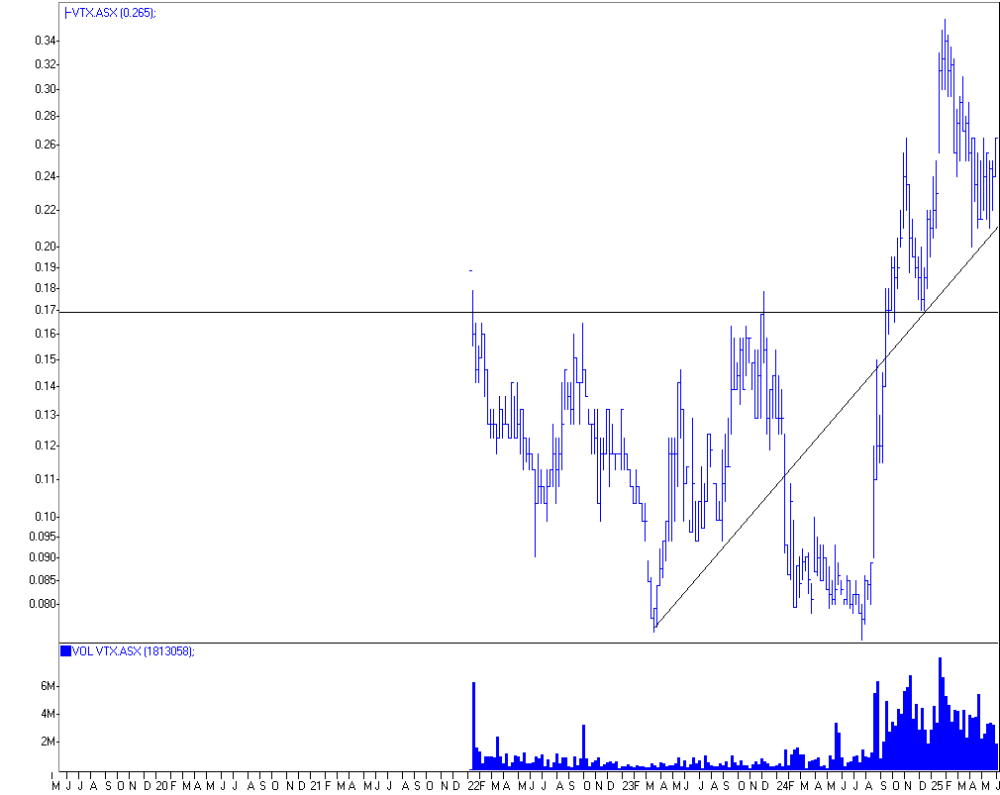

VTX, an emerging high-grade gold producer.

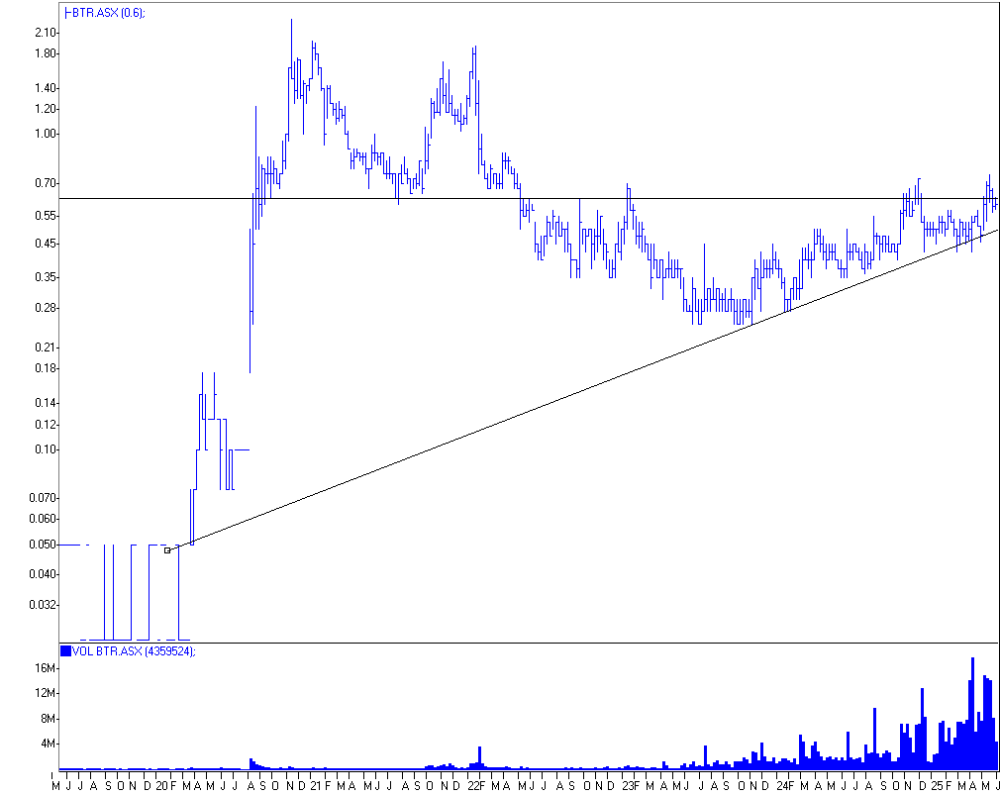

Emerging WA gold producer.

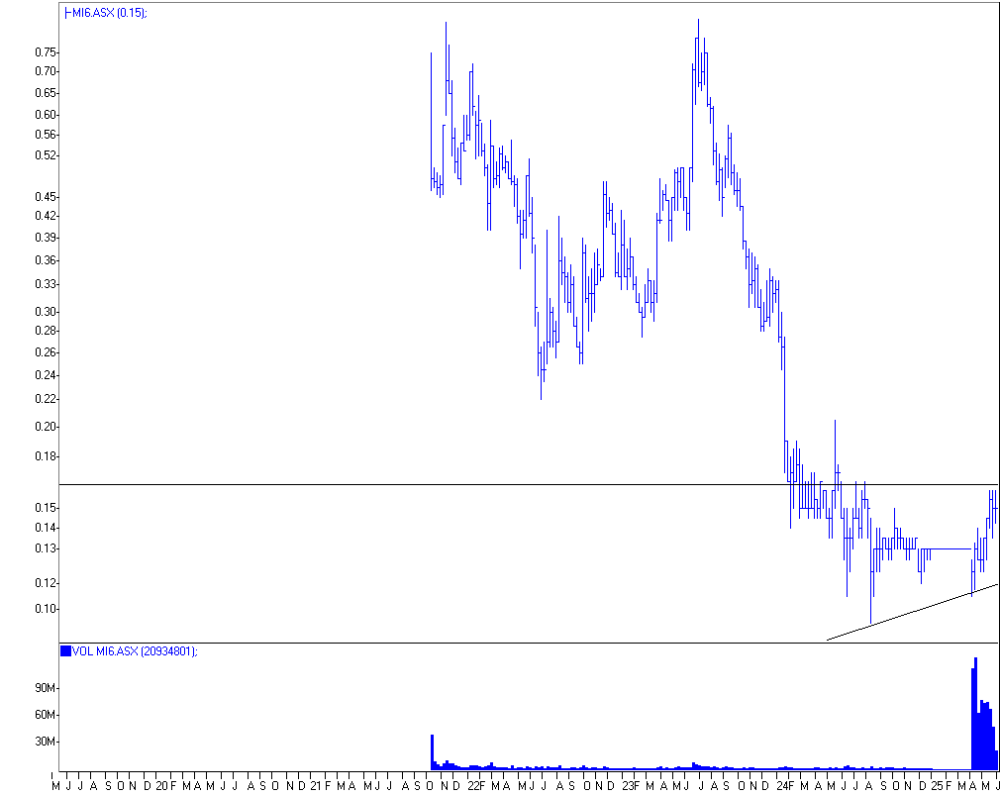

MI6 Developing Bullabulling.

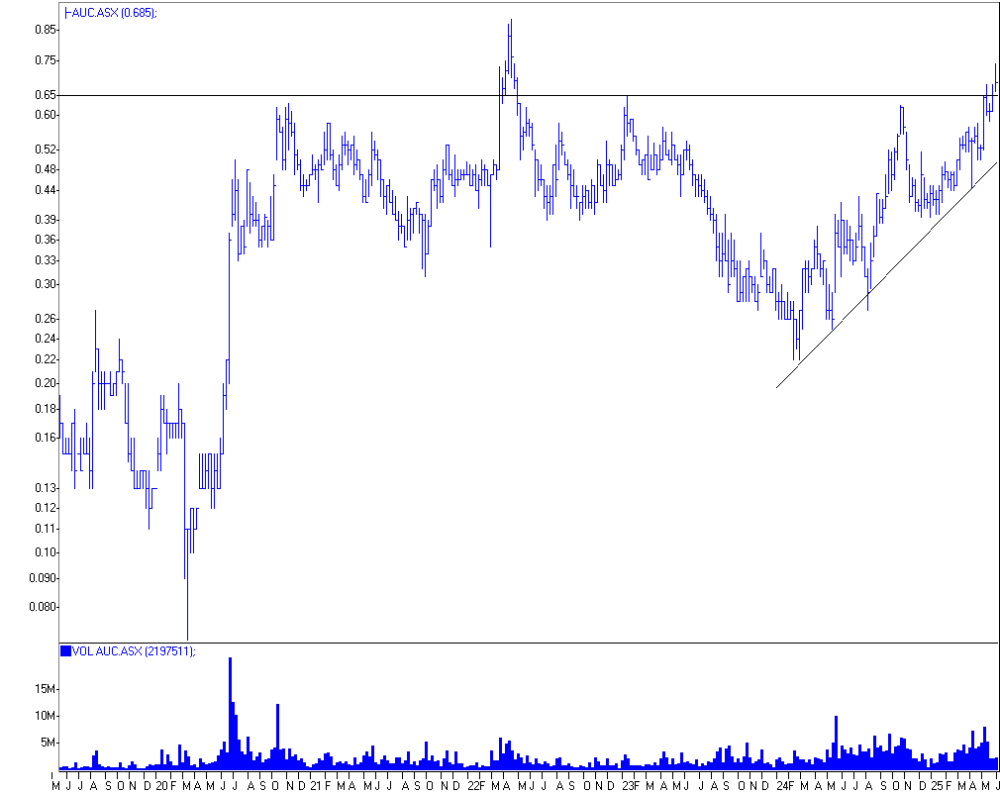

AUC

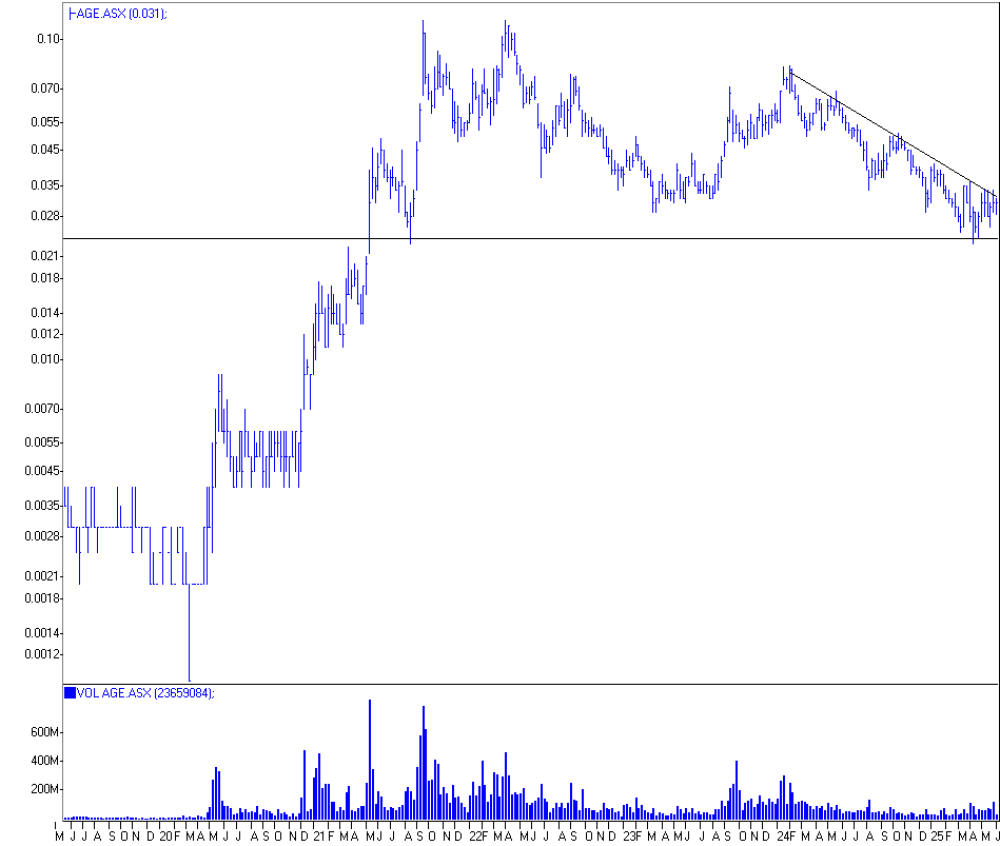

AGE Uranium in Sth Aust

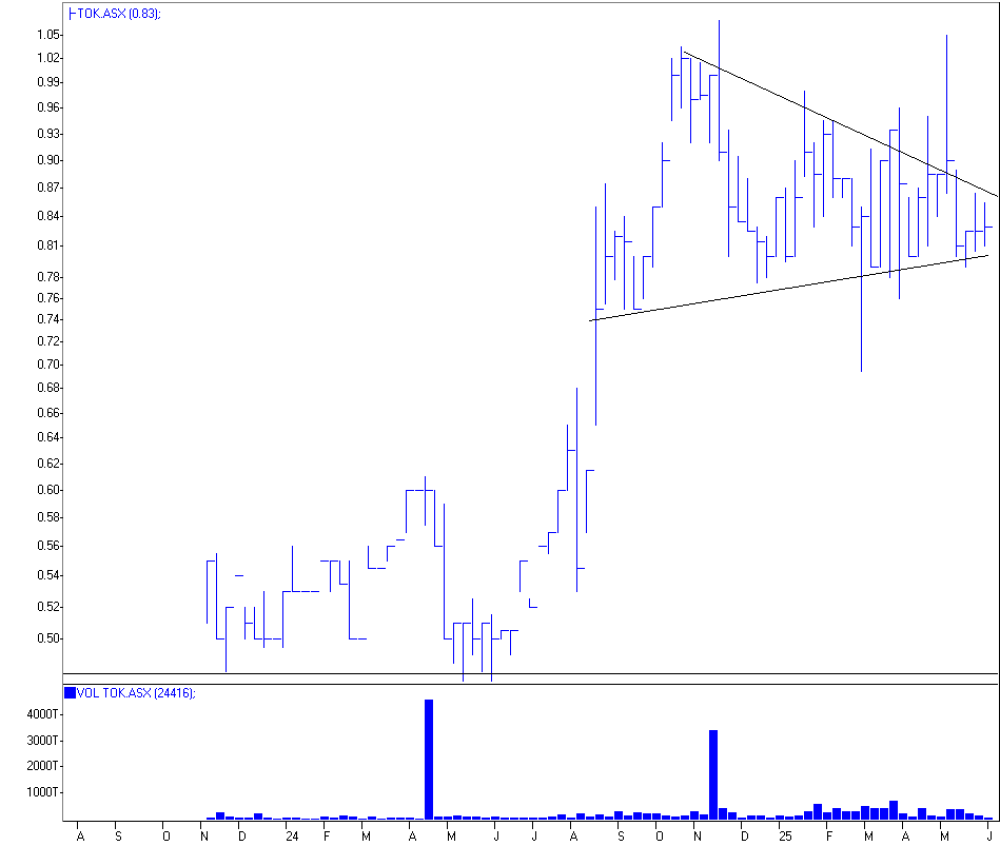

TOK

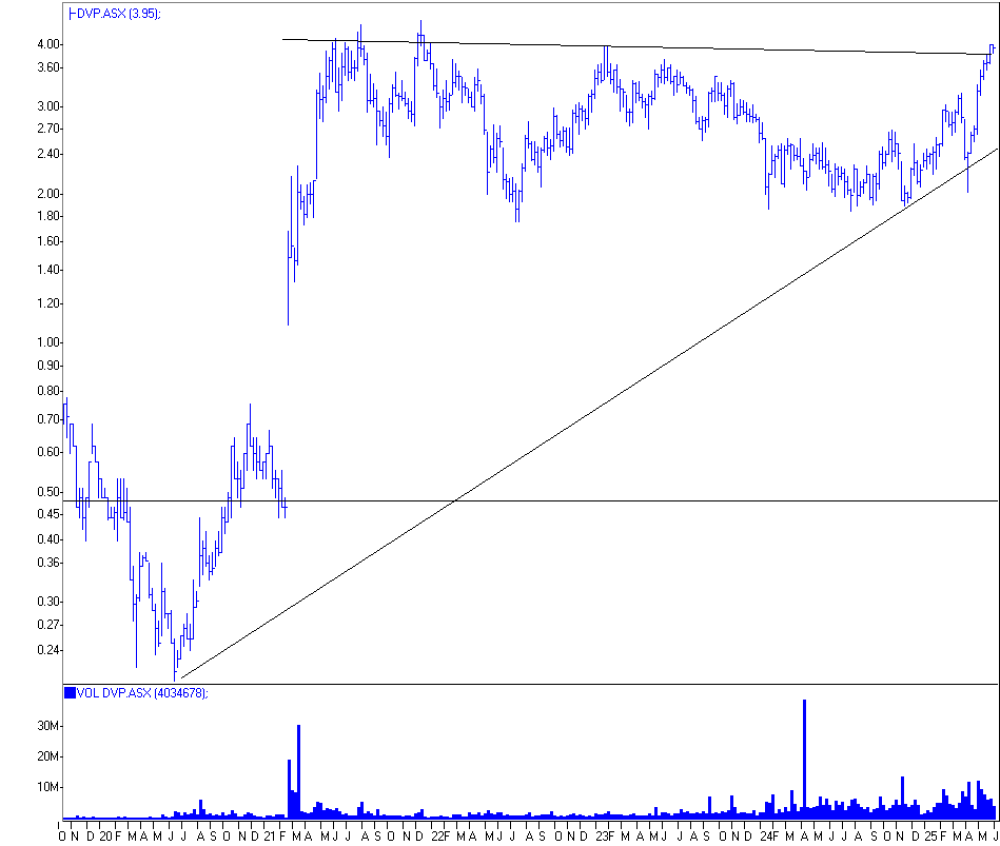

DVP

| Want to be the first to know about interestingBase Metals,PGM - Platinum Group Metals,Battery Metals,Gold andCritical Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Barry Dawes: I, or members of my immediate household or family, own securities of: All of the ASX stocks listed, including Tamboran Resources, Critical Metals Corp., European Lithium, Nova Minerals, Western Mines Group, Iceni Gold, Rua Gold, Legacy Minerals Holdings, Vertex Minerals, Brightstar Resources, Minerals 260, Ausgold, Alligator Energy, Tolu Minerals, and Develop Global. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.`For additional disclosures, please click here.