Metals All Rallying; Stock Is Retreat

Michael Ballanger of GGM Advisory Inc. shares his current moves in this tumultuous market.

Michael Ballanger of GGM Advisory Inc. shares his current moves in this tumultuous market.

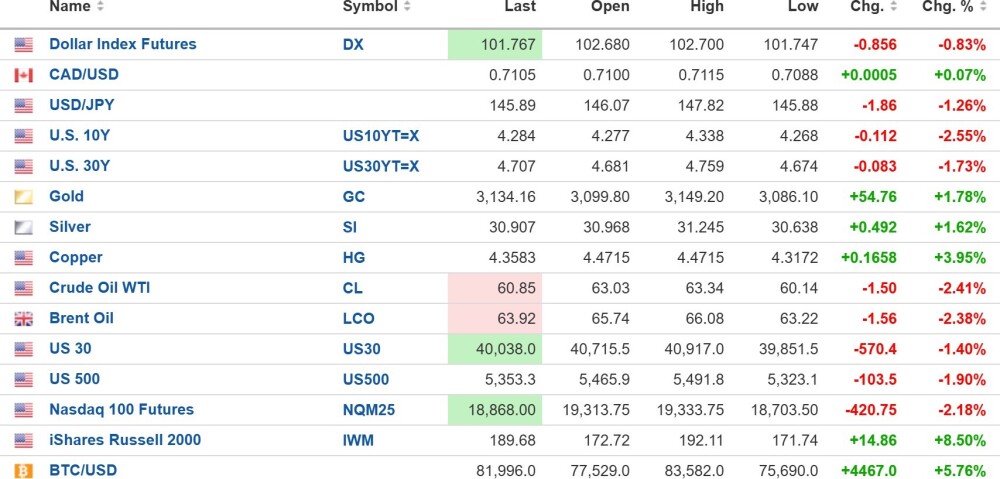

The USD index futures (-0.83%) are down to 101.767 this morning, with the 10-year bond yield (-2.55%) up to 4.284% and the 10-year (-1.73%) at 4.707%.

Gold (+1.78%), silver (+1.62%), and copper (+3.95%) are up, but oil (-2.41%) is lower.

The DJIA futures (- 1.40%) are lower by 570.4 points, with the S&P 500 futures (-1.90%) down by 103.5 points and the NASDAQ futures (-2.18%) down 420.75 points.

Risk barometer Bitcoin is up 5.76% to $81,996 but still down 25% from the peak and still in bear market territory.

Stocks

A few days ago, in the midst of the meltdown, I described it as a "tail risk" event where the U.S. President was controlling the narrative through the media with his tough talk on tariffs and global trade and an "America First" agenda. I told you that tail risk events were hazardous because, with one tweet or one executive order, Trump could trigger a reversal, which would be a classic "Trumpian" move.

Well, yesterday we got exactly that one of the biggest one-day screamers ever recorded on Wall Street as the DJIA added 7.87% or 2,976 points all in the final two and a half hours of trading. Announcing a pause in the implementation of "all tariffs except China," stocks exploded out of the gate within minutes of my getting filled on the UPRO:US (triple leverage SPY:US) via the UPRO May $60 calls at $3.60 after opening the position on Tuesday with 50 calls at $4.50.

During the last half hour of trading, I determined that the "W" formation, one of the most powerful reversal patterns there is, got skewered by the late-day spike making stocks a "Sell" by the closing bell. I unloaded 100 UPRO May $60 calls for $8.20, pocketing a fast $41,500 in less than a full trading session.

I might have gotten even more aggressive and sold the Freeport-McMoRan Inc. (FCX:NYSE) June $30 calls bought at $3.00 after seeing them touch $5.61 after the spike kicked into gear. However, as I indicated in the email sent out Wednesday evening, I love copper and FCX is ridiculously cheap at the current price level, so with over two months to go until expiry, I am speculating on a move to new all-time highs above $55.635 to match the recent all-time high in May copper at $5.37/lb.

The volatility proxies (UVIX:US and VIX:US) went berserk this week and while I certainly exited early, the drop in both of these vehicles yesterday was breathtaking.

With futures down sharply this morning, volatility will be rising quickly until we get a successful retest of the lows around SPY:US $481.80 which was the low for the move this week. If we can hold that low, there is a good chance that a more meaningful rally can take place but for now, I am a seller of rallies.

The chart of the SPY:US has one very interesting development about to occur which addresses the longer-term outlook, and that is the current trend and positioning of the 200-dma and 50- dma lines. You can see how the 50-dma is now in a full 45? descent and about to cross over the 200-dma which is now flattening after being in a sustained uptrend since 2023. When this occurs, it is commonly called "The Death Cross," and it has historically signaled the arrival of a bona fide bear market.

Now, I have been calling for the arrival of the "Papa Bear" since the GGMA 2025 Forecast Issue was first published, so it comes as little surprise to all subscribers. If we get a failure at the retest level, then yesterday's squeeze was a classic trap that ensnares the helpless bulls every time.

Since the top in February, we have now had two relief rallies, the first one in mid-March in anticipation of a less-threatening tariff attack by the White House. Yesterday was the second one, and while it might be the beginning of a tradable rally, only after the re-test will I know for sure that it was not just another bull trap.

However, and this is important, IF I get the arrival of "The Death Cross" as the market is headed down for a re-test, I will issue an immediate "SELL" on the SPY:US with an accompanying put option strategy because the odds of a successful re-test on the heels of the "DC" will be slim.

Juniors

Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) had a nice 16.25% recovery yesterday, and with assays pending from Polimet, drilling about to resume at Caballos, and drilling ongoing at Buen Retiro, there is going to be a great deal of news flow for this well-funded junior.

With copper rebounding today despite the retrace in stocks, it will be nice to see the red metal diverge from its close correlation to stocks.

There is no shortage of stocks to own, but there is a looming shortage of copper, which will play nicely into the fortunes of all shareholders for 2025 and beyond.

Sign up for our FREE newsletter

Important Disclosures:

of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Fitzroy Minerals Inc. Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.