Mining has nothing to fear from Fed rate hikes

As expected, the prices of gold and copper are down ahead of the US Federal Reserve Chair Janet Yellen's much anticipated annual speech on the direction of monetary policy.

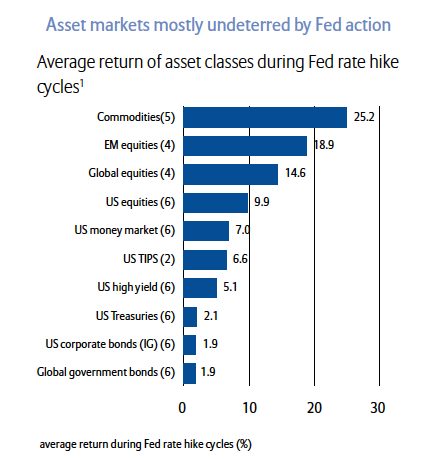

Source: Allianz Global Investors, Bloomberg, Datastream, BofA Merrill Lynch. Global equities, Emerging Market equities and global government bond returns in local currency

The consensus seems to have shifted in favour of earlier interest rate hikes than previously thought and the feverish speculation about what will transpire at Jackson Hole has seen an old research report being passed around again.

Two years ago Allianz Global Investors released an excellent study comparing the returns of different asset classes during Fed rate-hike cycles. The German firm with assets under management of $521 billion, looked at the six tightening periods since 1983.

The author of the report Martin Hochstein, Senior Strategist, said "conventional wisdom seems to suggest that a tightening of monetary policy should weigh on financial markets in general and risky assets in particular. The good news is that this assumption is not corroborated by historical evidence":

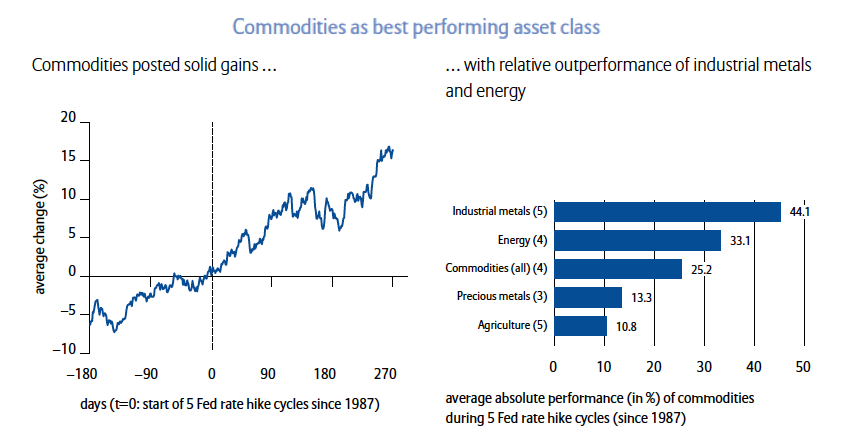

Commodities - and notably industrial metals and energy, which are the most growth-sensitive subsectors - did particularly well, with an average gain of more than 25%.

While that bodes well for metals and mining stocks, Hochstein does warn that the current rate hike cycle is different given the unconventional policies like quantitative easing that the Fed has employed (not to mention past performance is not a reliable indicator of future results and all that).

Source: Allianz Global Investors

Click here for the full report.