Mining Companies Reviving Historic Arizona Gold District

A move by a Vancouver mining company with international projects to expand into Arizona could end up breathing new life into the U.S. historic mining district, experts say.

A move by a Vancouver mining company with projects in Nicaragua and Guyana to expand into Arizona could end up breathing new life into the U.S. historic mining district, experts said.

Mako Mining Corp. (MKO:TSX.V; MAKOF:OTCMKTS) has announced its intention to buy the Moss gold mine in the Oatman district, where gold was first discovered in 1863, for between US$4.9 million and US$6.4 million, depending on the resolution of disputed net smelter return royalties.

Mako is acquiring the mine from former owner Elevation Gold Mining after it filed for creditor protection last August, citing debt and legal expenses. Mako announced February 24 it had received conditional approval of the acquisition by the TSX Venture Exchange.

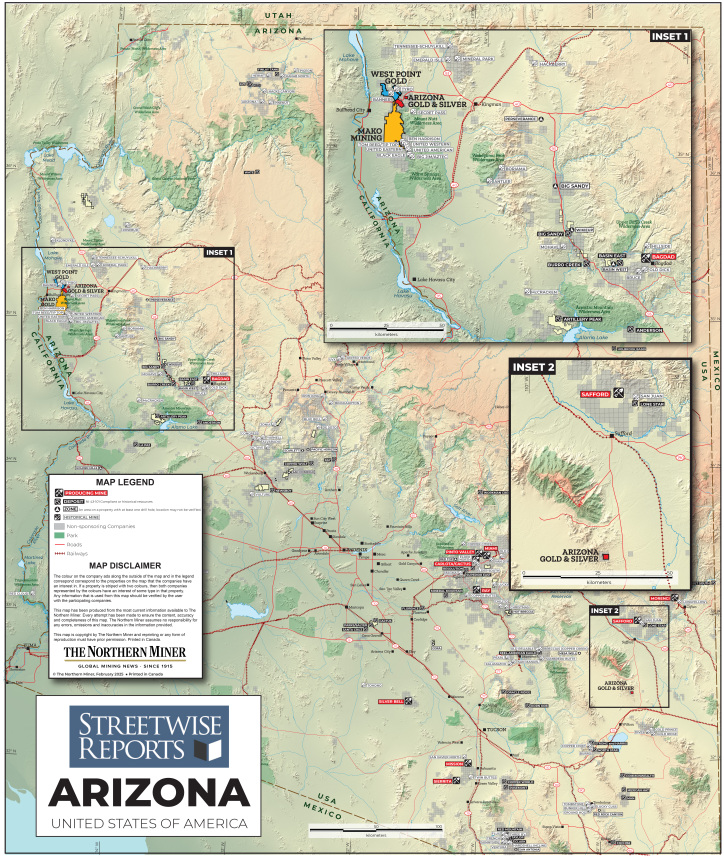

With other companies like West Point Gold Corp. (formerly Gold79 Mines Ltd.) and Arizona Gold & Silver Inc., already exploring there in the same area near the prolific Walker Lane Trend in Arizona and Nevada, some are wondering if the district's prospects are improving, and if the attention can attract majors with deep pockets.

*Writing about West Point on January 16, Technical Analyst Clive Maund said Mako's purchase of the Moss mine had "two important implications" for that company.

"One is that Mako's interest in the Moss Mine signifies that there is a worthwhile resource there; otherwise, Mako would not be interested in buying it, which means that there are probably significant resources on (West Point's) Gold Chain property, as it is nearby on the same trend," Maund wrote. "The other is that it increases the likelihood that a larger resource company will approach West Point in the future, wanting to buy the Gold Chain property or even West Point itself, which will have obvious major benefits for West Point shareholders."

On January 7, Ceasar's Report newsletter wrote about the acquisition, stating, "It's interesting to see Mako Mining entering the United States to further diversify its asset base, and it will be equally interesting to see if it picks up more land in the regional district."

"This is really looking interesting for a lot of the majors right now," Arizona Silver & Gold President and Chief Executive Officer Mike Stark said in a video interview on Junior Resource Investing posted recently on YouTube.

Below, a map from The Northern Miner shows Mako's Moss Gold mine in relation to West Point Gold and Arizona Gold & Silver's projects. As you can see on the map below, these companies' projects are quite close to each other.

Source: https://maps.northernminer.com/

Source: https://maps.northernminer.com/Moss Mining Operations Paused

According to former owner Elevation Gold, the Moss Mine covers about 165 square kilometers in the Oatman District about 90 minutes south of Las Vegas.

Per a 2021 National Instrument 43-101 technical report, it has Proven and Probable reserves estimated to contain 184,500 ounces gold (Au) and 2.2 million ounces silver (Moz Ag) in 12,744 kilotonnes grading 0.45 grams per tonne (g/t) Au and 5.4 g/t Ag, Measured and Indicated resources estimated to contain 490,200 ounces Au and 5.75 Moz Ag in 38,857 kilotonnes grading 0.39 g/t Au and 4.6 g/t Ag, and Inferred resources estimated to contain 73,800 ounces Au and 940,000 ounces Ag in 6,562 kilotonnes grading 0.35 g/t Au and 4.5 g/t Ag.

More than 120 exploration holes have been drilled since the 2021 report, Elevation said.

An open-pit heap leach operation, Moss is currently producing gold at a limited capacity, with mining operations temporarily paused. Mako plans to restart full-scale mining and optimize operations following the acquisition.

The company plans to restart mining operations swiftly, optimizing the mine plan and de-bottlenecking the crushing plant, which is expected to boost output within months of the acquisition.

Arizona Gold & Silver Inc.: A Novel Approach

Enter other companies in the district, like Arizona Gold & Silver Inc. (AZS:TSX; AZASF:OTC). Stark said that with no mine feeding Moss, Arizona can help the companies help each other.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

Arizona Gold & Silver Inc. (AZS:TSX; AZASF:OTC)

*Share Structureas of 2/5/2025Source: Arizona Silver"We've mentioned from day one that we are not going to be a producer," he said. "The only one that can feed it is us, and we're the neighboring property."

With its Philadelphia project about 6 to 7 miles away, "We have the material, we have the supply," Stark told Junior Resource Investing.

Building its own plant would take significantly longer than having the nearby Mako plant, which is idle, processing it.

"This district is absolutely ripe for the picking as far as we see it," Stark said. "We have the supply."

Arizona has come up with a novel approach to possibly make that happen. They approached a conveyor belt company about building one between the sites. According to Stark, the costs for trucking the material that distance work out to more than US$5 to US$7 per ton, while the conveyor belt alternative could cost as little as US$0.25 per ton after it is built. Even with the initial capital investment required for the conveyor belt, Stark said the trucking option isn't viable.

"This is doable. We actually did the math," Stark said during the YouTube interview.

Arizona's flagship asset is the Philadelphia gold-silver property, where the company is drilling off an epithermal gold-silver system ahead of an initial resource calculation. It's company fact sheet says the project has a 3-kilometer strike length and 100% of the 73 holes on the patented claims have hit gold mineralization.

According to the company, recent results from the property include hole PC24-140, which intersected 55.8 meters at 1.27 g/t Au and 2.5 g/t Ag between 0 and 55.8 meters downhole. True width is estimated at 52.4 meters, based on the overall 70-degree dip of the mineralized zone. The overall intercept includes two high-grade intercepts at 39.02 meters to 40.24 meters grading 24.5 g/t Au and 3.9 g/t Ag, and 51.98 meters to 54.73 meters grading 5.95 g/t Au and 9.3 g/t Ag.

"Our overall objective at Philadelphia is to build a bulk tonnage low grade heap leachable resource at grades better than 0.5 g/t gold," Vice President Exploration and Director Greg Hahn said. "This grade is known to be mineable in this district. Importantly we need to delineate the high grade veins that are known to exist between the footwall and hanging wall structures that define the mineralized corridor. Some of these veins were the subject of historic mining and others are new discoveries. Our results are accomplishing our objective."

Arizona Gold & Silver provided a breakdown of its ownership and share structure, where insiders and advisors own approximately 23% of the company, 9% is held by institutions, Sprott holds 8%, and 44% is with family and friend investors. The rest is retail.

According to Reuters, there are 93.86 million shares outstanding, while the company has a market cap of CA$30.03 million and trades in the 52-week period between CA$0.25 and CA$0.52.

West Point Gold Corp.: More District Success

West Point Gold Corp. (WPG:TSX; WPGCF:OTCQB) just recently announced more results from its recently finished eight-hole diamond-drill campaign focused on the Tyro Main Zone at its Gold Chain Project.

Streetwise Ownership Overview*

Streetwise Ownership Overview*

West Point Gold Corp. (WPG:TSX; WPGCF:OTCQB)

*Share Structureas of 2/7/2025Source: RefinitivAmong the 1,264 meters of drilling, hole GC24-34 intersected 42.8 meters of 2.50 g/t Au, including 11.7 meters of 5.94 g/t Au, returning mineralization from surface. Hole GC24-32 intersected a hanging wall zone of mineralization for 6.94 meters of 4.3 g/t Au, including 1.44 meters of 15.24 g/t Au from 16.31 meters, the company said. It also intersected a footwall wall zone of 16.08 meters of 1.35 g/t Au from 49.07 meters.

The Q4 2024 drill program was designed to improve the company's understanding of the Tyro Main Zone's structural model and controls of the mineralization, West Point said.

West Point said it has started both a fluid inclusion study of the Tyro vein system and a hyperspectral study of the core from the most recent program to better understand this area.

"The company continues to believe that these results are consistent with the previously announced exploration target of 15.6 to 31.2 Mt (metric tonnes) at 1.5 to 2.5 g/t Au and conform with the existing geologic model based upon drilling, trenching and geologic mapping conducted over the vein system," a company release said.

Technical Analyst Maund said, "The stock charts for West Point Gold are entirely positive they show a stock that is just starting to ascend out of a low base pattern on increasing upside volume."

He noted an uptrend has already become established, with the price ascending out of a low last Summer. Following a breakout move higher on robust volume early in October, the stock has settled into a rectangular trading range, which with good reason is viewed as a consolidation pattern that will lead to a renewed advance.

"Starting with the long-term arithmetic chart going back to 2000, we see that West Point Gold is currently trading at a historically very low level since it got as high as CA$30 back in 2007 and 2009 and almost made this level again in 2011, which means that at its current price, it is at almost a 99% discount to its price at its peak," Maund wrote.

"The conclusion is that West Point Gold is in the earliest stages of a major bull market that we can expect to unfold against the background of a broad sector bull market, and with it still relatively very close to its lows, there is believed to be everything to go for with the prospect of very substantial percentage gains going forward and it is rated an Immediate Strong Buy for all time horizons," the analyst continued.

According to Refinitiv, about 8% of West Point Gold is owned by insiders and management and about 1% by institutions. The rest is retail.

Top shareholders include Executive Chairman Derek Macpherson with 3.01%, Gary Thompson with 2.39%, Chief Financial Officer John McNeice with 0.49%, U.S. Global Investors Inc. with 1.29%, and Director Anthony Paterson with 1.51%.

Its market cap is CA$28.98 million with 65.86 million shares outstanding, and it trades in a 52-week range of CA$0.15 and CA$0.52.

The Catalyst: Tariffs Continue to Drive Gold Higher

Gold has repeatedly hit new highs in recent weeks, and Lyle Niedens reported for Investopedia that the threshold of US$3,000 appears in reach, as gold is considered a safe-haven asset for investors during times of uncertainty.

"Several Wall Street firms have raised their gold price forecasts to US$3,000 or higher," Niedens wrote. "Goldman Sachs, for instance, cited 'structurally higher central bank demand' for gold in addition to investors' appetite for parking assets in safe havens when it early this week raised its gold-price forecast to US$3,100 by the end of 2025, up from US$2,890 previously."

On Tuesday, spot gold reconquered the US$2,900 threshold following U.S. President Donald Trump's tariff announcement of levies of 25% on goods from Canada and Mexico and an additional 10% on Chinese imports.

"Gold's downside remains limited, given the apparent demand for safe havens amid rising geopolitical and economic growth uncertainties," said Han Tan, Exinity Group's chief market analyst, according to a report by Rahul Paswan for Reuters.

| Want to be the first to know about interestingGold investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Arizona Gold & Silver and West Point Gold Corp. Steve Sobek wrote this article for Streetwise Reports LLC and provides services to Streetwise Reports as an employee.This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company. For additional disclosures, please click here.* Disclosure for the quote from the Clive Maund article published on January 16, 2025

For the quoted article (published on January 16, 2025), the Company has paid Street Smart, an affiliate of Streetwise Reports, US$3,000.Author Certification and Compensation: [Clive Maund of clivemaund.com] is being compensated as an independent contractor by Street Smart, an affiliate of Streetwise Reports, for writing the article quoted. Maund received his UK Technical Analysts' Diploma in 1989. The recommendations and opinions expressed in the article accurately reflect the personal, independent, and objective views of the author regarding any and all of the designated securities discussed. No part of the compensation received by the author was, is, or will be directly or indirectly related to the specific recommendations or views expressedClivemaund.com Disclosures

The quoted article represents the opinion and analysis of Mr. Maund, based on data available to him, at the time of writing. Mr. Maund's opinions are his own, and are not a recommendation or an offer to buy or sell securities. As trading and investing in any financial markets may involve serious risk of loss, Mr. Maund recommends that you consult with a qualified investment advisor, one licensed by appropriate regulatory agencies in your legal jurisdiction and do your own due diligence and research when making any kind of a transaction with financial ramifications. Although a qualified and experienced stock market analyst, Clive Maund is not a Registered Securities Advisor. Therefore Mr. Maund's opinions on the market and stocks cannot be only be construed as a recommendation or solicitation to buy and sell securities.