No Shortage Of Worries Bolstering Gold Price

Gold price is feeding off a growing number of investor worries.

Bitcoin's latest setback is also increasing gold demand.

Gold has plenty of safety concerns to continue fueling rally.

Gold is slowly working its way back into the spotlight as more and more investors become nervous over the possibility that the coming weeks could witness a long-anticipated stock market correction. There is also a belief by some observers that a war, however unlikely, between the U.S. and North Korea is possible further out. Whatever the basis behind the growing gold demand, the metal continues to gain traction in the early part of 2018 and is now headed for its biggest test of strength since last summer. In this commentary we'll discuss the challenge that lies ahead for gold and see why the yellow metal should continue to impress in the coming weeks.

After slipping in early trading on Tuesday, gold clawed its way back and closed 0.29% higher from the previous day's four-month high. The rebound came on the heels of a pullback in the U.S. equity market and in spite of losses elsewhere in the commodities complex. Spot gold finished the day at $1,338 while February gold futures closed at $1,337. Gold rallied for the fourth consecutive trading session as investors awaken to the possibility that the U.S. economy may finally see the return of inflation this year after years of remaining under the Fed's 2 percent inflation target.

Gold's latest gain also occurred against the backdrop of a weak U.S. currency as the dollar clawed back some losses the day after hitting a three-year low. The dollar has weakened as investors have grown increasingly confident that a global recovery could outpace U.S. growth in 2018. Shown here is the dollar index (DXY), which is in free fall after recently hitting its lowest level since December 2014. The relentless weakness in the dollar is another in a growing list of investor worries that is bolstering near-term demand for gold.

Source: www.Barchart.com

Another concern facing investors right now is the near-term outlook for the cryptocurrencies. Bitcoin fell as much as 25 percent on Tuesday as worries about a regulatory crackdown on the market spread after reports suggested that South Korea may ban crytocurrency trading.

Bitcoin's slide triggered a selloff across the broader cryptocurrency market, with rival Ethereum losing as much as 23 percent at one point on Tuesday. Meanwhile, Ripple, bitcoin's third biggest competitor, plunged by as much as a third. Also weighing on bitcoin was a news report that a senior Chinese central banker said authorities should ban centralized trading of virtual currencies and prohibit individuals and businesses from providing related services.

Source: www.Bitcoincharts.com

The commencement of the bitcoin correction roughly coincided with gold's latest rally, which began last month. There have been suggestions among some gold traders that the precious metal's rally is in part a safe-haven reaction to bitcoin's declining fortunes. While that may or may not be true, gold has more than its fair share of safe-haven catalysts right now. This includes the return of inflation, a topic we've been discussing in recent commentaries. Suffice it to say that gold has enough underlying support from investor worry to maintain its intermediate-term upward trend for a while.

Gold's biggest obstacle ahead, from a technical perspective, is the $1,355 level, which is the nearest intermediate-term peak. Gold last achieved this level on a closing basis on Sep. 8, hitting an intraday high of $1,365 that same day. Gold is only about $20 away from the $1,355 closing high right now and will likely test this level before the momentum carrying its latest rally has become exhausted. If gold manages to close above $1,355, it would send a signal to skeptical commodity traders who have missed this latest rally that gold is indeed mounting a serious turnaround of greater than short-term proportions. This in turn would likely increase demand for the yellow metal from investment fund managers.

Source: www.Barchart.com

For disclosure purposes, I am currently long iShares Gold Trust ETF (IAU), my favorite proxy for the gold price. After taking some profit earlier this month cone the $12.75-$12.80 area was reached, I've since recommended that traders raise stop losses on the remaining part of this trading position. Currently the stop-loss should be raised to slightly under the $12.65 level (closing basis) where the 15-day moving average is found in the daily chart. I also recommend raising the stop loss on existing long positions to slightly under the $1,312 level in February gold, which is where the 15-day moving average is currently found in gold's daily chart. From here on, the 15-day moving average will serve as our guide for progressively raising the stop loss on our long position in IAU.

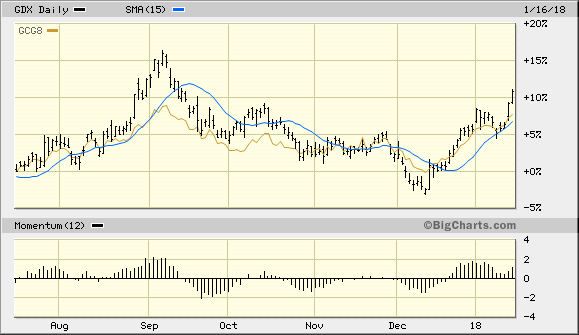

I'm also currently long the VanEck Vectors Gold Miners ETF (GDX), which is my favorite tracking vehicle for the actively traded gold mining shares. I recommend using a level slightly under the $23.50 level as the stop-loss on a closing basis. This of course answers to the current location of the 15-day moving average for GDX. As can be seen in the daily chart below, GDX is outperforming the yellow metal as smart money moves into gold stocks as investors try to leverage the latest gold rally. My near-term target for GDX is the $25.50 level, which is about $1.00 above the latest price.

Source: www.BigCharts.com

With no shortage of things for investors to worry about, gold appears to have plenty of fuel to continue its rally in the weeks ahead. Additionally, investor sentiment on the metal hasn't yet reached exuberant levels which have historically coincided with major market tops. Thus the gold and gold mining stock rally is still in a healthy condition as we head further into what has been a bullish seasonal period for the precious metals.

Disclosure: I am/we are long IAU, GDX.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.