Not All That Glitters Is Gold: Finding The Next African Diamond Mine

In my opinion, Lucapa is the most promising publicly traded junior diamond miner.

Regular finds of large, top-white diamonds at its Lulo concession suggests its drawing nearer to a major kimberlite diamond resource that will attract the majors.

Lucapa is focused on finding and producing large and colored diamonds, the parts of the diamond market that have seen steady price growth in recent years.

Expect the stock to re-value in the second half of 2018 as Lucapa opens its second high-value mine and diversifies political risk.

The Lucapa Diamond Company (OTC:LCPDF) is the only publicly traded diamond exploration company that presents clear value amid declines in overall diamond prices in recent years in my opinion. The company was reiterated as a speculative buy this month (January) by Perth-based financial advisory company Euroz Securities, which valued the company at A$0.64 per share (US$0.51 per share). As of January 2018, Lucapa traded on the Australian Stock Exchange (ASX) at A$0.25 (US$0.20), with 355 million in outstanding shares and a market capitalization of A$89 million (US$71 million). This article will explore why this small miner presents a great chance for investors interested in mining stocks to double or triple their money over the medium term (2-3 years).

I. Angola

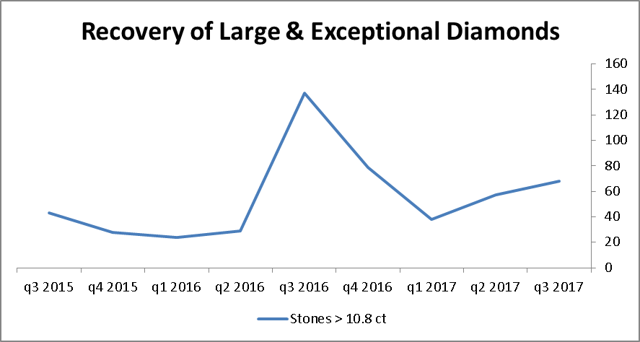

Lucapa's only revenue-producing asset at present is the Lulo river concession in Angola which is mined by Lucapa's 40 percent owned and operated subsidiary Sociedade Mineira Do Lulo (SDL). Alluvial mining in the local river system has consistently produced large and exceptional Type IIA white diamonds larger than 10.8 carats in size. These fortuitous discoveries have become a regular and increasingly frequent occurrence over the past nine quarters (see Figure 1). Anecdotally, when I was a reporter covering the diamond industry in Ramat Gan, I heard from dealers that Angolan diamonds are some of the best in terms of color quality and command healthy premiums.

Figure 1

Source: Created by author, based on Lucapa production reports

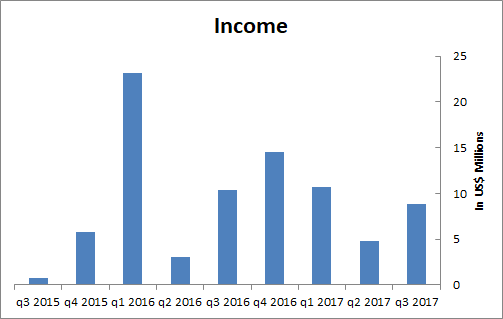

From Figure 2, you can see that, with the exception of q1 2016, the revenue produced by Lucapa's Lulo concessions has tracked the discovery of large and exceptional diamonds. Lulo is, in fact, responsible for the two largest Angolan diamonds ever recovered, weighing 404 carats and 227 carats.

Figure 2

Source: Created by author, based on Lucapa financial reports

The high-value recoveries have continued beyond the last reported period as well. A 130-carat Type IIa diamond and a 79-carat Type IIa stone were found in November. Meanwhile, in January, a large colored diamond - 43 carat yellow gem - was recovered at Lulo. Colored diamonds have also performed well in the market in recent years, with prices rising thanks to strong demand from wealthy buyers in Asia and elsewhere in the world. All these discoveries should each return millions of dollars to the company when sold in Antwerp.

The profits Lucapa receives from SDL and the Lulo concession have been in part reinvested into exploration activities there to find the kimberlite rock that must be the source of all the large diamonds found in the river. Should Lucapa succeed in finding the diamondiferous kimberlite responsible for its alluvial discoveries - one that is likely commercially exploitable - it would be a game changer. In my opinion, the stock price will at least double on such news.

The company at that point would either seek to develop the mine or it would become an acquisition target for a major diamond producer such as ALROSA (OTC:ARRLF) or Rio Tinto (RIO). ALROSA already operates in Angola with its role in managing the large Catoca mine, such that adding Lulo to its portfolio might meet with the approval of the government which is a minority owner SDL via Endiama that state diamond monopoly that controls Angola's diamond sales. On the other hand, Rio Tinto has declared that it is looking for new diamond mines to add to its portfolio. If Lucapa finds a sizeable kimberlite source at Lulo, an acquisition by Rio Tinto might suit the mine's management quite well.

Of course, Lucapa could seek to develop the Lulo ground mine by raising more funds via debt and equity. To see an Africa focused mining company that has managed to succeed amid the overall weakness in the diamond industry take a look at Lucara Diamond (OTCPK:LUCRF). Like Lucara, Lucapa is positioning itself to be a producer primarily of high-value diamonds.

Lucara, which successfully implemented this strategy, declared full-year revenue of $296 million in 2016 boosted by the sales of its large and exceptional diamond discoveries at its only producing asset, the Karowe mine in Botswana. In the third quarter of 2017, Lucara management noted that "Karowe sales remain strong compared to the diamond sector which is experiencing influx of new production, increasing weakness in the smaller and poorer quality stones as well as low color brown diamonds."

Lucara had the good fortune to find its high-value producing asset in the stable democracy of Botswana. Lucapa, on the other hand, is located in the dysfunctional state of Angola, which may be why it trades at such a low price. However, for investors willing to invest in countries with a higher geopolitical risk profile, Lucapa presents a chance for investors to get in early on the next Lucara.

II. Lesotho

The 70-percent-owned Mothae mine presents an opportunity for Lucapa to diversify its political risk from its Angola operation by adding another high-value diamond producing mine in Lesotho. Lucapa plans to open the mine for commercial production in the second half of 2018.

According to the assessment of the mine published by Lucapa in March 2017, Mothae has an indicated and inferred diamond resource of 1 million carats - which makes it a small mine. However, the average value of the diamonds to be mined was estimated at $1,063 per carat, making the mine a billion-dollar deposit. The high value of the diamonds at Mothae derives from the large diamonds discovered there during the trial mining phase carried out by previous owner Lucara Diamond. In addition, the area where Mothae is located has a mining pedigree, with the mine located within five kilometers of Letseng, the world's highest dollar per carat kimberlite diamond mine.

Lucara found hundreds of diamonds larger than two carats during the trial mining phase at Mothae when 23,400 carats of diamonds were recovered from the site. Among the diamonds recovered were dozens of large and exceptional diamonds larger than 10.8 carats. These diamonds were type IIa, meaning they should producer top color, i.e. high value, white diamonds when polished. When these stones were sold by Lucara in Antwerp, they yielded millions of dollars in revenue for the company with prices reaching $57,000 per carat for a single stone.

So much for the good news about Mothae.

The bad news is that Lucara's management decided to dispose of the mine after determining that mining the resource would not provide enough of a return to shareholders warrant commercial production. We can infer from Lucara CEO William Lamb's comments to shareholders that the ore grade at the site was too low compared to the cost of processing the ore. This leads us to question why Lucapa thinks it can produce better results.

Lucapa management said they designed a different mine plan for the site - one that is better suited to profitable mining of the resource. However, it's possible that Lucapa decision to commercially mine the Mothae resource is overly dependent on discoveries of large diamonds and optimistic regarding its pricing estimates. There is a significant chance that investors will be disappointed by Mothae's productions returns, but only time will tell. Until there are several quarters of regular production at Mothae, it will be impossible to determine the real frequency of large diamonds recoveries present at the site and whether Lucapa made a wise purchase decision and a well-thought out mine plan.

Lucapa has taken out a $15 million financing facility from Equigold to ready the mine for production, which is budgeted to cost $17 million. Meanwhile, at of the end of the third quarter of 2017, Lucapa had $7 million in cash in hand. This also does not include the $9.4 million held by SDL and another $1.3 million held in Angola for exploration activities in Angola. Management has also not indicated in financial statements any delays in reaching production at Mothae by the second half.

It seems like Lucapa will not run into any financial trouble as it has enough resources to bring Mothae online. Importantly, Equigold has already decided to convert its fees and the last $3.75 million in quarterly repayments of the facility into Lucapa shares. While the effect is dilute ownership of existing shareholders, Equigold's decision also shows its belief in Lucapa's long-term value and management.

III. Further Exploration Targets

Aside from its mining development projects in Angola and Lesotho, Lucapa is also engaged in diamond exploration activities in Botswana and Western Australia. The areas under exploration in Botswana and Australia are both interesting geological provinces with proven diamond producing records. The Orapa field which Lucapa is exploring in Botswana is home to De Beers' mega mine Orapa mine that produces millions of carats per year. Lucapa exploration activities in Western Australia are at its 80 percent owned Brooking project in Little Spring Creek. The area under exploration is 50 kilometers from the Ellendale mine last operated by Kimberley Diamonds. The mine was famous for producing during its operation more than half the world's yellow diamonds, which is sold to jeweler Tiffany.

On January 15, Lucapa announced that its exploration activities at the Brooking project had uncovered a source for the diamond-bearing lamproite ore. Some 119 diamonds were recovered from the ore. The site will be tested further to determine if the feasibility of commercial mining.

There has yet to be positive news this year from the Botswana exploration team.

The exploration efforts in these two regions are worth noting because they contain the prospect of eventually transforming Lucapa. A large volume discovery in the Orapa field will transform the company into a medium size producer of diamonds while a colored diamond discovery in Australia will expand its portfolio of low volume, high-value diamond production. If the company can locate and bring into production three diamond mines that regularly produce large and exceptional white and colored diamonds, it could become a significant player in the healthy high-end of the diamond market.

The downside to this exploration activity is that perhaps it is diverting the focus of the company's time and other resources. The odds of finding a diamond producing kimberlite like there are in Botswana is 1 out of 77. Meanwhile, Lucapa already has high-value mining sites in Angola and Lesotho that it should be focused on turning into developed mines. This lack of focus is somewhat worrying, and given the low odds of success in diamond exploration, these activities should be valued at nothing for the time being.

IV. Experienced CEO

Lucapa CEO Stephen Wetherall started his career in Africa working for De Beers and then junior miner Gem Diamonds. However, perhaps his most valuable prior experience was his brief tenure at Australian diamond miner Kimberley Diamonds (ASX: KDL) as its CFO. Wetherall is familiar with the diamond bearing region of Western Australia as well and the challenge of managing low volume mines that produce special diamonds from his time as CFO. He left Kimberley Diamonds after less than a year and moved to Lucapa about a year before Kimberley Diamonds got into trouble by failing to meet its projections for price growth in yellow diamonds. KDL got into further trouble when it expended significant money in returning the Lerala diamond mine in Botswana to production. The latter effort, like the Australian Ellendale mine, ended up going bankrupt and leaving millions in debt to local governments and contractors due to the actions of company's board and owner Alex Alexander.

Wetherall's time and timely escape from a poorly managed mining operation dependent on exceptional colored diamonds could serve him well by preventing him from making the same managerial mistakes as CEO this time around at Lucapa. The fact that Wetherall comes from an accounting background suggests that he will also pay close attention to managing the cash flows of Lucapa to minimize financial risk.

V. Why Lucapa

The advantage that Lucapa has compared to current Canadian exploration plays and junior miners is that Canadian diamond mines are known in the trade for producing almost entirely white diamonds smaller than 10.8 carats. This portion of the diamond market has been experiencing price weakness in recent years as supply has expanded. Affected companies include junior Canadian miners Mountain Province Diamonds (MPVD) and Stornoway Diamond Corp. (OTCPK:SWYDF), along with explorers Kennady Diamonds (OTC:KDIAF) and North Arrow Minerals (OTC:NHAWF). All these miners share prices are well below their five-year highs as a result of flood of low quality and small diamonds on the market.

Meanwhile, colored diamonds and white large and exceptional white diamonds above 10.8 carats have experienced price growth as the truly wealthy in Asia, Russia and elsewhere around the globe appreciate the true rarity and beauty of these stones.

VI. Stock listings

Meanwhile, Lucapa is the undiscovered gem holding steady between $0.215 and $0.225 per share in the pink sheets and trading on the ASX under LOM at A$0.245 (US$0.20) near its 52-week low of A$0.20 (US$0.16) and well below its 52-week high of A$0.44 (US$0.35).

Investors should try to invest their money in LOM as there is much more liquidity in the stock on the ASX. The average volume of shares traded is 934,976 shares per day according to the ASX.

In comparison, the pink sheet LCPDF listing is very illiquid, with no regular volume in trading. Lucapa also maintains a listing on the Frankfurt Stock Exchange (FWB) under the NHY ticker. These shares also trade at a low average volume of 7,000 shares per day.

Lucapa also considered listing on the London's Alternative Investment Market (AIM) in the fourth quarter, but it put those plans on hold after receiving financing for Mothae from Equigold. That means it's best to stick to ASX for the time being.

That said, between the regular high-value discoveries at Lulo and soon to be regular production from Mothae, Lucapa is due to see a revaluation of its share price. Investors looking to profit from the stock's revaluation higher should seek to get in before production starts at the Mothae mine in the third quarter this year.

Disclosure: I am/we are long LCPDF.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: I am a former diamond industry journalist. However, the opinions in this article do not represent the beliefs of my current or former employers.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.