Of 22 banks polled NO-ONE sees copper price rally continue

The surge in the copper price to near 18-month highs following Donald Trump's win in the US presidential election came as a surprise to an industry under pressure since 2011 over growing supply.

The bullishness about the impact of Trump's $500 billion infrastructure plans on demand for the bellwether metal has cooled down considerably.

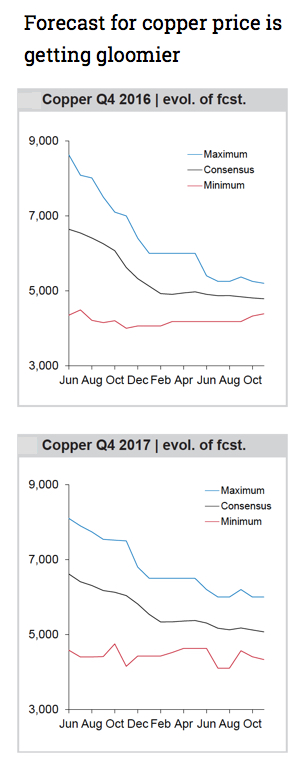

Source: FocusEconomics

In pre-regular hours trade on Thursday copper for delivery in December declined slightly to trade at $2.458 per pound ($5,418 a tonne) in New York, a fifth down day in a row. Copper is down 10% from intra-day highs of $2.73 a pound last week.

After underperforming other metals and steelmaking raw materials in 2016, copper is still looking healthier than pre-Trump with a 15% rise year-to-date.

However, according to a new survey of 22 investment banks and other commodity research institutions by FocusEconomics analysts and investors continue to call into question the sustainability of the rally.

And as the graphs show, the outlook for the copper price has been adjusted downwards for more than a year.

Of those polled not a single analyst sees copper averaging the final quarter of 2016 above the current spot price. In fact, the median estimate for Q4 is 12% below today's ruling price and sets up copper for a fifth annual average price decline.

The consensus forecast for Q4 2017 is only a slight improvement over this year with a rise to $2.29 a pound ($5,070 a tonne).

The most bullish institution is Unicredit which sees copper averaging 2017 at today's price of around $2.45, but the average forecast for the full year 2017 among those surveyed is still a disappointing $2.19 a pound ($4,846 a tonne) and well below the spot price.