Oil stocks weigh on FTSE 100; Darktrace slumps to 2-month low

Nov 3 (Reuters) - London's FTSE 100 slipped on Wednesday as losses in heavyweight oil stocks and the stronger pound weighed, while traders held back on uncertainty around a potential UK rate hike.

The commodity-heavy FTSE 100 index (.FTSE) ended 0.4% lower, recording its worst session in nearly two-weeks, dragged by weakness in oil majors Royal Dutch Shell (RDSa.L) and BP (BP.L).

UK's energy subindex (.FTNMX601010) fell 2.2%, tracking crude prices after industry data showed a big build in crude oil and distillate stocks in the United States.

"Any weakness over the near term of oil prices and oil producers is a potential buying opportunity," said Joshua Mahoney, market analyst at IG Group.

The dollar earners in the index including Diageo (DGE.L), Unilever (ULVR.L) and British American Tobacco (BATS.L) took a hit from sterling's strong gains.

Buoyed by soaring fuel prices, UK energy stocks have far outperformed other sectors and the FTSE 100 index this year. However, their performance this quarter has been muted so far, falling 0.8%, compared with a 2.5% rise on the benchmark index.

Recent signs of slowing economic growth have raised doubts among investors about potential interest rate hikes ahead of the Bank of England's meeting on Thursday. read more

"The challenge facing central bankers is that if they move too soon on rates they risk choking off the recovery, too late and the evident inflationary pressures could run out of control," said Russ Mould, investment director at AJ Bell.

Base metal miners (.FTNMX551020) rebounded 0.6%, on the back of strong copper prices.

Clothing retailer Next Plc (NXT.L) was among the worst performers on the blue-chip index, declining 3.3% after it warned of slowing sales growth. read more

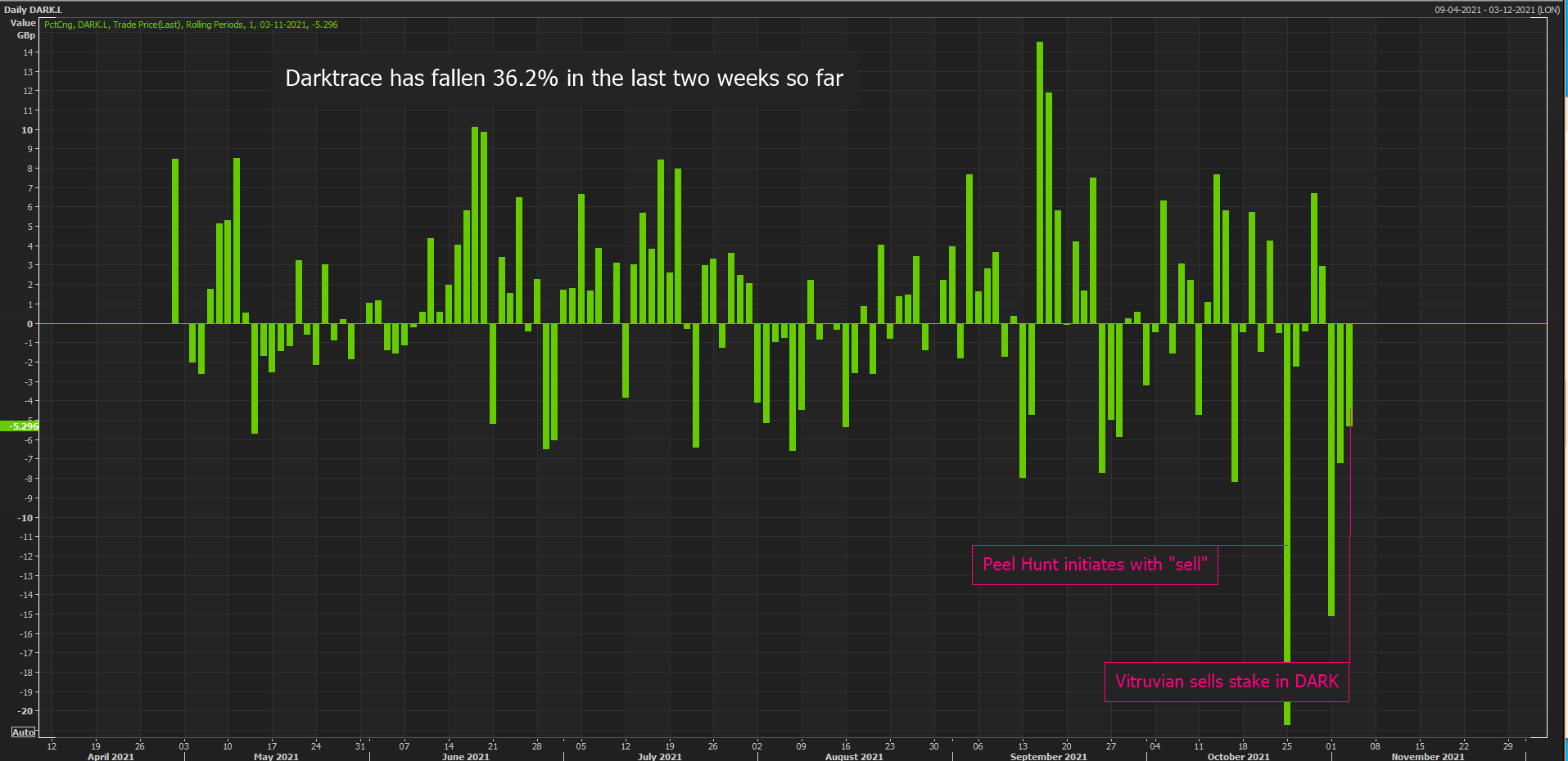

Cybersecurity firm Darktrace Plc (DARK.L) declined 5.1% to hit a more than two-month low after British private-equity firm Vitruvian Partners said it had sold about 11 million ordinary shares in the company.

The domestically focussed mid-cap index (.FTMC) erased early gains to end 0.2% down, with Trainline (TRNT.L) sliding 7% after it said lack of clarity on UK's Williams Shapps Plan, and its potential implications creates uncertainty for the railroad operator.

Dark days for Darktrace, stock down 36.2% in two weeks so farReporting by Bansari Mayur Kamdar and Amal S in Bengaluru; Editing by Shounak Dasgupta, William Maclean

Dark days for Darktrace, stock down 36.2% in two weeks so farReporting by Bansari Mayur Kamdar and Amal S in Bengaluru; Editing by Shounak Dasgupta, William Maclean