One Copper Stock Powers Higher

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market and takes a look at one of his favorite copper stocks.

Michael Ballanger of GGM Advisory Inc. shares his thoughts on the current state of the market and takes a look at one of his favorite copper stocks.

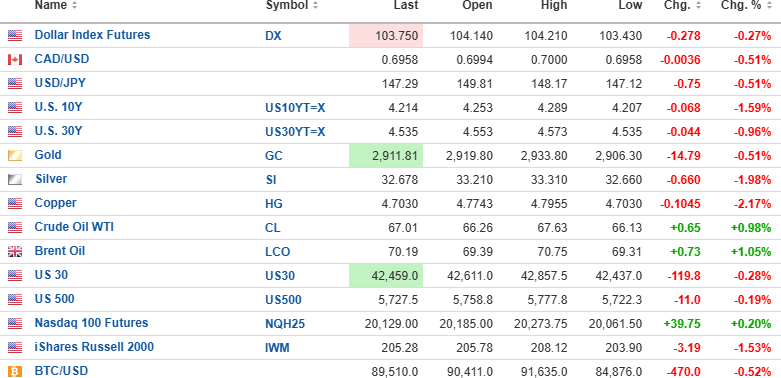

The U.S. dollar Index futures are lower by 0.27% to 103.750, with the 10-year yield down 1.59% to 4.214% and the 30-year yield down 0.96% to 4.535%.

Gold (-0.51), silver (-1.98%) %), and copper (-2.17%) are down, but oil (+0.98%) is up.

The DJIA futures (-0.28%) are down 119.8 points; the S&P 500 futures (-0.19%) are down 11.0 points; but the NASDAQ 100 futures (+0.20%) are higher by 39.75 points.

Risk barometer Bitcoin is down 0.52% to $89,510.

Stocks

Stocks were lower yesterday across the board, with the NASDAQ and the Mag Seven all sharply lower as the larger portfolios and ETFs scrambled for liquidity.

There are currently 530 ETFs that hold NVidia Corp. (NVDA:US) shares in various sizes and with varying degrees of leverage.

With NVDA:US closing below its 200-dma, one must remember that this company led all markets higher for most of the past two and one-half years, dragging billions of CAPEX dollars into the "artificial intelligence" space.

Likewise, one could surmise that it will also be the downside leader as investors move to de-leverage AI-centric portfolios and ETFs.

With that in mind, it is of note that the ETF for the S&P 500 (SPY:US) has not yet broken below its 200-dma which resides at $569.28 a mere $3.43 lower than the Thursday close.

Since this is a "jobs" Friday with the NFP Report at 8:30 am, it is my conviction that by later this afternoon traders will ignore the number and instead choose the safety of the sidelines in order to sleep restfully over the weekend.

In the GGMA 2025 Trading Account:

Buy 25 contracts SPY April $550 puts at $7.00They closed at $7.89 yesterday but I look for a modest intraday uptick in the futures that will allow for a "buy the dip" entry point.

Gold

Gold has been bouncing around either side of unchanged until a few minutes ago after the NFP report was "in line" with expectation but with minor downward revisions to earlier reported numbers. It is now down almost $15.00. As I have been opining for the past two weeks, gold looks ready to correct with sell signals in all three metrics MACD, MFI, and TRIX but with RSI in the 50s down from the high 70s in early February, perhaps the bulk of the pullback was completed last week with the dip to $2,844.10. It has since recovered 50% of the drop from the record high and looks to be trying to find a bottom.

Whether or not traders elect to move to the sidelines before the pit session closes at 1:30 pm is a toss-up but since I do not want to be going into the weekend holding hedges on a commodity right in the midst of a powerful bull market, I will try to cover by 1:30 pm..

In the GGMA 2025 Trading Account:

Sell 25 puts GLD April $265 at $4.80If gold is flat or higher by the close of the pit session at 1:30 EST, sell the position "at market."

PDAC

PDAC ended at noon Wednesday, and I held fast to my determination to avoid the "monkey show" that has typified the largest mining conference in the world. Not only is it a long commute from Port Perry, I have found it to be a marketing contest where the loudest, most colorful booths manned by the most attractive females handing out the most keychains win the prize.

All of the feedback thus far from PDAC 2025 is that it was relatively well-attended but with many more industry attendees than retail attendees, which is a good sign for the junior resource companies with quality projects. The problem with this industry is that there are too many companies with sub-standard projects being showcased by state-of-the-art marketing programs that utilize all sorts of social media and high-technology applications that reach millions of users with the pressing of a button. The average investor finds it impossible to differentiate between the fake and real jewelry, which means that the "VVS1" diamonds are being valued the same as "bort" because the settings tend to distract from the cut, clarity, color, and carat value of the stone.

Getchell Gold Corp. (GTCH:CSE; GGLDF:OTCQB) has a "VVS1"-style project in Nevada valued at over US$470 on an after-tax, fully-discounted basis versus a market cap of US$32 million. Over a ten-year mine life, the CAPEX gets recovered in 3.1 years which means that it will generate around $47 million per year for seven more years.

Most producers trade at 3-5 times pre-tax cash flow so it is fairly easy to see how Getchell should be valued at US$141-235 million (US$0.68-1.14 per share). With a USD share price at $0.1520, that is a fourfold to sevenfold lift from current levels.

Most importantly, that lift is without risk. Furthermore, catalysts to increasing those valuation metrics include a) rising gold prices and b) expanded resource size with more drilling. Now that is a "VVS1" diamond that is being treated like "bort."

Fitzroy Minerals Inc. (FTZ:TSX.V; FTZFF:OTCQB) will shortly close the Ptolemy Mining acquisition that will bring the Buen Retiro concessions "over the wall" after which the test results from Caballos will probably be back from the lab.

The stock is trading at a level just under the February 14 high of CA$0.235, and once it clears that level, a test of the November highs at CA$0.30 is a "wash."

There are "big eyes" on FTZ/FTZFF right now and they are growing more intense by the day. A "must- own" proposition...

| Want to be the first to know about interestingGold,Critical Metals,Silver andBase Metals investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Getchell Gold Corp. and Fitzroy Minerals Inc.Michael Ballanger: I, or members of my immediate household or family, own securities of: All. My company has a financial relationship with: All. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.