Options Traders Jump On Disney, Alibaba as Stocks Diverge

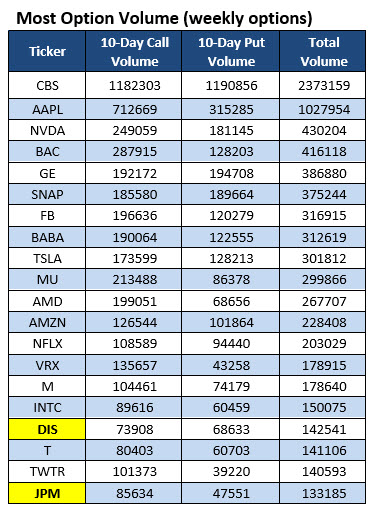

The 20 stocks listed in the table below have attracted the highest total weekly options volume during the past 10 trading days. Stocks highlighted in yellow are new entries to the list. Data is courtesy of Schaeffer's Senior Quantitative Analyst Rocky White. Two names to note are entertainment giant Walt Disney Company (NYSE:DIS) and e-commerce stock Alibaba Group Holding Ltd (NYSE:BABA). Below we'll break down recent options trading activity on DIS and BABA.

Put Traders Take On Weak DIS Stock

According to White's chart above, weekly calls have outpaced weekly puts during the past two weeks for Disney, but widening the scope shows a much different story. For instance, the equity has a Schaeffer's put/call open interest ratio (SOIR) of 1.47. Not only does this show put open interest among options expiring within three months outweighs call open interest, but it stands as a 52-week high, showing such a put-skew is highly unusual.

Digging deeper, the December 92.50 and 97.50 strike puts saw notable increases in open interest during the past two weeks, and data from the major options exchanges shows a mix of sell- and buy-to-open activity at each. The sellers are betting on the strikes acting as technical support, while the buyers are hoping to see DIS shares fall below the strikes in the coming weeks.

Meanwhile, the March 2018 92.50-strike put actually saw the largest increase in open interest by far during this time frame. But this option saw almost exclusive sell-to-open activity, so many are speculating on the blue-chip stock holding above $92.50 in the months ahead.

On the charts, Disney stock has struggled in recent months, despite renewed M&A buzz in the media sector. DIS hit a 52-week high above $116 in April, but was last seen trading at just $102.99, with breakout attempts thwarted by a declining trendline from that peak. Also capping the most recent jump from the shares was the 200-day moving average.

Weekly Calls Hot On BABA Stock

The opposite has been the case for Alibaba stock, which seemingly can't be stopped on the charts. Overall, the shares have more than doubled in 2017, and continue to trade near record-high territory, last seen at $188. Traders today are reacting to news of the China-based company's newly announced stake in grocery chain Sun Art Retail Group.

Looking at recent options activity, the January 185 call and put and the 190 call and put from the same series all saw huge rises in open interest during the past 10 days, due to a number of major spread trades. In today's action, though, weekly traders are out in force, with more than 26,000 weekly 11/24 190-strike calls crossing today, but it's not clear what strategy is being deployed.

What is clear is that Alibaba has rewarded premium buyers over the past year, based on its Schaeffer's Volatility Scorecard (SVS) of 96, showing it has regularly made bigger-than-expected moves on the charts on the past year compared to what options traders were pricing in. Plus, BABA stock currently has a Schaeffer's Volatility Index (SVI) of 26%, which ranks in the low 20th annual percentile, suggesting volatility expectations are relatively muted for near-term contracts.