Options Traders Line Up for JPMorgan, Roku Calls

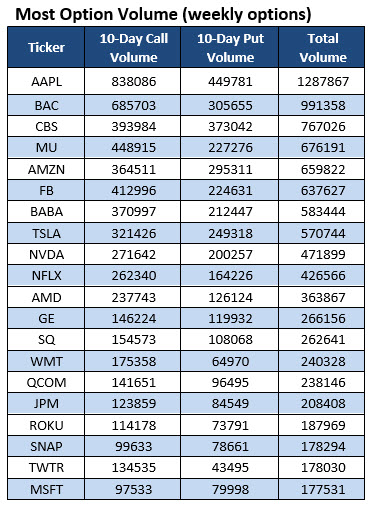

The 20 stocks listed in the table below have attracted the highest total weekly options volume during the past 10 trading days. Data is courtesy of Schaeffer's Senior Quantitative Analyst Rocky White. Two names to note are bank stock JPMorgan Chase & Co. (NYSE:JPM) and streaming content provider Roku Inc (NASDAQ:ROKU). Below, we'll break down recent options trading activity on JPM and ROKU.

Call Traders Pile On Red-Hot JPM Stock

Earlier today, JPMorgan stock touched a record high of $108.40, and was last seen trading up 2.4% at $107.23. The entire financial sector is enjoying a breakout day, cheering the business-friendly Republican tax plan that the Senate passed over the weekend. In addition, the central bank's expected decision to raise interest rates later this month has been a boon for bank stocks. JPM stock has added over 24% in 2017.

During the past two weeks at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), options traders have bought to open 1.55 JPM call options for every put. Digging deeper, the December 120 call is home to the largest increase in open interest during this time frame, with nearly 16,500 contracts added. For "vanilla" traders who bought to open calls here, the goal is for JPM stock to rise above $120 before front-month options expire at the close on Friday, Dec. 15.

Among weekly options, the 12/29 120-strike call saw the biggest increase to open interest, with nearly 4,400 contracts added in the past two weeks. Again, vanilla buyers of the calls expect JPM to surmount $120, but before the Dec. 29 expiration date.

Today, options traders are once again favoring JPM calls, which are trading at two times the expected intraday rate, with more than 70,000 traded so far. In fact, JPMorgan call volume is on pace for the 98th percentile of its annual range. Furthermore, the equity's Schaeffer's Volatility Scorecard (SVS) of 95 suggests the bank stock had consistently rewarded premium buyers over the past year, relative to what the options market had priced in.

Call Buyers Taking Notice Of ROKU

ROKU stock touched a record high of $51.80 early last week, thanks to encouraging Cyber Monday sales. However, the stock is now on pace for a fifth straight day in the red, down 2.3% to trade at $42.55 -- and testing support at its 10-day moving average -- as tech stocks struggle. Still, Roku shares aretrading at more than three times their September initial public offering (IPO) price of $14.

The tech stock could resume its uptrend soon, in the form of a short squeeze. Short interestincreased by 51% during the last reporting period, to 7.23 million shares, a new all-time high. This represents a whopping 46% of ROKU's total available float.

Call buyers have been active on Roku,and perhaps some of that -- at least at out-of-the-money (OOTM) strikes -- is attributable to short sellers seeking an options hedge. The security has a 10-day call/put volume ratio of 1.41 at the ISE, CBOE, and PHLX, and the largest increase in open interest during this time was at the OOTM weekly 12/1 50-strike call, where nearly 5,600 positions were added. However, excluding now-expired weekly calls, the January 18 put saw the biggest open interest change.