Osisko Gold Royalties Sees Rapid Growth As It Catches Up With Leaders

Newest of major royalty companies has rapid growth.

Revenue to double in next six years.

Investments in juniors to pay off.

It is now the turn of the new boy on the block to catch up.

A little more than two years ago, I wrote an article, published here, on the major gold royalty companies. One, Franco-Nevada, I called the blue-chip of the group; today, its stock price is virtually doubled where it was recommended. The second, Royal Gold, I said had the most short-term potential; the stock price more than doubled with in 12 months. The third I suggested had the greatest longer-term potential, and its stock price has lagged.

Osisko Gold Royalties (NYSE:OR) was the third of the large gold royalty companies. Wheaton Precious Metals, which recently changed its name-and its focus-from Silver Wheaton, was not included in the earlier article since at that time it was not gold focused.

Rapid Growth

Osisko came into being as a royalty company after the Canadian Malartic mine it had found and developed was sold. Following a hostile takeover bid, Osisko found a white knight who agreed to give the company a very attractive 5% net smelter return royalty. Shortly after, Osisko acquired Virginia Gold and its royalty on the Eleonore deposit which Virginia had found and sold, retaining a royalty, on a sliding scale up to 3.5%, again a very attractive royalty. Eleonore's buyer, Goldcorp, put the mine into production in 2015. Though there have been geological difficulties encountered, with the ramp-up taking longer than expected, the mine is still attractive with up 20 years ahead of it.

With these two assets, Osisko has significant royalties on two long-life mines based in Quebec, one of the safest mining jurisdictions in the world. Since then, the companies has grown by acquiring various royalties, capping its acquisition run last August with the $1.1 billion purchase of a package of royalties and royalty-type assets (streams and an offtake agreement) from a private venture capital company, Orion Resource Partners. The package includes an attractive royalty on a new diamond mine in Canada, again a long-life asset. Some of these newly acquired royalties have buyback rights, most notably a royalty on Pretium's new Brucejack mine. That mine's start-up has been successful, there is little doubt now that Pretium will exercise its right. Although one cannot include the upside from these royalties in Osisko's revenue forecasts, payments made to buy them back will in effect reduce the purchase price.

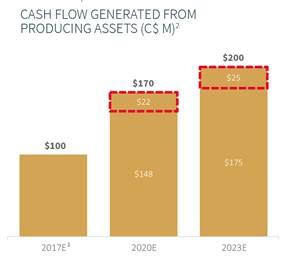

Even without Pretium, however, Osisko can expect a 75% increase in cash flow from existing assets over the next six years.

Dotted line represents cash flow from Pretium if not bought back

Osisko's presentation

Diversification from latest acquisition

The Orion portfolio diversified Osisko's royalty portfolio. It currently has over 130 royalties and streams of which 16 are currently generating revenue, and another 13 in development. Though the Orion purchase expanded Osisko's royalties into Africa, Greece and Turkey, the majority of their larger assets are in North America, while their largest cash-flowing assets are in Canada.

The Orion assets also expanded Osisko's previous gold-only focus, with royalties and streams on silver, diamonds and copper, though gold continues to dominate, both cash flow and assets.

Osisko's secret weapon

This royalty package also puts Osisko well and truly into the big leagues. But in addition to these acquisitions, Osisko has a "secret weapon," its so-called accelerator program, whereby it invests in juniors, often lending its expertise, whether in exploration or mine building, in exchange for shares and royalties, as well as rights to acquire royalties, on future production.

This part of Osisko's strategy distinguishes it from other royalty companies. It makes it more speculative and the stock more volatile, but it also adds meaningful upside.

First, Osisko has been an astute investor. It has realized over $70 million from the share portfolio, with a current market value of C$411 million. Currently, the portfolio consists of six major positions and a handful of undisclosed positions. The largest are:

Marketable Securities | Number of shares | Cash Cost (C$M) | Estimated Fair Value | ||

Osisko Mining Inc | 32,302,034 (15.5%) | 72.5 | 109.5 | ||

Barkerville Gold Mines Ltd. | 142,309,310 (32.7%) | 71.3 | 106.7 | ||

Dalradian Resources Inc. | 31,717,687 | 39.7 | 42.0 | ||

Falco Resources Ltd. | 23,927,005 (12.7%) | 15.4 | 20.8 | ||

Aquila Resources Inc. | 49,651,857 | 12.9 | 12.9 | ||

Osisko Metals Incorporated | 9,006,667 (12.8%) | 5.7 | 7.8 | ||

Other | 127.9 | 111.6 | |||

TOTAL | 345.4 | 411.3 | |||

The equity portfolio can be used to add cash when needed, and is part of its strong balance sheet, consisting of C$400 million in cash and C$462 million in debt, most of which is a recent convertible debenture which allowed the company to complete the Orion purchase.

One important factor regarding the balance sheet is the investment of the Quebec public pension funds, their strong support. When Osisko seeks funds for an acquisition, they stand ready to support the effort. The largest of these, Caisse de Depot, holds over 12% of Osisko shares.

Solid and undervalued

By most metrics, then-balance sheet, management, revenue flows, diversification of cash flow and future pipeline-Osisko is in a very strong position. It is fair to say that it also lags the other major royalty companies, notwithstanding the rapid growth over the last few years.

But the stock price fully discounts the size differential. On most metrics, it is better value than its larger competitors, trading at a price-to-book less than half its rivals, a p/e one-third lower than Franco's, with debt burden significantly lower than Royal's (3/2% debt-to-assets ratio versus 19%; Franco has no debt). and yielding slightly more (1.4% vs 1.2%). It now trades on the NYSE (and there is a dividend reinvestment plan for U.S. shareholders as well).

Disclosure: I am/we are long OR, FNV, RGLD.

I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional disclosure: Clients of Adrian Day Asset Management are long OR, FNV, and RGLD, as well as Osisko Mining and Osisko Metals.