Other Than That Mrs. Lincoln, How Was the Play?

Rick Mills of Ahead of the Herd once again interviews Bob Moriarty of 321Gold to discuss Trump's presidency, the current turmoil in the Middle East, the economy, gold, and some companies they have kept their eyes on.

Below is an interview by Rick Mills, the editor and publisher of Ahead of the Herd, with Bob Moriarty of 321 Gold.

Rick Mills (RM): Let me pose this question directly: Has the current Trump presidency achieved any successes during this second term? When I examine the Iranian situation, the Israeli conflict, developments in Syria, Russia-Ukraine tensions, the Qatar arrangement, cryptocurrency controversies, plus China-Taiwan relations, trade policies, diplomatic efforts, the proposed legislation, fiscal matters, budget deficits, and now this complete breakdown in American diplomatic relations where they cannot restrain Israel's actions leading to Iranian bombardments it's clear Israel opposed any nuclear agreement between America and Iran. Can you identify any accomplishments for this administration during the past four to five months?

Bob Moriarty (BM): Besides all that, Mrs. Lincoln, what did you think of the theater performance?

RM: Excellent comeback. Nothing appears to be functioning properly.

BM: You could compile approximately fifteen campaign promises that Donald Trump was chosen to fulfill. I support his selection of Acting Assistant Secretary Amy Holman for the Bureau of Economic and Business Affairs, plus his choice of Robert F. Kennedy Jr., however this administration operates under Israeli control, which threatens both nations' survival.

RM: Following Israel's Iranian assault, I examined market reactions immediately after the initial strike equities declining, petroleum prices rising, gold advancing, silver remaining stable, copper falling, gasoline costs increasing, natural gas climbing, long-term treasury yields ascending, and the dollar strengthening. The dollar appears to regain safe-haven status, though the increase was modest.

Debt financing will become increasingly challenging, yet I'm confident the proposed major legislation will pass through the Senate.

Do you anticipate significant inflationary pressures this summer, considering that reasonable inflation figures have been maintained by low energy costs?

BM: The likelihood of Iran blocking the Strait of Hormuz approaches absolute certainty. Such action would devastate both the American and global economies.

Current developments frighten me, and we've been forecasting these scenarios for weeks. Who could have predicted revolutionary activity in Los Angeles spreading nationwide? Trump's celebration could have easily transformed into another significant battle. We face potential legal and military crises.

RM: I question the presence of 700 American marines patrolling LA streets they'd benefit more from Middle Eastern and desert combat training. Typically, only developing nations witness such close military presence.

While Marines occupy our streets with expansion plans, I find the concept of military parades celebrating Donald Trump's birthday somewhat contradictory. Your thoughts?

BM: Do you recall Roman imperial triumphs?

RM: Yes, but please elaborate.

BM: When generals or emperors achieved important victories, Rome would celebrate with festivities. Citizens received free food while the victor paraded through the city in what was called a triumph similar to Trump's parade. However, unlike Donald Trump's version, during Roman times, a servant accompanying the emperor in his chariot would whisper something specific. Can you guess what?

RM: Melania, positioned on his left, whispered her excitement, while Defense Secretary Pete Hegseth, on Trump's right, expressed similar sentiments. But the servant said, "Memento mori" remember your mortality.

Do you believe this conflict might trigger a regime change in Iran? Will Iranians grow tired of clerical rule and the Ayatollah?

BM: They will resist. Looking back at World War II studies comparing British and American bombing effects on Germany, the British discovered that bombing actually prolonged the war and increased casualties. If you expect a regime change, it will occur in Israel, not Iran.

RM: Were you aware that China provides Iran with precursors like ammonium perchlorate for solid rocket fuel production? In early January 2025, two Iranian vessels traveled to China, loaded these materials, and returned with sufficient fuel for 260 ballistic missiles. They've arranged for China to supply fuel for over 800 missiles total.

China represents Iran's primary trading partner, especially for oil exports. The nations signed a strategic partnership agreement in 2021 covering security cooperation, joint military training, and weapons development. Beijing has also provided Iranian forces with satellite imagery for missile targeting. China's involvement exceeds most people's understanding.

BM: That's incorrect. Both Russia and China have publicly stated they won't permit Israel to destroy Iran. Regarding ballistic missile components, the fundamental question is whether Iran possesses inherent self-defense rights - the answer is obviously yes. Here's what's illogical: Does Iran operate a nuclear weapons program?

RM: Does Iran have the right to develop civilian nuclear power? Absolutely. But why would any nation insist on purchasing uranium, enriching it, and enduring such destruction?

The Nuclear Energy Institute indicates fuel costs represent approximately 17% of total generation expenses. Nuclear fuel costs are the smallest portion of overall operating expenses compared to labor, maintenance, and capital investments.

Iran could exchange oil for uranium-235 with numerous countries through existing trade agreements with China, which already purchases much of Iran's sanctioned petroleum. Why trade oil for reactor-grade uranium when they could avoid enrichment altogether?

BM: Would you trust the U.S. intelligence chief who announced two weeks ago that all 18 American intelligence agencies concluded Iran hasn't maintained a weapons program since 2003 and has no plans for nuclear weapons development? One nuclear-armed Middle Eastern state threatens global stability, and it's not Iran.

RM: How does Israel manage to fly to Iran seemingly unimpeded, bombing targets at will, according to news reports? They've conducted multiple sorties from Israel. What happened to Iranian defense systems? Why aren't we hearing about aircraft being shot down or the Israeli Air Force facing greater challenges?

BM: Who controls media narratives?

RM: Certainly not Iran.

BM: Exactly. We've discussed this previously. Everything told by the U.S. and Western governments is false. Everything from mainstream media is false.

We're not receiving the truth, so we don't know Iran's actual responses. As a former F-4 pilot, I'd say the attack succeeded tactically but failed strategically. I published an article suggesting we've initiated World War III.

RM: Iran won't retreat they've already declared they'll abandon the UN and nuclear treaty. Iran stated directly that it'll continue enrichment for civilian purposes.

BM: They have every right to do so. Iran signed the Nuclear Non-Proliferation Treaty and follows its provisions. Israel hasn't. We have a rogue Middle Eastern state conflicting with Gaza, the West Bank, Syria, Lebanon, Iran, and Yemen, yet we're supposed to consider them victims. They're not victims - they're aggressors.

RM: Brad Aelicks ranks among the smartest traders I know, and I follow his speculation advice. He's been purchasing Mogotes Metals (MOG on Toronto exchange).

This is purely speculation I have no company relationship. I'm investing in 80,000 to 100,000 shares because I want to see drill results.

They're exploring for copper and gold adjacent to the major Filo discovery, on the same geological fault as three other copper discoveries. Mogotes Metals' Filo Sur project sits immediately south of Filo Corp's flagship Filo del Sol project, where BHP and Lundin Mining formed a 50/50 joint venture called Vicu?a Corp. for the Filo del Sol and Josemaria projects.

It's positioned along the world-class, newly discovered sulfide deposits in the Vicu?a Copper District, with NGEx Minerals' recent Lunahuasi and Los Helados exploration projects nearby.

I believe investing in this stock could pay off significantly. They're currently financing at $0.20, with a billionaire Argentine family, the Brauns, contributing $9 million and taking a board seat.

Occasionally, maybe two or three times yearly, I get the urge to gamble on potential drill results. If they return even one hole resembling these other major discoveries trading at $15-30, the stock should have considerable upside. This is pure speculation, and I'm definitely not recommending others follow me.

BM: You're selecting a stock I've owned for years, positioned on the same trend as three other major deposits. One drill hole could increase that stock five to ten-fold. The stock is extremely undervalued. I own it, like the stock, trust the management, but we should also discuss Harvest Gold Corp. (HVG:TSX.V).

RM: You want to discuss Harvest Gold warrants.

BM: Here's the situation it's crucial for our readers to understand that mining is capital-intensive, always requiring funding. Junior miners have been devastated over the past year or two because nobody has advancement money. That's beginning to change and improve, but we discussed Harvest Gold when it was 2.5 cents per share - now it's $0.09.

That's been a home run over recent months, but here's what matters: They have 17 million warrants at $0.07 that are in-the-money. As time passes, people will sell shares to exercise warrants, benefiting both investors and potential investors. It will prevent price volatility and bring company funding.

Additionally, there are 25 million warrants at $0.05 exercisable in August. All warrants are in-the-money 17 million exercisable now, another 25 million in August. The company is well-positioned financially and just needs to deliver results.

RM: I calculated that money exceeds $2.4 million: a very nice reserve. Their latest survey results from last year were spectacular, and earlier this week they released targeting information. They have numerous high-quality drill targets, permits, and drillers. I'm speaking with HVG's CEO, Rick Mark, on Monday morning about those targets and drilling plans.

They'll likely need additional funding for drilling, but good drill results will drive share prices higher, exercising those warrants and putting $2.4 million into company coffers while avoiding dilution.

BM: Absolutely correct.

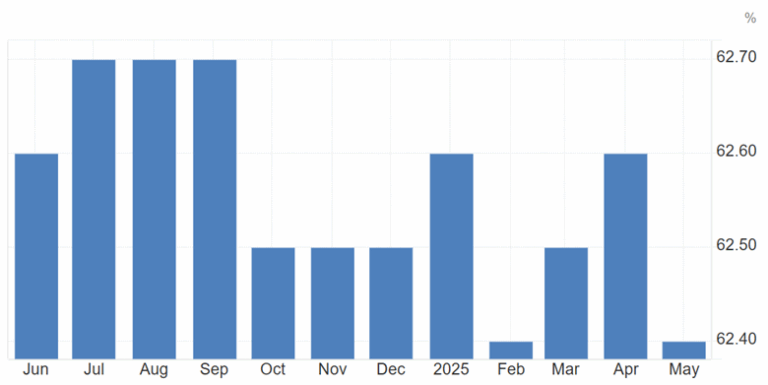

RM: Let me examine something I've been researching we've always known inflation is undercounted and under-represented, always higher than reported. If the Fed claims 3%, you can bet it's much higher. But here's something that will shock most people.

Consider tariffs at a basic 10% rate on U.S. imports. Walmart and others will increase pricing this month. Assuming they pass through the full 10% tariff after all adjustments, imports constitute one-third of consumer goods purchased. So one-third of imports will have 10% tariffs, clearly causing a 3.3% price increase. Are you following my calculations?

BM: Yes.

RM: So tariffs cause a 3.3% price increase, plus the Fed reports pre-tariff inflation at 2.4% in May. Combined, you potentially have 5.7% inflation.

But we're not finished. What about the dollar's decline from early January's 110 to yesterday's 97 before the Iranian attack? That's a 13-point drop.

Trading Economics

Trading EconomicsYou must include this in inflation calculations because U.S. consumers have lost 10% of their purchasing power on that one-third of imports this year. That must be counted, but it isn't.

What's the difference between a 10% import price increase from tariffs and a 10% purchasing power loss on imports? Nothing.

Manipulate the numbers however you want - today's inflation reports, as calculated, won't include what's coming and never will. They've never included shrinkage inflation (greed inflation) and won't include the dollar's coming purchasing power loss and further shrinkage inflation.

BM: Everyone else is missing this. I experienced all the inflation of the '60s, '70s, and '80s inflation is persistent and will go much higher. This World War III will worsen things so rapidly that everyone will ask why we weren't warned.

RM: There's more to this. Major money managers like Paul Tudor Jones, who manages the macro hedge fund Tudor Investment Corp, said the dollar could easily be 10% lower in a year.

Multiple factors are dragging the dollar down. One rarely discussed is foreign investors hedging their bond exposure with dollar hedge ratios of 70-100% because currency movements can eliminate bond returns.

Foreign equity investors were never hedging fans, never needed to be, so their dollar hedge ratios were typically 10-30%. Not anymore. The dollar faces such pressure that investors from Denmark, Scandinavia, the Eurozone, and Canada everywhere with high dollar exposure have surged their U.S. asset dollar hedge ratios to 75%.

I don't think they'll continue hedging dollar exposure long-term.

Why not abandon ship for other currencies if they expect further dollar weakness? We must consider whether the dollar will regain lost safe-haven status due to Middle Eastern war, or if things settle down and we return to that weakening status.

BM: We've gone from a dangerous world to literally World War III overnight. There's something else I wanted to discuss you're absolutely correct, but because it's impossible to predict outcomes, closing the Strait of Hormuz is easily predictable, but beyond that, it's nearly impossible to predict Russian, Chinese, or Iranian actions. We know the media lies to us, we know the media is incredibly biased toward Israel, and we're not getting the truth.

But there's something you mentioned previously did I send you the article about farmers complaining about not receiving farm equipment from Mexico?

RM: I read that article.

BM: The strange thing is, we had alluded to it. Many U.S. farmers ordered Mexican-manufactured machinery, and when Trump started threatening Canada and Mexico, Mexican border officials entered slowdown mode, holding up farming equipment shipments until planting season passes.

It's one of those situations where they can have a remarkable impact by doing nothing and preventing equipment passage. Equipment will eventually enter the United States, but when it won't help farmers.

We'll have a farming crisis. We currently have a beef crisis from screwworm, but we'll have a farming crisis this year, regardless of weather, much of it self-inflicted.

RM: You're right, and farmers have another self-inflicted concern. Every year there's a surge of legal temporary workers entering the States I'm not denying some illegals are included but basically, the agricultural industry relies on this yearly influx of Mexican migrant workers to harvest fruit and work fields.

Reports indicate they're afraid to cross the border not afraid of being returned home, but literally terrified of being picked up from streets when collecting paychecks, lining up for farmer selection, or ICE raiding farms and bunkhouses. They're very concerned about being shipped to El Salvador's prisons, discussions about using Libya, and now talk of sending them to Rwanda. Farmers complain they can't find workers.

BM: Let me explain something about myself I've never discussed. In Vietnam, I flew the F-4, which in the Marine Corps is a two-man aircraft pilot in front, radar intercept operator in back.

The Air Force version had pilots in both seats, but Navy and Marine Corps had a pilot forward and radar intercept operator aft. I flew dozens of missions with one person in the F-4 in Vietnam in 1968. He returned home, became a veterinarian, and raised Christmas trees in North Carolina a very important part of North Carolina's economy.

One hundred percent of U.S. Christmas trees are raised by migrant labor from Mexico. They work six months, return to Mexico when trees are cut in November, and return in spring. There will be no Christmas trees harvested in the United States if Trump continues current policies.

Nobody wants to admit it, but inexpensive Mexican labor has always been fundamental to American agriculture. There are unintended consequences Americans can't see now, but increased inflation is already guaranteed it's going to get bad.

RM: I agree. It's similar to British Columbia's transient worker situation. Our forest industry does replanting during specific months of the year. Many French men and women come from Quebec annually, and it's remarkable how dependent the industry is on these French tree planters. If they were suddenly barred or refused to come to British Columbia for tree planting, our forest industry would face serious trouble.

This extends to our agricultural industry in the Okanagan Valley and lower mainland. The Okanagan is semi-desert from Vernon to Osoyoos a huge, rich agricultural area growing grapes, vegetables, and various fruits much picked by migrant workers.

BC's agricultural industry centers on the Okanagan and lower mainland. The industry would be devastated if these migrant workers didn't arrive. They come, work, are reliable daily workers with purpose, return home, collect unemployment, then return for picking or planting seasons to do work nobody else wants. Magnify this by 1,000 times for US workers, and yes, they're heading for a crisis without those migrant workers.

BM: Things were bad before yesterday but have gone super critical now. Nobody can predict how bad it will get, but many bad things are happening with more coming.

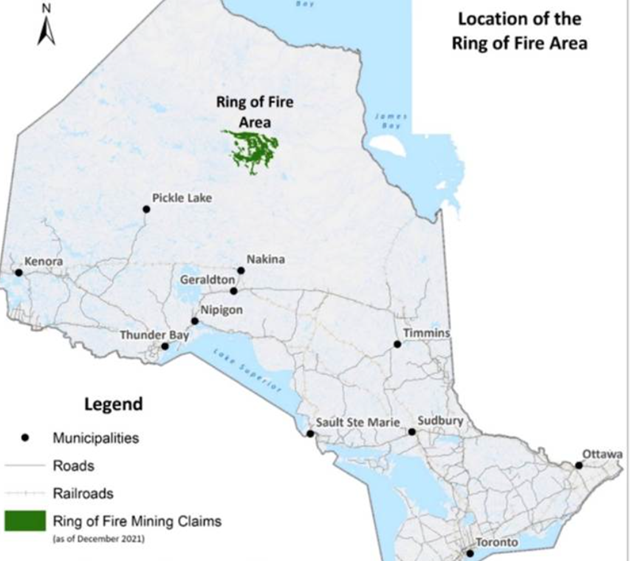

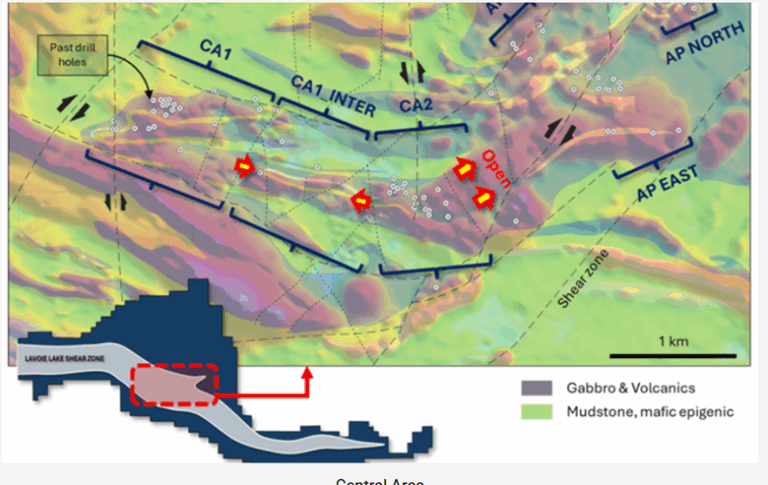

RM: I sent you information about the Ring of Fire and PTX Metals Inc. (PTX:TSXV; PANXF:OTCQB; 9PX:FSE).

BM: I'm very familiar with the Ring of Fire, and you made an excellent point there aren't many junior companies operating there.

RM: You're a PGE (platinum group element) enthusiast. Are you still bullish on platinum and palladium?

BM: Absolutely.

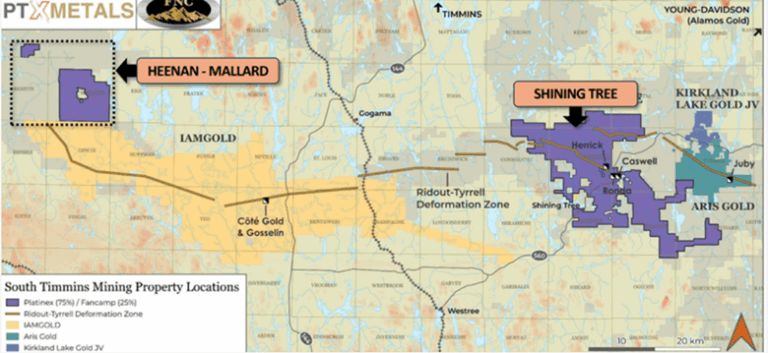

RM: What I like about PTX Metals is their Shining Tree gold project with nice properties and discoveries in the right area. Cote's gold mine has 20 million ounces, plus Aris and the Kirkland Lake joint venture in that region.

I believe they might spin the project into a separate company they're good projects with interest, providing a nice shareholder bonus if executed.

But what's fascinating is the size and richness of their other land package. They're a PGE-nickel-copper-cobalt project, 100% owned, with most mineralization at surface in the Ring of Fire.

The Ring of Fire is a very underexplored camp, potentially one of the world's more interesting copper-nickel-PGE camps. It's underexplored mainly due to access limitations, but with current federal government activity in Canada Prime Minister Carney's programs and promises and Ontario Premier Doug Ford's commitment of a billion dollars for development.

Last year, 16 First Nations in the Ring of Fire received electricity, with 10 more this year all connecting to Ontario's power grid. Road construction is ongoing, a billion dollars is going into the area, and Ontario plans to install a concentrator.

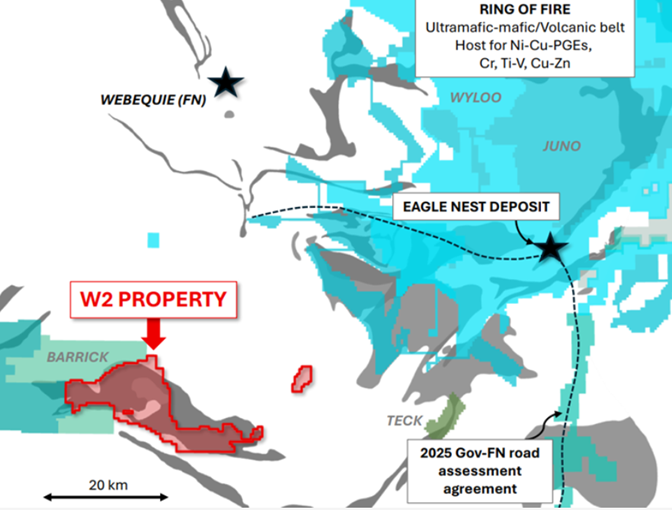

Major miners are moving in, securing the camp. Fortescue Metals owns Wyloo Metals, which owns Eagle's Nest the deposit that started everything. Teck's there, Barrick's there, plus private Juno owning massive acreage.

The mine closest to PTX's W2 project is Fortescue Metals' Eagle's Nest mine. Their base metal company, Wyloo Metals, acquired it for $600 million. W2's mineralization is very similar, except it's surface-level, not a 1.5-kilometer-deep pipe. It's not as high-grade obviously, but it is surface-accessible, and these ultramafic systems are common with well-understood metallurgy.

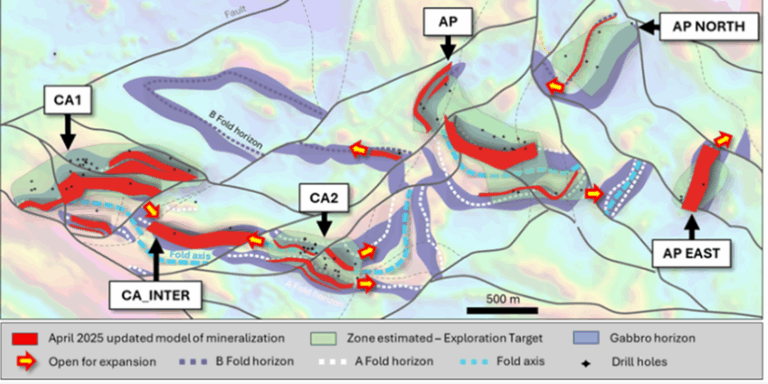

Eagle's Nest kickstarted the entire Ring of Fire story, but the difference is that W2 lies flat, spanning over 8 kilometers and open at depth, while Eagle's Nest is a pipe. At Eagle's Nest, they drilled through lower-grade mineralization into higher-grade second layers, continuing to even higher-grade third layers, extending 1.5 kilometers down. Interestingly, W2 shows better grades with deeper drilling.

They've estimated all historical drilling, building substantial tonnage currently 135 million tonnes grading 0.8% copper equivalent using a half-percent Cu eq cut-off. It's a combination of copper, nickel, and PGEs, importantly, not accounting for metallurgical processing losses.

Looking at their work, this represents a very small area of known mineralized zones. Aurora Platinum was there, and there's an area with much higher PGEs they'll drill this year.

The platinum-palladium-gold component represents about 25% of economics. Copper accounts for approximately 50%, with nickel sulfides around 25%. At a reasonable 0.5% cut-off, you get 2 million ounces of platinum-palladium, with palladium being the heaviest component.

I like this one. The Ring of Fire will be developed with very few junior options in that area play. Most land is controlled by major mining companies. I've never really seen a major area play before, but I think that's what's developing, making any junior with large, shallow deposits very valuable.

The Ontario government will provide an area concentrator, and Sudbury has the smelters - great for the province. I like having a junior in that play.

BM: You raised an excellent point. Many people contact me because I've been a big fan of both silver and platinum for the past six months to a year they're especially cheap relative to gold.

People kept asking for a platinum play, and frankly, I told them to buy the Sprott Platinum ETF because I didn't know the alternatives. I know you didn't spend much time considering their market cap, but with 135 million tonnes of potential ore, a $12-million market cap is extremely cheap.

RM: Yes, you're right. They just need more drilling and Ring of Fire excitement building.

BM: Majors don't like 2-3-5 million tonne projects because they're not worth their investment. When you exceed 100 million tonnes, they take it seriously because their processing costs can be so low. I have shares in San Cristobal Mining in Bolivia it costs them about $4.50 per tonne for mining and milling at 50,000 tonnes daily. That's what majors want to see.

RM: I want to address something people really aren't noticing - we've discussed the job situation before. The last jobs report showed modest job increases kind of a mediocre report.

The BLS publishes "birth-death assumptions" about new business formation it's the biggest pile of nonsense I've ever seen from a tax-supported organization. They published data behind their birth-death assumptions, assuming 200,000 jobs were created in May.

There are no facts supporting this it's based on their magical formula. So, 200,000 jobs were assumed into existence in May, and in April, they assumed 400,000 more jobs into existence based solely on the idea that new companies are always starting.

There's another way of calculating jobs through household surveys. People should pay attention and read the previous information. This involves calling thousands of people across the U.S. asking: "Are you working? Is this person working? Has this person lost a job? Are they on unemployment? How long have they been looking? How long have they stopped looking?" This direct survey paints a clearer picture of what's happening nationwide regarding the economy and jobs.

United States Labor Force Participation Rate - Trading Economics. Link to Forbes must read household survey.

United States Labor Force Participation Rate - Trading Economics. Link to Forbes must read household survey.They talk to households, and the numbers don't match. The difference is 700,000 jobs. Can you imagine? There's obviously something wrong in the U.S. employment market that isn't being reported.

BM: I don't believe anything the government says or any of the statistics. Private agencies and non-mainstream media are the only sources of somewhat accurate information. I think the U.S. economy is balanced on a cliff and about to fall over.

We could have not only World War III but also revolution or civil war in the United States that's pretty scary.

RM: Yet here we are.

BM: Remember Kent State in 1970?

RM: I was 12 years old, thinking about other things, but I know what you're referencing.

BM: The problem with the military is they're taught not to think, just obey orders. The same people who were out of control in Iraq and Afghanistan are quite willing to be out of control in the United States. Someone's backing it, it's organized, it's funded, and it could get ugly quickly. Donald Trump would love to be the world dictator, and he's being manipulated by Netanyahu.

RM: Would you believe me if I told you the U.S. Justice Department's team dedicated to investigating foreign bribery allegations is essentially non-existent under Donald Trump's administration? They fired most of them.

BM: He doesn't even hide it. He goes to Qatar and says, "You've got this nice $400 million airplane I'd like to have," and to show the corruption he said, "We'll fix it up and I'll use it as a presidential limousine for the next two terms, then donate it to my library." The cryptocurrency situation we've never really explored, his outright bribery on behalf of crypto people it's a dangerous time in the US.

RM: I want to end on a positive note and say we're not just "doom and gloom buy gold." We had very good news with the headline "Doctors hail potential cure for common cancer," and I'll read it to you it's brilliant: "A group of 97 patients had longstanding multiple myeloma, a common blood cancer that doctors consider incurable."

These patients faced long, slow, extremely painful death within about a year. They had undergone a series of treatments, each controlling their disease temporarily, but it returned as it always does - there's just no hope.

They reached the stage where they were out of options and looking at hospice, but they got involved in a study as a last-ditch effort, and they all received immunotherapy.

A third responded so well they got an astonishing reprieve, and after five years, the cancer hasn't returned for those patients a result never before seen in this disease. How great is that?

BM: That's a great story. There have been many good medical advances over the past 50 years.

RM: We'll leave it here. As always, great talking to you, Bob.

BM: Good deal, bye.

| Want to be the first to know about interestingGold,Uranium,Oil & Gas - Exploration & Production andSilver investment ideas?Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

Rick Mills: I, or members of my immediate household or family, own securities of: Harvest Gold. My company has a financial relationship with: Harvest Gold and PTX Metals. I determined which companies would be included in this article based on my research and understanding of the sector.Bob Moriarty: I, or members of my immediate household or family, own securities of: Harvest Gold. My company has a financial relationship with: Harvest Gold Corp. I determined which companies would be included in this article based on my research and understanding of the sector.Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy. This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company. This article does not constitute medical advice. Officers, employees and contributors to Streetwise Reports are not licensed medical professionals. Readers should always contact their healthcare professionals for medical advice.For additional disclosures, please click here.

Ahead of the Herd Disclosures

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.