PDAC sadness: Is there a timing curse on mining stocks?

In his March 1st interview with Jim Goddard, Bob Hoye from ChartsandMarkets.com tackles the question whether there is a PDAC curse on the share prices of mining stocks. The idea being that mining stocks often run up and peak going into the large convention of mining prospectors, promoters and investors that traditionally takes place in the first week of March in Toronto every year. This year it starts Sunday March 3rd and wraps up on Wednesday Mach 6th.

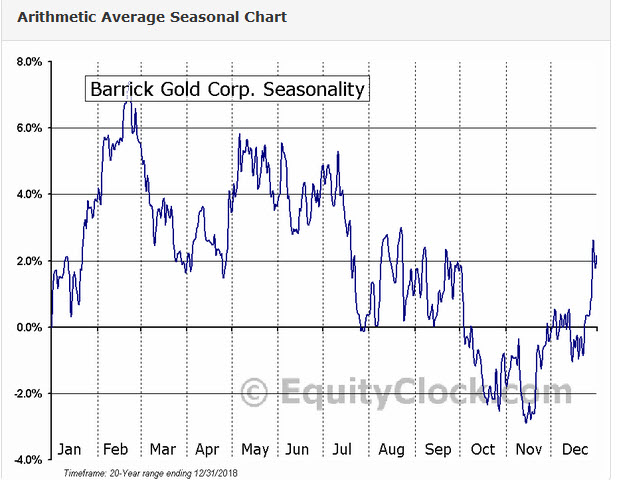

Historically Barrick Gold peaks right before PDAC. Do juniors follow the same path?

Hoye recalls that there were some savvy investors who would often begin to accumulate positions in junior mining stocks with good prospects in December to get a position in place before New Year's. The idea was to anticipate a rebound through to at least March.

Yes, there was a seasonality to Canadian gold exploration companies, and you did do your buying at Christmas, and then you had a good move by March you would lighten up on the stock. But now I think the idea of tying it to PDAC is on top of an already existing pattern.

Looking back, Hoye recalls a great deal of folklore in the market about the curse. However, looking at the present, he characterizes opportunities on the gold side as outstanding. As he explains, in a post-bubble contraction the real price of gold typically advances which restores profitability to the gold mining industry leading to a bull market for the gold stocks.

At some point over the next year, you are going to get the next leg up in gold stocks

However, he cautions that they look overbought right now. Nevertheless, he sees a new bull market on the horizon for a number of years.

The main interruptions would be on the business cycle, and the big stock market going into bull and bear phases.

The main thing for Hoye right now is that he really likes the exploration side and is looking forward to a bull market in that sector. But he recognizes that entry is going to be difficult. That said, with recent good moves in some junior stocks, it shows the market is turning from a long bear market in junior mining to a potential bull market.

If Hoye is right, patience after PDAC may be rewarded with years of happiness for mining stock investors.

This post first appeared on INKResearch.com.