Palo Alto Networks Stock Pulls Back After Goldman Downgrade

Cybersecurity stock Palo Alto Networks Inc (NYSE:PANW) touched an annual high last week after an upgrade from Evercore ISI, who said the company has "room to flourish." It's a different story today, however, with PANW stock sliding 3.1% to trade at $152.29 following bearish attention from Goldman Sachs. The firm downgraded the shares to "neutral" from "buy" and trimmed its price target to $168 from $171, saying "virtual firewall adoption has lagged public cloud adoption to date."

This is a rare bout of negative attention for the tech security, since 30 of the 35 covering analysts say it's a "buy" or "strong buy." Meanwhile, the average 12-month price target of $170.16 prices in upside of 11.7%, and represents territory not seen since January 2016.

Options traders have seemingly shared this enthusiasm. Palo Alto Networks has accumulated a 10-day call/put volume ratio of 2.18 at the International Securities Exchange (ISE), Chicago Board Options Exchange (CBOE), and NASDAQ OMX PHLX (PHLX), showing call buying has more than doubled put buying. This reading also ranks in the 70th annual percentile, suggesting such a tilt toward call buying is unusual.

But PANW's 30-day implied volatility skew currently stands at 14.8%, putting it just 2 percentage points from a 52-week high. That means volatility premium for puts is actually much greater than for calls at the moment. Speaking of volatility expectations, it should be noted that the equity has a Schaeffer's Volatility Scorecard (SVS) of 95, showing a strong tendency to make bigger-than-expected moves over the past year, compared to what the options market has priced in.

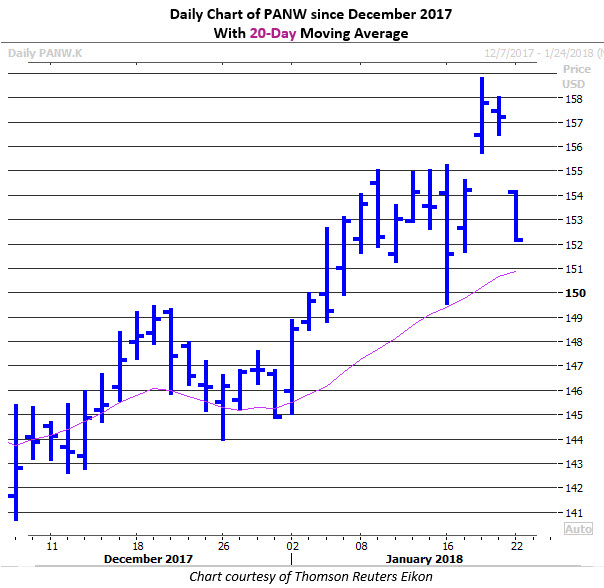

Coming into today, the stock had a 14-day Relative Strength Index (RSI) of 67 -- just shy of overbought territory, so maybe a short-term pullback was in the cards even without the bear note. PANW shares are still up 9.3% in the past six months, and are holding above the recently supportive 20-day moving average.